The framework for Antigua taxes favors US expats, enabling them to optimize their taxes and even alleviate some of their tax burdens. Here is an in-depth guide to taxes in Antigua and Barbuda for Americans, with insight into the following:

- Antigua personal income tax

- Antigua corporate income tax

- Antigua taxes for Americans

- US tax forms for Americans in Antigua

- Antigua tax treaties

- Other Antigua taxes

- Antigua tax forms for Americans in Antigua

Key Antigua and Barbuda Tax Statistics

- Personal income tax rate: 0 percent

- Corporate income tax rate: 25 percent

- Primary tax forms: The Antigua and Barbuda Inland Revenue Department does not issue printed payment or tax declaration forms for individuals.

- Tax year: Based on a company’s fiscal year-end

- Tax deadline: 31 March for self-employed individuals and businesses

- Population: 94,298

- Capital City: Saint John’s

- Currency: Eastern Caribbean Dollar (EC or XCD)

- Tax treaty: Antigua and Barbuda and the United States do not have a double tax agreement.

- Totalization agreement: Antigua and Barbuda and the United States do not share a totalization agreement to prevent American expats from double taxation on Social Security income.

Antigua Personal Income Tax

In 2016, the government of Antigua and Barbuda introduced a tax reform abolishing personal income tax, meaning Antigua and Barbuda has no personal income tax.

Non-residents pay a withholding tax of 12.5 percent on dividends, interest, and royalties gained in the nation.

Self-employment tax in Antigua and Barbuda

If you earn self-employment income in Antigua and Barbuda, there is a variable tax rate of 0, 8, or 25 percent. An Antigua and Barbuda tax calculator can assist with determining the correct tax rate. Self-employed Americans must register with the Antigua and Barbuda Inland Revenue Department and obtain an Antigua Tax Identification Number.

Antigua and Barbuda Corporate Tax

- It is incorporated or registered as an external company in Antigua and Barbuda

- It is centrally managed and controlled in Antigua and Barbuda

- It operates in Antigua and Barbuda

- It receives income from Antigua and Barbuda

- Owns assets in Antigua and Barbuda that are used to generate income for the company

In this case, a resident company is taxed on worldwide income. Meanwhile, a non-resident company pays the flat corporate tax-rate only on income derived or sourced from Antigua and Barbuda. This tax rate is applied on a sliding scale with rates ranging from zero to 25 percent of gross income and is due quarterly.

Regarding foreign tax relief, foreign tax credits are not normally given unless the taxes have been paid in a British Commonwealth country that grants similar relief for Antigua and Barbuda taxes or where there’s a tax treaty providing merit for such a credit.

Antigua tax benefits for International Business Companies

Antigua and Barbuda taxes and corporate laws offer several benefits for International Business Companies (IBC), including:

- No requirement to pay taxes of any kind or submit a tax return in Antigua and Barbuda

- No public records of the identities of shareholders or beneficiaries

- Fast company incorporation, usually within one business day

- Permission for 100 percent of company shares to be foreign-owned

- No minimum capital requirement for incorporation and operation

- The option for a sole shareholder to be the sole director of the IBC

Medical Benefits Scheme (MBS) contributions

Employed | Employees over 16 and under 60 pay a tax of 3.5 percent of their gross wages. Employers contribute the same amount. |

Employees aged 60 to 69 pay a 2.5 percent tax on their gross wages. Employers are not required to contribute. | |

Employees aged 70 and over and their employers are not required to contribute. | |

Self-employed | Self-employed individuals aged 16 to 59 pay a tax of 5 percent on their gross earnings. |

Self-employed individuals aged 60 to 69 pay a tax of 5 percent on their gross earnings. | |

Self-employed individuals aged 70 and over are not required to contribute. |

Taxes in Antigua and Barbuda for US Expats

By becoming an Antigua and Barbuda citizen via the Antigua and Barbuda Citizenship by Investment Program, Americans can avoid double taxation due to Antigua and Barbuda’s zero percent personal income tax rate.

The US Foreign tax credit of $120,000 for 2024 allows Americans living in Antigua and Barbuda to significantly reduce their tax obligations. Foreign tax credits are also available to other foreign nationals in Antigua and Barbuda who have paid or are liable to pay British commonwealth income tax.

Antigua and Barbuda’s government actively encourages company owners to relocate their headquarters to the country, thanks to friendly tax incentives for resident and non-resident companies. Moreover, individuals are exempt from Antigua and Barbuda income tax on worldwide income or assets held in foreign financial institutions by holding Antiguan citizenship— without needing to register their tax residence in the country. Only income derived from inside the country is subject to taxation.

Taxes for UK citizens

US Tax Forms for Expats in Antigua and Barbuda

Foreign Earned Income Exclusion: The Foreign Earned Income Exclusion (FEIE), available through Form 2555, allows US citizens with Antigua and Barbuda residency to exclude income earned in the country from their US taxable income.

