The Governments of Antigua and St Lucia provide citizenship programs. This guide compares Antigua vs St Lucia citizenship, reviewing their investment options, costs, citizenship timelines, and destinations in their 140-plus visa free countries.

Whether you aim to increase global mobility, reduce taxes, or diversify your assets, this guide covers all the bases, including:

Benefits of Antigua and St Lucia Citizenship by Investment Programs

- Quick application process: Applicants can gain a second passport in as little as six months.

- Dual citizenship allowed: Both countries allow dual nationality, permitting successful applicants to get Caribbean second citizenship.

- Enhanced travel privileges: Antigua and St Lucia passport holders can travel to over 140 countries visa free, including the UK, European Union, China, Russia, Qatar, Hong Kong, and Taiwan.

- Entire family is eligible: Both countries provide comprehensive family inclusion, allow primary applicants to include their spouse, children, parents, grandparents, and siblings.

- Affordable second passport: Foreign investors can obtain a second passport with a minimum contribution of $230,000 for a single applicant or a family of up to four.

- Attractive tax regimes: Residents of St Lucia and Antigua enjoy several tax benefits, including no worldwide income tax or capital gains, inheritance, or wealth tax.

- Multiple investment opportunities: Both Caribbean nations offer unique investment options, including a university fund donation and a refundable government bonds option.

- No in-person interviews: Applicants can apply for citizenship remotely, and the mandatory interview takes place remotely.

Antigua vs St Lucia Comparison: At a Glance

Program Characteristics | Antigua Citizenship by Investment | St Lucia Citizenship by Investment |

Citizenship Timeline | 6 months | 10 to 12 months |

Visa Free Countries | 151 visa free destination, including EU Schengen countries, the UK, China, Russia, Qatar, Hong Kong, and Singapore | 148 visa free destination, including EU Schengen countries, the UK, Taiwan, Hong Kong, and Singapore |

Minimum Investment | $230,000 | $240,000 |

Investment Options | Four | Four |

Taxes | No personal income tax, wealth tax, gift tax, inheritance tax, or capital gains tax | No income tax on worldwide income, wealth tax, gift tax, inheritance tax or capital gains tax |

Residence Rule | Five days in the first five years | No stay requirements |

Family Eligibility | Spouse, children, parents, grandparents, and siblings | Spouse, children, parents, grandparents, and siblings |

Application Requirements | No in-person interview or language requirements | No in-person interview or language requirements |

Passport Global Ranking | 51st | 70th |

Antigua and Barbuda Citizenship

The Antigua and Barbuda citizenship by investment program was created in 2013, as one of five Caribbean citizenship programs, foreign investors can obtain Antigua citizenship in exchange for investing in the country. Foreign investors can choose one of the following options:

- Donation of at least $230,000 to the Antigua and Barbuda National Development Fund.

- Pre-approved real estate purchase or shares of real estate investment worth a minimum of $300,000.

- Business investment of $400,000 in an enterprise worth $5 million in total, or $1.5 million as a single investor.

- Donation of at least $260,000 to the Antigua and Barbuda University of the West Indies Fund – this option is available for families of six members or more and entitles one person to a one-year scholarship

The entire application process can be completed remotely in six months. It is, however, the only one with a minimum stay requirement. Once you have been granted citizenship, you are only required to spend five days in the country during the first five years of citizenship. Antigua and Barbuda passport holders can travel visa free to 151 countries.

