About the Cyprus Investor Immigration Program

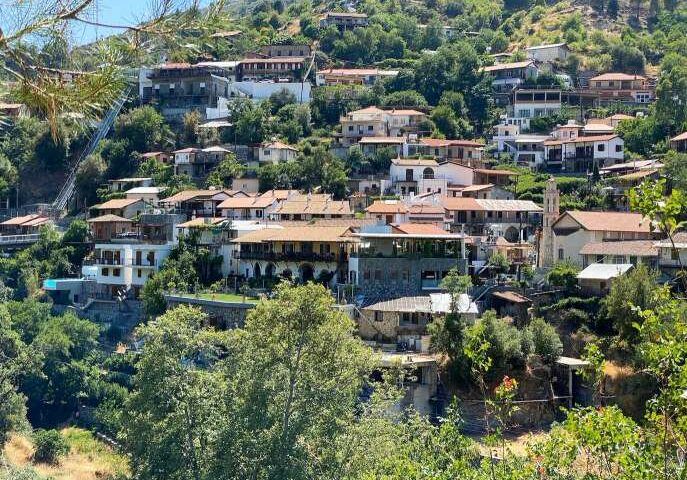

A Cyprus investor immigration program, known as the Cyprus Permanent Residence Program, offers you the chance to move to Europe and enjoy stunning views, crystal-clear waters, a warm climate, and an excellent quality of life – all while reducing your tax burden. For these reasons, permanent residence of Cyprus is popular among foreign investors and retirees.

The Cyprus Permanent Residence Program

Foreigners can get Cyprus permanent residency by investment through immigration authorization or by living five years in Cyprus with a residence permit. The fastest way to get Cyprus permanent residency is to invest €300,000 in real estate or securities. This process usually lasts nine months.

Through an investment of at least €300,000 in Cypriot real estate, share capital of a company in Cyprus, or a Cyprus Collective Investment Organization, you can be granted lawful permanent residence in Cyprus with no renewal requirements.

The right to work in Cyprus through investment immigration

The Cyprus investor program granting residence in Cyprus doesn’t directly offer the right to work in Cyprus to non-EU nationals. The right to work in Cyprus must be acquired through an alternative visa involving work-related activity. However, it’s technically possible to work in Cyprus as a director, through a Cypriot residence permit acquired from buying shares in a Cypriot company.

Other types of permanent residency in Cyprus

Permanent residency by five years of domicile

Non-EU nationals who have been legally and continuously domiciled in Cyprus for five years are eligible to trade their temporary residence permit for a permanent one. They provide a title of ownership of property or rental agreement in Cyprus, proof of stable income, and proof that they paid taxes in the country.

Permanent residency for EU citizens

Based on the entry of freedom of movement in the Treaty on the Functioning of the EU (TFEU), any EU citizen and their family members can acquire permanent residence.

Permanent residency by marriage to a Cypriot

An applicant married to a Cypriot citizen is allowed to apply for a permanent residency permit. This extends to their children from a previous marriage and the parents of the Cypriot citizen or parents-in-law.

How to Obtain Cyprus Permanent Residency by Investment

Obtaining a permit for permanent residence in Cyprus through investment is simple and efficient. Once the investment has been made, and all documents and biometric data have been submitted to the Civil Registry and Migration Department (CRMD), the permit can be approved in a few months.

Investment

You have three investment options to be eligible for the Cyprus Investor Immigration Program. All have a minimum investment amount of €300,000.

Investment Requirements

Real estate purchase: Eligible real estate for investment includes residential property like a house or apartment, or commercial real estate, such as a shop, office, or hotel. The value of an investment in immovable property must be at least €300,000 plus VAT (the standard VAT rate of 19 percent can be reduced to 5 percent if the property is for the investor’s personal use).

This amount can be spread between two properties for residential properties and multiple properties for commercial real estate.

Purchase of company shares: Shares of a company registered in Cyprus can be purchased, provided that it has a proven physical presence in Cyprus and employs at least five people.

Mutual fund investment: You can purchase units of a Cyprus-registered investment fund (or investment funds).

Secured annual income requirement

all applicants must also provide proof of secured yearly earnings of at least €30,000. This income can include wages, pensions, dividend income from shares, or rental income.

If choosing to purchase a house or apartment, the income must derive from abroad. For all other investment options, such as commercial real estate and shares in a company, this income can include earnings from rent and resident companies in Cyprus.

Applying for family members

It is possible for the main applicant to include a spouse in a Cyprus investor immigration application through Cyprus residence by marriage. Dependents, such as children under 18, can also be included with an additional admin fee.

