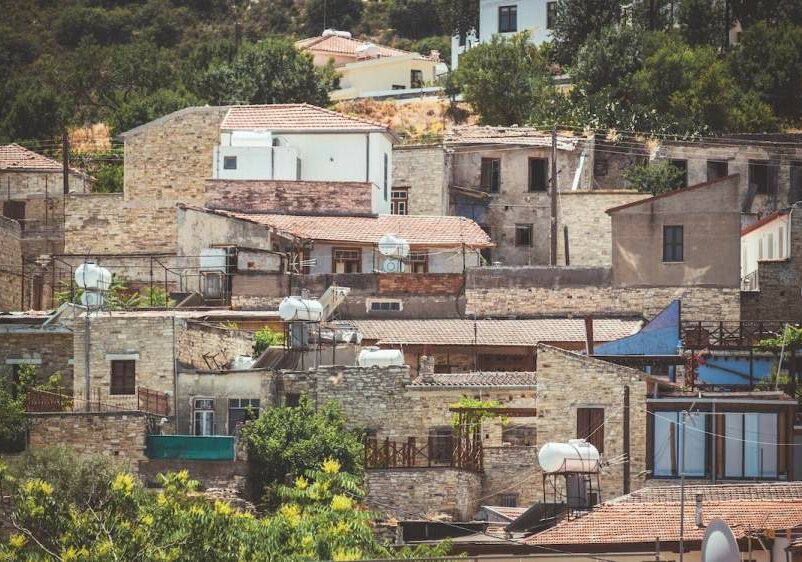

Cyprus, the third-largest island in the Mediterranean, is an increasingly popular destination for real estate investment. The island’s strategic location, rich cultural heritage, and favorable economic conditions make it an attractive option for property buyers.

This article provides a detailed guide on why you should consider buying property in Cyprus, the pros and cons, market insights, legal requirements, and a step-by-step process to make your purchase smoother.

Why Consider Buying a Property in Cyprus?

The island’s diverse landscapes, from the beaches of Ayia Napa to the Troodos mountains, cater to both short-term visitors and long-term residents. Cyprus boasts several Blue Flag beaches, recognized for their high standards of water quality, safety, and environmental management, ensuring a pristine and enjoyable experience for beachgoers.

Cyprus has shown strong economic growth, particularly after recovering from the 2013 financial crisis. Key sectors like tourism, financial services, and real estate drive its economy, making it an attractive destination for prospective buyers.

As an EU member, Cyprus benefits from economic stability, with government incentives further enhancing its appeal.

Despite a relatively low cost of living, Cyprus offers modern amenities, excellent healthcare, and top educational institutions.

Pros and Cons of Buying a Property in Cyprus

Pros:

- Economic stability: As part of the European Union, Cyprus provides a stable environment for investment with protections and benefits that appeal to foreign buyers.

- Tax incentives: The Cypriot government offers one of the most attractive tax regimes in Europe, including low corporate tax rates and exemptions for foreign residents.

- Residency and citizenship opportunities: Purchasing property can open the door to obtaining permanent residence or even citizenship.

- High rental yields: Cyprus’s tourism and expatriate communities ensure a strong demand for rental properties, particularly in popular areas like Paphos.

Cons:

- Property prices in prime locations: While Cyprus offers affordable options, properties in a popular area can be expensive.

- Bureaucratic hurdles: Purchasing property can involve significant paperwork and legal complexities, especially for non-EU citizens.

- Issues in Northern Cyprus: Purchasing property in Northern Cyprus can be legally complex due to the political situation, and buyers should exercise caution.

- Title deed delays: These can sometimes be delayed, though recent reforms have aimed to speed it up.

What’s the Real Estate Market Like in Cyprus?

Popular areas for real estate investment are, for example, Limassol, Paphos, Larnaca, and Nicosia. Each of these cities offers something unique, from bustling city centers to serene coastal environments.

Property prices in Cyprus country are generally more affordable compared to other European markets, though prices in prime locations can be higher.

Besides that, the prices of real estate in the city center are typically higher than those outside. It will be well worth to rent out a house or apartment in the city center.

The market includes a wide range of options, from luxury villas to more affordable apartments. For investors, the Cypriot real estate market offers good rental yields, particularly in areas popular with tourists and expatriates.