Requirements and Eligibility Criteria of St Lucia and Antigua

Rquirements Antigua and Barbuda St Lucia Minimum Investment $230,000 $240,000 Age 18 and over 18 and over Criminal History Clean Clean Health Conditions Good health Good health Qualified Dependents -Spouse -Children under 18 -Children 18 and 30, if supported, as well as their spouse and dependent children -Children 18 or over and physically/mentally challenged -Parents and grandparent -Unmarried siblings without children -Spouse -Children under 21 -Children 21 and 30, if supported -Children 21 or over and physically/mentally challenged -Parents and grandparen -Unmarried siblings without children Documents Required -Valid passport -Birth certificate -Criminal record certificate -Personal reference -Marriage certificate (if applicable) -Affidavit of support for dependents -Citizenship by investment application form -Investment confirmation form -Medical certificate -Licensed Agent form -Bank statement -Valid passport -Birth certificate -Criminal record certificate -Marriage certificate (if applicable) -Affidavit of support for dependents -Citizenship by investment application form -Investment confirmation form -Medical certificate -Professional reference -Licensed Agent form -Bank statement Citizenship Process 1. Authorized Agent carries out pre-screening 2. Complete necessary application forms and submit to Authorized Agent 3. Agent submits forms and support document to Antigua CIU 4. Take citizenship interview 5. Receive approval in principle 6. Complete chosen investment 7. Receive citizenship certificate 1. Authorized Agent carries out pre-screening 2. Complete necessary application forms and submit to Authorized Agent 3. Agent submits forms and support document to St Lucia CIU 4. Take citizenship interview 5. Receive approval in principle 6. Complete chosen investment 7. Receive citizenship certificate

Antigua and St Lucia Investment Options Comparison

Antigua and St Lucia both offer a wide range of investments to get a second passport. There investment opportunities include a state fund contribution and real estate purchase. Investment properties have a minimum ownership period of five years after acquiring citizenship.

Investment Option Antigua and Barbuda St Lucia Non-refundable Contribution National Development Fund (NDF) $230,000: Single applicant $230,000: Family of four $245,000: Family of five or more National Economic Fund (NEF) $240,000: Single applicant $240,000: Family of four +$10,000: Additional dependent under 18 +$20,000: Additional dependent over 18 Real Estate $300,000 Processing fee: $10,000 for single applicant or $20,000 for family of four $300,000 Processing fee: $30,000 for single applicant or $55,000 for family of four University Fund Donation $260,000 for a family of six Processing fee: $10,000 for each additional dependent - Enterprise Investment OPTION A: $1.5 million as a solo investor OPTION B: $400,000 in a $5 million joint enterprise OPTION A: $3.5 million as a solo investor OPTION B: $250,000 in a $6 million joint enterprise Government Bonds Acquisition - $300,000 Application fee: $50,000

Which program to pick?

Both Caribbean citizenship programs are solid and well-respected ways to become a Caribbean citizen, and both countries recognize dual citizenship and allow it to be passed down to future generations. A Caribbean passport affords a number of great benefits to the holder, so the choice between these Caribbean citizenship investment programs will depend entirely on your specific circumstances and expectations.

Antigua and Barbuda is known as a family-friendly option, not only because of the University of the West Indies Fund option, which is perfect for large families but also because it is the most affordable option for a family of four, at $230,000. Both St Lucia and Antigua require applicants to take a Caribbean citizenship interview.

While there are no residency requirements to invest in St Lucia and obtain citizenship, applicants to the Antigua and Barbuda second citizenship program must spend five days in the country during the first five years of citizenship.

Visa free access

The Antigua and Barbuda passport ranks 51st in the Global Passport Index compared to 70th for the St Lucia passport. Foreign nationals with Antigua and Barbuda or St Lucia Caribbean passports can visit at least 145 destinations without a visa. The Antigua and Barbuda has 151 visa free countries compared to 148 with the St Lucian passport.

St Lucia citizens can enter Taiwan without a visa, whereas Antigua and Barbuda citizenship facilitates visa free entry to Qatar and China.

Country | Entry Requirements for Antigua and Barbuda Citizens | Entry Requirements for St Lucia Citizens |

EU Schengen Countries | Visa free | Visa free |

China | Visa free | Visa required |

Russia | Visa free | Visa free |

United Kingdom | Visa free | Visa free |

South Africa | Visa free | Visa required |

Taiwan | Visa required | Visa free |

Qatar | Visa free | Visa required |

Passport validity

In a St Lucia vs Antigua passport validity comparison, a St Lucia passport is valid for five years for citizens under 16 and ten years for citizens over 16. In contrast, an initial Antigua and Barbuda passport for citizens over 16 is valid for five years, with subsequent passports valid for ten. All passports for citizens under 16 are valid for five years.