Applying for adult children

A student child between 18 and 25 years of age who is financially dependent on their parents can obtain an immigration permit, provided that:

- They’re dependent on the investor

- They’re unmarried

- They’re a higher education student abroad on the date of submission of the application

- The investor can present an additional annual income of €5,000

Applying for parents and parents-in-law

Parents and parents-in-law can also be granted an immigration permit, provided that:

- They’re dependent on the investor

- The investor can present an additional annual income of €8,000 for each dependent

Once you’ve made your investment, you can then submit an application for permanent residence to the Cypriot immigration authority. You’ll need to include proof of your investment, as well as evidence that you meet the program’s other requirements, such as having sufficient yearly earnings to support yourself and a clean criminal record certificate from your home country or place of residence.

Requirements to Obtain Cyprus Permanent Residency by Investment

- Copy of a valid passport

- Curriculum Vitae

- Original criminal record certificate (issued from any and all countries of residence and submitted with an official and certified translation)

- Signed statement that you are not seeking employment in Cyprus (except for employment as a Director in a Company invested in)

- Title of ownership or contract of the sale of property or proof of shares or units purchased in Cyprus

- Bank swift confirmation for the payment of the purchase price to the value of €300,000 and receipts of payment

- Documents to prove a secured annual income from abroad of €30,000 (and the additional required annual income if applying for children between 18 and 25 years of age or parents or parents-in-law)

All documents you submit must be in English or Greek; if they’re not they should translated into English by a certified translator. If income derives from commercial real estate in Cyprus or shares of a Cypriot company, it can be used to contribute to or make up the required yearly earnings.

If the application includes a spouse and children under 18, the applicant must also present the following documents:

- Copy of a valid passport for each applicant

- Marriage certificate duly certified (official and certified translation)

- Each child’s birth certificate duly certified (official and certified translation)

For property purchases, the main applicant must register the sales agreement at the Land Registry and pay at least €200,000 plus VAT in order to begin their application. A bank deposit must be made into the bank account of the seller in Cyprus, and the money should be transferred from abroad.

Permanent residence application procedure

The application to obtain a permanent residence permit in Cyprus through its investment program can be submitted by the foreign investor or a legal representative on their behalf to the Civil Registry and Migration Department.

After submission, applicants are required to provide a photo and biometric data to receive a residency card once the application has been approved. This can be done at any time before final approval at any migration district unit in Cyprus.

Processing time

An application submitted through the fast-track Cyprus residency by investment program can be processed and approved within two months.

Government fees

In addition to the investment of €300,000 required for the permanent residence permit scheme, a fee of €500 must be paid to the Civil Registry and Migration Department (CRMD). A payment of €500 is also required for each additional applicant.

Conditions and restrictions of the program for permanent residence in Cyprus

The residence permit program in Cyprus has certain conditions and restrictions based on investment and character that must be met in order to be eligible for the program and to maintain it:

- Applicants must be non-EU nationals

- Applicants must have no previous criminal history

- Applicants must have a valid passport

- Applicants must have proof of financial means to support themselves during their stay in Cyprus, including medical insurance.

- Applicants must make a minimum investment of €300,000

- Applicants must keep €30,000 deposited in a Cypriot financial institution for three years

- Applicants must not have been refused entry into Cyprus within the last five years

- Applicants must not be included in the list of undesirables issued by the Ministry of Foreign Affairs

- Applicants who sell commercial or residential properties purchased to acquire permanent residence must buy a new property of equal value to the property sold.

- Applicants must visit Cyprus at least once every 24 months

Cyprus Immigration Permit Categories

There are six additional categories in which immigration permits can be applied in Cyprus:

Category A: This applies to foreign nationals who have land or the means to acquire land in Cyprus and will be self-employed in the agriculture, cattle/bird breeding, or fish culture sectors. They have at least €430,000 at their disposal, and their activities do not negatively affect the Cypriot economy.

Category B: This applies to foreign nationals with sufficient financial means and a relevant permit who will be self-employed in the mining sector in Cyprus. They have at least €350,000 at their disposal, and their activities do not negatively affect the Cypriot economy.

Category C: This applies to foreign nationals with sufficient financial means and a relative permit who will be self-employed in a profession or trade. They have at least €260,000 at their disposal, and their activities do not negatively affect the Cypriot economy.

Category D: This applies to foreign nationals with the necessary academic or professional qualifications and sufficient financial means who will be self-employed in a scientific field or a profession in demand in Cyprus. They will also possess adequate funds.

Category E: This applies to foreign nationals who have been offered a permanent work position in Cyprus and whose presence does not cause unnecessary local competition.

Category F: This applies to foreign nationals with an independent annual offshore income that is enough to provide for comfortable living in Cyprus without having to work.