Foreign Housing Exclusion: US taxpayers who own a primary residence in Antigua and Barbuda can deduct housing-related expenses from their US tax bill by claiming the Foreign Housing Exclusion. This exclusion is only available to those who claim the FEIE through filing Form 2555.

UK tax forms

Foreign Tax Credit Relief (FTCR): Can be claimed on a Self Assessment Tax return for UK citizens living abroad.

Form R43: Can be used to claim refunds for UK income personal allowances for non-resident taxpayers of the United Kingdom.

Form R105: Allows non-residents to receive UK savings interest tax free.

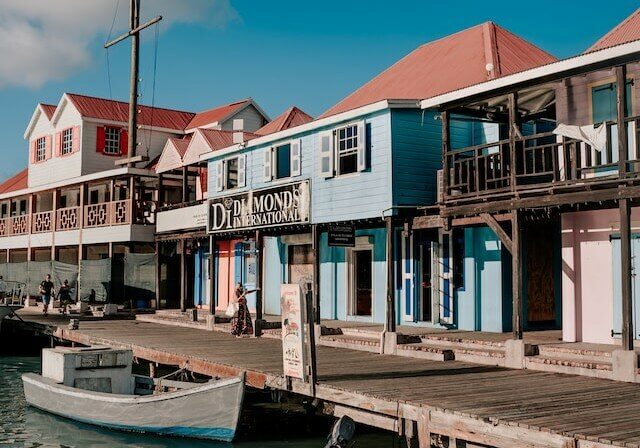

Antigua and Barbuda Citizenship

Applicants to the economic citizenship program must go through a strict due diligence check carried out by the Barbuda Investment Authority in order to acquire an Antigua and Barbuda passport. Investing in Antigua and Barbuda rewards expats with a myriad of opportunities, including visa free travel to 151 destinations worldwide, including the United Kingdom, Europe’s Schengen Area, Hong Kong, and more.

Tax advantages in Antigua and Barbuda

Citizenship in Antigua and Barbuda comes with the right to Antigua tax residency. One may wonder, “Why apply for the Antigua residency as an American? In short, Antigua and Barbuda’s tax regime allows individuals to benefit from no capital gains taxes or estate taxes and no personal income taxes. The currency is the Eastern Caribbean Dollar (EC), which is pegged to the US dollar at 2.70.

While Antigua and Barbuda is by no means considered a ‘tax haven,’ the nation has a solid taxation structure that appeals to investors.

Antigua Tax Treaties and Agreements

- Barbados

- Belize

- Dominica

- Jamaica

- Grenada

- Guyana

- Saint Kitts and Nevis

- Saint Lucia

- Saint Vincent and the Grenadines

- Sweden

- Switzerland

- Trinidad and Tobago

The nation also has Tax Information Exchange Agreements with countries including Aruba, Australia, Belgium, Denmark, Finland, France, Germany, Iceland, Ireland, Liechtenstein, the Netherlands, Netherlands Antilles, Norway, Sweden, the United Kingdom, and the United States.

In addition to this, Antigua and Barbuda has signed the Organization of Economic Cooperation and Development (OECD) Convention on Mutual Assistance in Tax Matters, implementing measures to facilitate the automatic exchange of financial account information under the OECD’s Common Reporting Standard (CRS).

Other Tax Situations in Antigua and Barbuda

Transfer tax: Non-residents must obtain an Alien Landholding License to legally conduct Antigua real estate transactions, which is 2.5 percent for the buyer, based on the property’s market value.

- Stamp duty: Stamp duty tax on the sale of real estate in Antigua and Barbuda is 7.5 percent for the seller and 2.5 percent for the buyer, based on the property’s purchasing value.

- Sales tax: Similar to Value-Added Tax, Antigua and Barbuda sales tax is generally fixed at 15 percent as of 1 January 2024. However, hotels and holiday accommodations are lower at 10.5 percent and 12.5 percent, respectively.

Property taxes for buyers, sellers, and real estate owners in Antigua

- Property tax: Antigua and Barbuda property taxes range from 0.1 to 0.5 percent of the property value. Non-residents who own undeveloped land must pay an undeveloped land tax, which is 10 to 20 percent of the value of the land, depending on how long the property has been owned.

- Transfer tax: Non-citizens must obtain an Alien Landholding License (ALHL) to legally buy Antigua and Barbuda real estate, which is 2.5 percent for the buyer based on the property value.

- Stamp duty: Based on the property’s value, stamp duty on Antigua and Barbuda real estate sales is 7.5 percent for sellers and 2.5 percent for buyers.

Annual property taxes

Antigua property tax is based on the property’s market value at a rate of 0.1 to 0.5 percent. The final rate depends on whether the property is used for residential or commercial purposes.