Age limits for eligible dependents

Dependent | Antigua and Barbuda | St Lucia |

Spouse | No limit | No limit |

Children | -Under 18 -18 and 30, if supported -18 or over and physically/mentally challenged | -Under 21 -21 and 30, if supported -21 or over and physically/mentally challenged |

Parents | 55 and over | 55 and over |

Grandparents | 55 and over | 55 and over |

Siblings | No limit | 18 and under |

Tax considerations

While both Caribbean nationals are tax friendly, the primary difference of Antigua vs St Lucia citizenship for taxes is Antigua and Barbuda does not impose income tax, whereas St Lucia tax residents must pay personal income tax on foreign income.

Antigua and Barbuda reaffirms its favorability for taxes with a corporate tax rate of 25 percent vs 30 percent in St Lucia.

Tax | Antigua and Barbuda | St Lucia |

Personal Income Tax | 0 percent | 0 to 30 percent (foreign income) |

Corporate Income Tax | 25 percent | 30 percent |

Social Security Contributions | 13 to 14 percent | 10 percent |

Stamp Duty | 2.5 percent | 2 percent |

Wealth Inheritance, Capital Gains Tax | No tax | No tax |

Main Differences between the Antigua and St Lucia Passport

Antigua and Barbuda CBI strong points

- Most affordable for large families: $260,000 University of the West Indies (UWI) Fund donation covers families of six or more.

- Faster processing time: Antigua and Barbuda’s application process takes 6 months on average versus 10 to 12 months in St Lucia.

- More powerful passport: Antigua and Barbuda’s passport offers 151 visa free countries versus 148 with St Lucia’s.

St Lucia CBI strong point

- Refundable investment: St Lucia is the only Caribbean country offering a refundable government bonds investment route.

- Cheaper enterprise investment: St Lucia’s enterprise investment option starts at $250,000 versus $400,000 in Antigua and Barbuda.

- No residency requirement: Investors are not required to visit St Lucia or reside there before or after they obtain Caribbean citizenship.

Our experts at Global Citizen Solutions will help you find the best Caribbean citizenship for yourself and your family, and you can have a Caribbean passport in hand in a few months.

Why use Global Citizen Solutions?

Global Citizen Solutions is a multidisciplinary firm offering bespoke residence and citizenship solutions in Europe and the Caribbean. In a world where the economy and politics are unpredictable, having a second citizenship opens up opportunities and creates flexibility for you and your family.

So, why work with Global Citizen Solutions to obtain Caribbean citizenship?

- Global approach by local experts: We are corporate members of the Investment Migration Council, with local expertise in all five Caribbean CBI programs.

- 100 percent approval rate: We have never had a case rejected and will offer you an initial, free-of-charge, due diligence assessment before signing any contract.

- Independent service and full transparency: We will present to you all the investment options available, and all expenses will be discussed in advance, with no hidden fees.

- An all-encompassing solution: A multidisciplinary team of immigration lawyers, investment specialists, and tax experts will take into consideration all your and your family's mobility, tax, and lifestyle needs.

- Confidential service and secure data management: All private data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

Don’t forget to check our other Caribbean comparison articles:

- Caribbean Citizenship by Investment Comparison Guide

- St Lucia vs Dominica Citizenship

- St Kitts and Nevis vs Dominica Passport

- Grenada vs St Kitts Citizenship

- Grenada vs St Lucia Citizenship

- Saint Kitts vs Saint Lucia Citizenship

- Grenada vs Dominica Citizenship

- Antigua vs St Kitts Citizenship

- Antigua vs Grenada Citizenship

- Antigua vs Dominica Citizenship

Frequently Asked Questions about Caribbean Citizenship

Can I acquire St Lucia citizenship?

