The taxation of capital gains, which are profits made from the sale of assets, varies widely from country to country in the global financial landscape. While most nations impose a tax on capital gains to maintain economic growth and equity, some countries offer a unique advantage – no capital gains tax at all.

This distinct fiscal policy attracts investors looking to maximize their returns and makes these countries lucrative personal and corporate investment destinations.

In this article, we will explore the nations that eschew capital gains tax, their reasons for doing so, and the implications of this policy for their economies and global investment patterns.

What is capital gains tax?

Capital gains tax is a tax on the profit realized from the sale of a non-inventory asset purchased at a cost lower than the amount realized on the sale. In simpler terms, it’s the tax you pay on the profit from selling something you own for more than you spent to acquire it. These assets can include investments like stocks and bonds and tangible assets like real estate.

The specific rate at which capital gains are taxed depends on various factors, including the type of asset, the time it was held, and the jurisdiction imposing the tax. Typically, there are two types of capital gains: short-term and long-term.

Short-term capital gains are usually taxed at a higher rate and apply to assets held for a year or less. Long-term capital gains apply to assets held for more than one year and are generally taxed at a lower rate, reflecting an incentive for longer-term investment in the economy.

Some jurisdictions may offer exemptions or reduced rates under certain conditions to encourage investment or not unduly burden the selling of personal properties, such as a home where you’ve lived for several years. The rationale behind the capital gains tax is to tax the increase in value of an asset, thus capturing a portion of the gain that the seller has realized.

It’s a way for governments to generate revenue from the increase in the value of assets within their economy while also encouraging the long-term holding of assets, which can contribute to a more stable economic environment.

10 Countries that have no capital gains tax

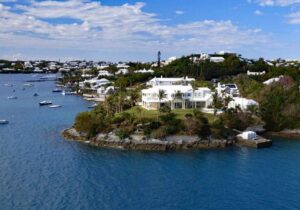

Bermuda

This approach is part of a broader strategy to encourage multinational corporations, hedge funds, and other investment funds to make Bermuda their preferred domicile.

The island’s economy flourishes as a global hub for insurance and reinsurance, thanks to its tax-friendly environment. The government primarily earns revenue from customs duties, payroll taxes, and license fees rather than direct taxation on income or capital gains.

This simplifies tax compliance and administration, which makes the location even more appealing to high-net-worth individuals and businesses looking to optimize their tax exposure.

However, it’s important to note that Bermuda’s high cost of living and the requirement for businesses to have a substantial local presence ensure its benefits are balanced with contributions to the local economy.

The Bahamas

Instead, the government relies on indirect taxes like value-added tax (VAT), import duties, and property taxes to generate revenue. This approach has made The Bahamas a popular choice for real estate investors, as property value appreciation is not subjected to capital gains tax.

Moreover, The Bahamas is known as a tax haven because of its regulatory framework, which supports privacy and asset protection. The country has a well-established banking and financial services sector that caters to international businesses and high-net-worth individuals seeking favorable tax conditions.

Despite criticisms of being a tax haven, The Bahamas maintains that its tax policies are intended to promote economic growth and job creation and maintain its competitive edge as a global financial center.

The United Arab Emirates (UAE)

The lack of capital gains tax applies to both residents and non-residents, making the UAE an attractive destination for international investors.

Furthermore, the country’s free zones offer additional tax incentives, such as 100% foreign ownership, full repatriation of profits, and exemption from import and export taxes.

These benefits are designed to attract foreign direct investment in key sectors like technology, finance, and renewable energy. The UAE’s approach to taxation, including the absence of capital gains tax, has contributed to its rapid economic growth and the development of world-class infrastructure.

However, the UAE has also implemented VAT and excise taxes to diversify government revenue sources and ensure sustainable development. This balanced approach maintains the UAE’s tax-competitive environment while addressing the need for public services and infrastructure.

Cayman Islands

The lack of a capital gains tax is complemented by no direct taxes on corporate earnings, income, or wealth, providing a simple and beneficial tax environment for both individuals and businesses.

The government derives its revenue from indirect sources, such as fees for company registration, work permits, and import duties.

This tax structure supports the Cayman Islands’ position as a leading offshore financial center, hosting a significant percentage of the world’s investment funds. The regulatory framework of the islands is tailored to meet international standards of transparency and cooperation in tax matters, aiming to balance tax advantages with responsible participation in the global financial system.

Monaco

This policy has made Monaco an attractive destination for wealthy individuals who wish to preserve their wealth. The principality’s tax regime is part of a broader strategy to maintain its status as a luxurious and prestigious place to live and conduct business.