Antigua and Barbuda land tax

Land tax in Antigua and Barbuda is included in the annual property tax.

Land tax rates

- Unimproved land (vacant land): 0.3 percent of the property’s value.

- Improved land (land with buildings): Applied to the land and its structures, with separate rates for each. The land is generally taxed at 0.3 percent, and the building adds 2 percent.

Specific land categories may be exempt from land tax or owners pay reduced rates, including land owned by charitable or religious institutions, agricultural land, and specific government real estate.

Why use Global Citizen Solutions?

Global Citizen Solutions is a multidisciplinary firm offering bespoke residence and citizenship solutions in Europe and the Caribbean. In a world where the economy and politics are unpredictable, having a second citizenship opens up opportunities and creates flexibility for you and your family.

- Authorized International Marketing Agent. Global Citizen Solutions have official certification by the Government of Antigua and Barbuda to promote and market their Citizenship by Investment program. You can find a copy of our certificate by clicking the image on the right

- Global approach by local experts. We are corporate members of the Investment Migration Council, with local expertise in all five Caribbean CBI programs.

- 100 percent approval rate. We have never had a case rejected and will offer you an initial, free-of-charge, due diligence assessment before signing any contract.

- Independent service and full transparency. We will present to you all the investment options available, and all expenses will be discussed in advance, with no hidden fees.

- An all-encompassing solution. A multidisciplinary team of immigration lawyers, investment specialists, and tax experts will take into consideration all your and your family's mobility, tax, and lifestyle needs.

- Confidential service and secure data management. All private data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

Frequently Asked Questions about Antigua and Barbuda Tax

Is Antigua tax free?

Antigua and Barbuda is not a tax-free country. However, an Advantage of Antigua vs St Lucia citizenship for example, is there are several Antigua and Barbuda tax exemptions. Residents and citizens do not pay Caribbean taxes on capital gains, wealth, or inheritance, and there are no personal income taxes.

Does Antigua tax worldwide income?

There is no income tax in Antigua, including local and worldwide earnings.

What is the VAT in Antigua?

Standard VAT (Value Added Tax) in Antigua and Barbuda imposed by the Inland Revenue Department increased to 17 percent from 15 percent on 1 January 2024.

What is ABST tax?

ABST is sales tax in Antigua and Barbuda, which typically operates at a flat rate of 15 percent. However, special rates for businesses such as hotels and other tourist accommodations pay a lower rate of 12.5 percent, while some goods and services have a reduced sales tax rate of 10.5 percent.

What is Antigua property tax?

Property tax in Antigua is assessed based on the property’s market value, which ranges from 0.1 percent to 0.5 percent.

Is Antigua and Barbuda a tax haven?

Antigua and Barbuda is not a tax haven, but it has a progressive and moderate tax regime that offers many advantages for those who invest in Antigua and Barbuda, such as no personal income tax, inheritance tax, wealth tax, or tax on capital gains.

Do you have to pay tax in Antigua?

An individual or legal entity may pay taxes in Antigua to the Inland Revenue Department. The Antigua and Barbuda tax rate can be influenced by residency; residents do not pay personal income tax, while non-residents are liable to pay a withholding tax rate of 25 percent.

Does Antigua and Barbuda offer specific tax benefits for certain sectors or industries?

When it comes to sales tax, which is similar to value-added tax (VAT), hotels enjoy a lowered rate of 10.5 percent, while holiday accommodations enjoy a rate of 12.5 percent. The standard sales tax rate imposed by the Antigua and Barbuda Inland Revenue Department is 17 percent.

Does the US have a tax treaty with Antigua?

The US does not have a tax treaty with Antigua and Barbuda.

Do you have to pay to leave Antigua?

Since August 2022, the visa requirements for Antigua and Barbuda moved the fee for the departure tax all airline tickets, eliminating any extra fees upon departure. For those departing by sea, a $5 per passenger sea departure tax applies, while those who stay over 24 hours and leave on a pleasure vessel must pay an embarkation sea port tax of EC 75 ($27.75.

How do Controlled Foreign Corporation regulations function in Antigua and Barbuda?

Controlled Foreign Company (CFC) rules are designed to prevent tax evasion by ensuring residents cannon artificially shift income to offshore entities in tax haven or low-tax jurisdictions. However, Antigua and Barbuda has no specific Controlled Foreign Corporation regulations.

Does the US Have a Totalization Agreement with Antigua and Barbuda?

The United States and Antigua and Barbuda do not have a Totalization Agreement.

Transfer tax: Non-residents must obtain an Alien Landholding License to legally conduct

Transfer tax: Non-residents must obtain an Alien Landholding License to legally conduct  If you are an American and do not have self-employed work or a registered business in Antigua and Barbuda, you need a tax identification number to open an account with

If you are an American and do not have self-employed work or a registered business in Antigua and Barbuda, you need a tax identification number to open an account with