In order to obtain Caribbean citizenship from St Lucia, you must invest at least $240,000 in the country. This can be a real estate investment, a non-refundable contribution to the National Economic Fund, a business investment, or the purchase of government bonds. All applications for the St Lucia citizenship program are processed by the St Lucia Citizenship by Investment Unit.

Can I acquire Antigua citizenship?

To acquire Antigua second citizenship, you must invest, you must invest at least $230,000 in the country’s economy. Options include buying shares of a real estate project, making a minimum contribution the National Development Fund (government fund), donation to a university fund, or making business investments. All applications are processed by the Antigua Citizenship by Investment Unit.

St Lucia or Antigua citizenship: Which one to pick?

Both Antigua and St Lucia passport provide visa free access to over 140 countries; however Antigua Caribbean passport holders can travel to 151 countries versus 148 with St Lucia’s passport. Antigua’s citizenship program is cheaper, starting at $230,000 versus $240,000 for St Lucia; however, the St Lucia investment program offers a refundable government bonds investment option. Antigua and Barbuda is ideal for large family through offering an option to donate to the University of the West Indies Fund, which grants a one-year scholarship to a family member.

What is the best Caribbean passport?

Five Caribbean countries offer citizenship by investment programs: Antigua and Barbuda, Dominica, Grenada, St Kitts and Nevis, and Saint Lucia. You can obtain citizenship in exchange for a qualifying investment. The best passport depends on your goals. For example, Grenada and St Kitts and Nevis offer visa free access to Saudi Arabia whereas Antigua and Barbuda offer entry without a visa to Qatar.

Which countries offer Caribbean citizenship by investment?

Five of the Caribbean countries offer investors the opportunity to acquire Caribbean citizenship by investment: Antigua and Barbuda, Dominica, Grenada, St Kitts and Nevis, and Saint Lucia.

Is Antigua a tax haven?

Antigua and Barbuda is considered a tax haven by many as its favorable tax environment includes no income tax or inheritance, wealth, or capital gains tax.

Which island is better: Antigua or St Lucia?

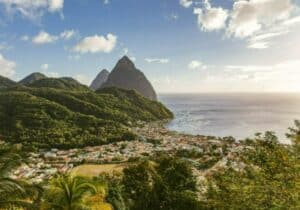

Deciding which is the best Caribbean island between Antigua and St Lucia is a personal choice. Antigua is known for its hundreds of beaches and celebrity resorts. St Lucia’s identity is defined by the iconic Pitons, which are popular among adventure seekers and nature lovers. Locals of both Caribbean islands offer warm hospitality, but Antigua leans more toward peaceful relaxation, whereas St Lucia offers a mix of adventure and untouched nature. It terms of costs, Antigua’s cost of living is higher than St Lucia’s, in addition to the average cost of Antigua real estate being more expensive.

Which passport is better, Antigua or St Lucia?

When comparing the Antigua vs St Lucia passports, Antigua has a better passport. It offers 151 visa free destinations versus 148 with St Lucia’s and ranks 19 places higher on the Global Passport Index, at 51st vs 70th for the St Lucia passport.

Is St Lucia better than Antigua?

St Lucia and Antigua have pros and cons, and the best island depends on your goals and preferences. Antigua provides the cheaper route to second citizenship, whereas St Lucia citizenship benefits include a fully refundable government bonds option. Antigua’s passport is more powerful, but St Lucia allows foreigners to establish a business to obtain citizenship.

How to get St Lucia residency?

Foreign nationals can reside legally in St Lucia through a work permit, student visa, or marriage to a St Lucia national. The requirements include fulfilling specific criteria to for eligibility, such as a job offer or enrollment at a university. Alternatively, foreigners can apply for St Lucia citizenship by making a $240,000 investment in the country’s citizenship program.

How to get Antigua residency?

Antigua and Barbud allows foreign nationals to get legal residence through a work permit, student visa, or marriage to an Antigua and Barbuda national. To qualify for such options requires having a job offer for the work permit or enrolling at a university for the student visa. There’s also the option to obtain investment citizenship from $230,000 through the Antigua and Barbuda citizenship program.

Joe Rice

Joe Rice