There is also immovable property. In the country, immovable property includes land and buildings that are permanently attached to the land.

The market’s stability is bolstered by the country’s growing economy, steady demand for rental properties, and government incentives aimed at attracting foreign buyers.

Requirements for Buying Property in Cyprus

Purchasing real estate in Cyprus involves a series of legal and financial steps that vary depending on your nationality. Whether you’re an EU citizen or a non-EU citizen, understanding these requirements is crucial.

Here are the key requirements:

- Legal Representation:I t’s highly recommended to hire a qualified lawyer who specializes in Cypriot real estate to handle the legal aspects of the purchase

- Due Diligence: Your lawyer will need to conduct due diligence to ensure the property has clear title deeds and is free from any legal disputes or encumbrances.

- Sales Contract: Sale contracts must be drafted and signed by both seller and buyer. This contract should be submitted to the Land Registry within 60 days of signing.

- Council of Ministers’ Permission (For non-EU nationals): Non-EU nationals must apply for permission from the Council of Ministers to purchase property. This involves background checks and typically takes a few months.

- Deposit: A deposit, usually 10% of the purchase price, is required when signing the contract to secure the property.

- Payment of Transfer Fees: This fee is required when the title deeds are transferred to the buyer’s name. These fees vary based on the property’s value.

- Stamp Duty: It must be paid on the property’s purchase price. The rate ranges from 0.15% to 0.20%.

- Transfer of Title Deed: The final step involves transferring the title deeds into the buyer’s name at the Land Registry Office. This is when the ownership is legally transferred.

- Financial Requirements: Proof of sufficient financial resources may be required, particularly for non-EU nationals.

- Mortgage (if applicable): If you are taking out a mortgage, you will need to arrange financing with a Cyprus bank and fulfill their requirements for loan approval. While applying for a mortgage, make sure to get the best interest rate.

- Tax Identification Number: Buyers must obtain a Cypriot tax identification number, which is required for all financial transactions related to the purchase.

- No Criminal Record (For non-EU nationals): Non-EU nationals may need to provide proof of a clean criminal record to gain the Council of Ministers’ approval.

These requirements ensure that the purchase is legally sound and that the buyer is protected throughout the purchase.

Can foreigners buy real estate in Cyprus?

Non-EU citizens are allowed to purchase one property for sale, which can be an apartment, a house, or a plot of land not exceeding 4,014 square meters.

Additionally, non-EU nationals must obtain permission from the Council of Ministers to complete the purchase of the apartment or house in question.

This process typically involves background checks to ensure the buyer has no criminal record and sufficient financial resources.

EU nationals, on the other hand, face fewer restrictions and can buy property for sale with the same rights as Cypriot nationals.

They do not need special permission and can purchase multiple properties if desired.

Buying a Property in Cyprus for Permanent Residence

One of the most important reasons why foreigners buy property is the opportunity to obtain a permanent residence permit.

The country offers a fast-track permanent residency program for non-EU citizens who purchase property with a minimum value of €300,000.

This program allows investors and their families to obtain a permanent residence permit within two months of application.

The permanent residence permit allows the holder to live in Cyprus indefinitely, though they are not permitted to work in the country.

However, the permit does allow for easy travel within the European Union, which is a significant advantage for many non-EU buyers seeking a residence permit in a stable and attractive location.

Non-residents in Cyprus, on the other hand, can benefit from favorable property investment opportunities and may also be eligible for a residence permit or permanent residency if they meet the required criteria.

Buying a Property in Cyprus for Citizenship

Cyprus no longer offers a citizenship-by-investment program, but there are alternative ways of obtaining Cyprus citizenship.

One of the most common alternative methods is the Cyprus Golden Visa. You can also get it by decent, marriage, naturalization, birth or adoption.

Costs of Properties in Cyprus

In general, prices are higher in popular tourist areas and city centers, such as the capital city, Nicosia, where demand is strong, but, in most cases, it will be worth investing in a house or an apartment since you can always rent them.

If you’re not happy with the property, you can put it up for sale.

For example, a luxury villa in a European city like Limassol Marina can cost several million euros, while a more modest apartment in a less central area may cost under €200,000.