Category F

Category F is a particularly viable option for retirees and expats with passive incomes. It requires that applicants prove an annual offshore income of at least €9568.17 and €4613.22 for each additional applicant.

You can only receive an immigration permit through any of the categories mentioned above if the Cyprus Immigration Control Committee recommends to the Minister of Interior that you meet the requirements of one of those categories.

It’s difficult to estimate the processing time for an immigration permit under one of these categories. Additional stages of approval are completed in senior departments on a case-by-case basis.

Benefits of the Permanent Residence in Cyprus Program

Living on an island by the Mediterranean Sea is already a fantasy many expats would love to turn into a reality. Stunning beaches, friendly locals, vibrant nightlife, and safety are all key aspects that draw outsiders to live in Cyprus.

A Cyprus permanent resident permit obtained through investment allows you to enjoy Cypriot quality-of-life benefits for as long as you want.

These provisions include:

Access to free public healthcare: Public healthcare in Cyprus is free for permanent residents. Private hospitals and clinics are also very affordable.

Freedom of movement within the Schengen Area: As a member of the Schengen Area, Cypriot residents can enjoy borderless travel through dozens of member states in the EU.

Sponsoring family members: Unlike in many countries, there is no requirement to invest further or pay substantial additional fees to sponsor immediate family. They can be included on an application for 500 per applicant.

Access to British schools: Several international schools in Cyprus, such as Heritage Private School and St John’s School, teach the British curriculum.

Safety: Crime rates in Cyprus are very low; reports of theft and attacks are not common, and safety is high when walking around day and night.

Cyprus also has a favorable tax regime for tax residents with local and worldwide income; benefits include:

- Tax exemption and credit on foreign income to prevent double taxation

- A high-income tax exemption bracket of €19,500 and zero tax on overseas rental income

- No gift or inheritance tax, and capital gains tax is limited to assets in Cyprus.

- Being among the friendliest nations in the European Union for corporation taxes, with a corporate tax rate of just 12.5 percent.

Obtain Cyprus citizenship

An underrated aspect of a Cyprus residence permit acquired through an investment program – commonly referred to as the Cyprus Golden Visa program, or Cypriot golden visa – is that it provides eligibility for a Cypriot citizenship application and a Cyprus passport after seven years, provided you meet all the requirements under Cypriot nationality law.

Cyprus doesn’t have any citizenship by investment programs per se, but this option enables you to achieve the same outcome once you’ve completed those seven years of permanent residency.

A Cypriot passport enables visa-free travel and visa-on-arrival access for Cypriot citizens to over 160 countries worldwide, and – conveniently located between the Middle East, Western Europe, and Africa – it’s the ideal base for international exploration.

Another benefit of citizenship obtained after seven years of holding a Cyprus Golden Visa is that, as an EU citizen, you have the right to live and work in any European Union member state. Additionally, the Republic of Cyprus recognizes dual citizenship; if your country of origin also allows dual citizenship, you’ll be able to maintain two citizenships concurrently.

Frequently Asked Questions about Permanent Residence in Cyprus

Can I immigrate to Cyprus?

You can immigrate to Cyprus by acquiring an immigration permit through one of Cyprus’ permit categories. These categories include being offered a permanent work position in Cyprus or conducting high-skilled and in-demand self-employed work there.

You can also immigrate to Cyprus through the Category F immigration scheme by demonstrating that you’re able to comfortably live in Cyprus without having to work by presenting proof of an annual offshore income that has the same or greater value than €9,568.17.

What is the Cyprus Permanent Residence Program?

The Cyprus Permanent Residence Program is an investment immigration program that grants permanent residence cards to successful applicants in exchange for economic investment.

How can I get permanent residence in Cyprus?

You can become a permanent residence card holder in Cyprus through its residence investment program. This program allows you to make a monetary investment in the country, and you’ll receive permanent residence status.

What are the benefits of Cyprus permanent residence?

Some of the benefits of a permanent residence permit in Cyprus include the following:

- Access to free public healthcare

- Freedom movement within Schengen Area countries

- Easily sponsor immediate family members

- Access to international schools that teach the British curriculum

- A safe environment with low crime

Cyprus’ tax legislation provides several tax-resident benefits, such as:

- Tax exemption and credits for foreign income to prevent double taxation

- A high-income tax exemption bracket of €19,500 and zero tax on overseas rental income

- No gift or inheritance tax, and capital gains tax is levied only on assets in Cyprus

- One of the lowest corporate tax rates in Europe at 12.5 percent

What is the Cyprus Golden Visa?

The Cyprus Golden Visa is a program that grants residency to non-EU citizens who invest in real estate in Cyprus. It offers a pathway to permanent residency and, eventually, citizenship, providing investors with access to the European Union and the European Economic Area.