Monaco’s economy benefits from high-end tourism, real estate, finance, and yachting. The absence of capital gains tax makes it more appealing for real estate investment, with property values among the highest in the world. Monaco earns revenue through VAT, corporate taxes on companies earning revenue from outside Monaco, and various fees and duties.

The principality has established strict residency requirements and invests in public services and infrastructure to ensure that its tax policies support the well-being of its residents and the economic stability of the country.

Barbados

To attract more businesses, Barbados offers various tax incentives, including special regimes for international companies that provide exemptions from certain taxes and duties.

One notable feature of Barbados’ tax system is the absence of capital gains tax, which makes it an attractive location for investment, especially in real estate and financial assets.

While maintaining a competitive tax system, the government ensures compliance with international tax transparency standards. Barbados’ taxation approach supports its development goals, attracts international business, and ensures sustainable economic growth.

Belize

The country’s economy is based on tourism, agriculture, and offshore financial services, which are sectors that the government encourages to grow. Belize does not have a capital gains tax, which is part of its broader strategy to create an advantageous tax regime.

Additionally, Belize has taken steps to improve its regulatory framework for financial services to address concerns about transparency and financial integrity. Its natural beauty, along with its tax policies, makes Belize an attractive destination for investors interested in emerging markets.

Oman

Oman has implemented several reforms, such as the introduction of value-added tax (VAT) and corporate income tax for certain businesses, to increase its revenue base while maintaining incentives for investment. By not imposing capital gains tax on most investments, Oman aims to become a competitive destination for regional and international businesses.

Oman focuses on developing key sectors such as tourism, logistics, manufacturing, and mining, which offer a stable and attractive investment climate.

Qatar

The country’s economy, one of the richest globally due to its substantial natural gas reserves, benefits from a deliberate strategy to attract foreign capital and expertise to diversify its economic base. Qatar offers a competitive business environment with tax incentives, including the absence of capital gains tax, to support its vision of sustainable economic development.

The government has invested heavily in infrastructure, education, and technology, positioning Qatar as a hub for innovation and investment in the Middle East. While Qatar introduced a minimal corporate tax rate for foreign companies, the lack of capital gains tax on personal investments remains a key feature of its tax policy.

Saint Vincent and the Grenadines

The island nation focuses on tourism, agriculture, and offshore financial services as principal economic drivers, providing various incentives to encourage investments in these sectors. The absence of capital gains tax enhances Saint Vincent and the Grenadines’ attractiveness as a destination for real estate investment and financial services.

The government aims to balance attracting investment with maintaining fiscal stability, ensuring that its tax policies support long-term economic development and contribute to the country’s appeal as a place to live, work, and invest.

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments. We guide you from start to finish, taking you beyond your citizenship or residency by investment application. How Can Global Citizen Solutions Help You?

Frequently Asked Questions About Countries That Have No Capital Gains Taxes

What are the benefits of investing in countries that have no capital gains taxes?

Investing in countries without capital gains tax can boost net returns on investments, simplify tax planning, and attract international investors, creating a vibrant investment community.

How do countries without capital gains tax generate revenue?

Countries without capital gains taxes typically generate revenue through other means, such as value-added taxes (VAT), sales taxes, property taxes, customs duties, and license fees.

Some also impose corporate taxes, particularly on companies operating within certain sectors, or generate significant income from natural resources. These alternative revenue sources help maintain public services and infrastructure without relying on capital gains taxes.

Are there any drawbacks to living or investing in a country with no capital gains tax?

Countries without capital gains tax may impose higher taxes in other areas, such as property or consumption taxes, that could offset the advantages. There may also be regulatory challenges, higher living costs, or less political stability in these countries. Moreover, they may offer fewer government-funded public services and infrastructure.

Can foreigners easily invest in countries that have no capital gains tax?

While many countries that have no capital gains tax actively encourage foreign investment to boost their economies, regulations and ease of investment can vary.

Some countries offer incentives for foreign investors, including residency permits or citizenship in exchange for significant investment. However, potential investors should be aware of any legal restrictions, reporting requirements, or financial regulations that might impact their ability to invest or repatriate profits.

Does the absence of capital gains tax in a country mean there are no taxes on investment income?

When it comes to taxes, just because a country doesn’t impose capital gains tax doesn’t mean it’s tax-free. Other types of investment income, like interest, dividends, or rental income, could still be taxed. Every country has different tax laws, so it’s crucial to consider the overall tax implications of your investment activities in different jurisdictions. To navigate these complexities effectively, it’s advisable to understand the specific tax laws and consult with a tax professional.