Resale properties tend to be more affordable than new developments, and there are also bargains to be found in less developed areas of the island.

Overall, Cyprus offers a wide range of real estate prices to suit different budgets, from affordable apartments to high-end luxury homes.

Cost of Legal Fees When Buying a Property in Cyprus

They typically range from 1% to 2% of the purchase price, depending on the complexity of the transaction and the lawyer’s experience.

In addition to these expenses, buyers should also consider other costs such as the reservation fee, which is usually 1% to 2% of the real estate price, and the stamp duty, which ranges from 0.15% to 0.20% of the purchase price.

Transfer expenses are another significant cost. These expenses are calculated on a sliding scale based on the property’s value and can range from 3% to 8%.

How to Buy a Property in Cyprus: Step-by-Step Guide

Buying real estate in the country involves several steps. Here’s a step-by-step guide:

1. Research and choose a property

Start by researching different areas and property types in the country. Consider your annual income, lifestyle, and investment goals.

2. Hire a lawyer

Engage a qualified lawyer who specializes in Cypriot real estate law. Your lawyer will handle all legal aspects of the purchase.

3. Make an offer and cover the reservation fee

Once you find a property you like, make an offer to the seller. If accepted, you may need to cover a reservation fee.

4. Conduct Due Diligence

Your lawyer will conduct thorough checks on the property, including verifying the title deed, checking for any legal disputes, and ensuring it is free of encumbrances.

5. Sign the Contract

Then, both the seller and buyer will sign the sale contract. A deposit, typically 10% of the purchase price, is usually required at this stage.

6. Apply for Necessary Permits

If you are a non-EU citizen, apply for the necessary permits from the Council of Ministers. This is usually a straightforward process but can take several weeks.

7. Payment and Transfer

Pay the remaining balance of the price, along with any transfer expenses and taxes for the apartment or house in question. Once that is paid for, you can move on to the next step.

8. Registration

The final step is to register the property in your name with the local Land Registry.

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique investment migration consultancy firm focused on finding the right residency or citizenship by investment program for individuals wishing to secure their future and become global citizens. With offices in Portugal, the United Kingdom, Hong Kong, and Brazil, our multilingual team guides individuals and families from start to finish, providing expert advice considering freedom, mobility, taxation, and security.

- We have helped hundreds of clients from 35+ countries in all the top residency by investment and citizenship by investment programs. With an in-depth and comprehensive understanding of the area, we provide our clients with solid guidance.

- Our team has never had a case rejected. Our 100 percent approval rate sets us apart from our competitors and guarantees that you can expect a successful application.

- Our transparent pricing covers all the processes from opening your bank account, document certification, and legal due diligence to investment and submission. As there is one fee for the entire process, you can be confident that you will not face any hidden costs later.

- All data is stored within a GDPR-compliant database on a secure SSL-encrypted server. You can be safe knowing that your personal data is treated with the utmost security.

- Global Citizen Solutions provides an all-encompassing solution. Our support can continue even after you receive your passport. We offer additional services such as company incorporation, Trusts, and Foundations formation.

- The BeGlobal Onboarding System® allows you to access the status of your application every step of the way, something that sets us apart from our competitors.

Frequently Asked Questions About Buying Property in Cyprus

What are the steps to buying property in Cyprus as a foreigner?

To buy real estate in Cyprus as a foreigner, follow these steps: hire local lawyers, conduct due diligence, sign a sales contract, pay a deposit, apply for Council of Ministers’ approval (if non-EU), complete payment, transfer the property at the Land Registry, and pay all required taxes and fees.

Buying real estate can lead to residence permits in Cyprus.

What are the costs associated with buying property in Cyprus?

The costs of purchasing real estate in Cyprus include the price of the property, additional fees (typically 1-2% of the property’s value), stamp duty (0.15-0.20%), transfer fees, and VAT if applicable.

Additional expenses may include the cost of the reservation, land registry fees, and, for non-EU buyers, application fees for necessary permits.

How to finance buying a property in Cyprus?

To finance purchasing a property in Cyprus, consider obtaining a mortgage from a local bank. You’ll need to provide proof of income, a down payment (usually 20-30%), and meet Cypriot lending criteria.

If getting a bank loan is not an option, explore personal loans or use cash reserves.