Starting a new business can be an exciting yet challenging journey, and choosing the right country to launch your venture is one of the most important decisions. Key factors like short startup times, government policies, tax breaks for small businesses and startups, and low corporate taxes play a crucial role in ensuring success. Additionally, a country’s business ecosystem, cultural diversity, and support for international expansion are essential for attracting a wide target market and promoting long-term growth.

This article will explore the 20 best countries to start a business, considering their status as some of the largest economies and their benefits to entrepreneurs.

This is what we will cover:

What to Consider When Choosing a Country to Start a Business

When starting a business, whether in your home country or abroad, you need to consider several important factors. It’s not just about registering a company and beginning to sell. Every country has its own rules and systems to think about.

Numerous reports evaluate countries that encourage entrepreneurs through different incentives. One such report is the Ease of Doing Business Report by the World Bank Group, which ranks countries based on how easy it is to start and run a business. It considers factors such as how long it takes to register a company, how many permits are needed, and the level of bureaucracy in each country. The Global Entrepreneurship Monitor (GEM) also publishes an annual report that helps identify the most entrepreneurial countries that support business growth and development through strong policies and resources.

Economic environment

Choose countries with stable economies and focus on growing industries like IT, which are driven by technological advances, and logistics, which are vital for global trade. Also, consider the local customer market to ensure demand for your business.

Tax policies

The best countries for business have lower corporate tax rates to help reduce operating expenses. Look for research and development tax credits or exemptions for specific industries, such as technology or green energy. Countries with a complex tax system may increase compliance costs, so it’s important to consider simplicity and clarity in tax regulations.

Ease of doing business

Consider the ease of registering a business, whether it’s a private limited company or a limited liability company. To streamline your business’s setup, look into the administrative process with as minimal red tape as possible.

Labor market

Opt for countries with skilled labor forces in diverse industries. Review policies on minimum wage, worker safety, and benefits.

Infrastructure and connectivity

Choose places with good transport systems for easy trade and shipping. Also, look for high-speed internet and tech hubs as these can help your business run efficiently and stay connected.

Access to funding and support

Find nations with strong government support for startups and many venture capital opportunities. For example, the United States offers Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) grants across the technology sector to promote innovation. European countries like Sweden and Estonia have grants and government support programs to assist entrepreneurs.

Market accessibility

Choose countries close to big markets to lower shipping costs and speed up delivery. For example, in the EU, free trade zones or agreements make it easier to reach other markets.

Residency and visa requirements

Check for visa programs that benefit business owners, like an Entrepreneur Work Visa or Golden Visas, that provide long-term residency opportunities in exchange for an investment.

Quality of life

Quality of life is an important factor when starting a business in another country because it directly impacts your well-being and that of your employees. High living standards provide a comfortable and secure environment.

20 Best Countries to Start a Business

These countries are ranked in accending order based on their ranking on the Ease of Doing Business report.

20. Finland

20. Finland

- Ease of Doing Business Rank: 20

- Corporate tax rate: 20%

Finland is a great place for entrepreneurs. The Finnish Patent and Registration Office (PRH) allows business registration to be completed online in one to two days. Known for its strong technology, clean energy, manufacturing, and education sectors, Finland offers a 20% corporate tax rate and efficient property registration that takes only a week.

Finland’s business laws make it easy to start a company, including the limited liability company law that protects owners from personal risk. The country also offers tax incentives for research and development in tech and clean energy. Labor laws focus on minimum wage, paid leave, and worker safety, ensuring a fair work environment. All this proves that Finland’s skilled workforce and great infrastructure are ideal for startups, especially in innovative sectors.

Aspect | Details |

Economy | GDP of USD 320 billion (2023), strong in forestry, electronics, and ICT |

Foreign Ownership | 100% allowed, restrictions on sensitive land |

Tax Benefits | 20% corporate tax |

Cost to Start | EUR 330 |

Time to Start | 1-2 days |

Remote Setup | Yes |

Visa Options | Entrepreneur Visa |

Language & Culture | Finnish and English; known for innovation and sustainability |

19. Latvia

19. Latvia

- Ease of Doing Business Rank: 19

- Corporate tax rate: 20% corporate tax

Latvia is another European country with a business-friendly environment. Property registration takes five to seven days and is done online, while registering a business takes a day or two. Latvia is known for logistics, IT, and manufacturing. Its location in Northern Europe makes it great for trade and tech services businesses. The country has a 20% corporate tax rate and offers tax breaks for reinvested profits. Latvia also has strong support for startups and a growing entrepreneur network.

Like Finland, Latvia makes it easy to start a business with quick registration and offers tax incentives for tech industries. It also has strong labor laws, such as minimum wage and worker safety, to guarantee a fair and highly skilled workforce. What makes the country stand out even more is the Latvia Golden Visa, which allows investors to gain residency by investing €50,000 in a business or €250,000 in real estate.

Aspect | Details |

Economy | GDP of USD 46 billion (2023), driven by transport, IT, and manufacturing |

Foreign Ownership | 100% allowed, restrictions on sensitive land |

Tax Benefits | 15% corporate tax |

Cost to Start | EUR 50 |

Time to Start | 1-2 days |

Remote Setup | Yes |

Visa Options | Latvia Golden Visa |

Language & Culture | Latvian and English; growing tech scene |

18. Estonia

18. Estonia

- Ease of Doing Business Rank: 18

- Corporate tax rate: 20%

Estonia is a leading startup hub known for its focus on digital entrepreneurship. The business registration process is entirely online, allowing entrepreneurs to set up in about 18 minutes. The corporate tax rate is 20%, and companies benefit from tax deferral on reinvested profits. The property registration process is quick, taking just five to seven days.

Estonia’s tech and startup ecosystem is thriving, with an e-residency program offering digital entrepreneurs the ability to manage their businesses remotely. The country’s minimal bureaucracy, transparent legal framework, and advanced e-government services make it an excellent choice for innovation-driven businesses.

Aspect | Details |

Economy | GDP of USD 43 billion strong in IT and digital services |

Foreign Ownership | 100% |

Tax Benefits | 0% corporate tax on retained earnings, digital services grants |

Cost to Start | EUR 190 (USD 200) |

Time to Start | 1-5 days |

Remote Setup | Yes |

Visa options | E-residency program |

Language & Culture | Estonian and English; highly digital and entrepreneur-friendly |

17. North Macedonia

17. North Macedonia

- Ease of Doing Business Rank: 17

- Corporate tax rate: 10%

North Macedonia allows businesses to register online in one to two days. The corporate tax rate is just 10%, one of the lowest in Europe. The country also offers incentives for foreign investments, including tax breaks and grants for companies in key sectors like manufacturing and technology. Property registration is fast, usually taking seven days, and the legal system is transparent.

North Macedonia’s Law on Trade Companies requires proper financial reporting and accountability, which helps safeguard shareholder interests. On the other hand, labor laws provide fair treatment with rules on minimum wage, worker contracts, and paid leave. North Macedonia’s growing industries like IT, manufacturing, and agriculture make it a great choice for businesses expanding in the Balkans and Europe.

Aspect | Details |

Economy | GDP of USD 16 billion (2023) strong in agriculture, textiles, and IT |

Foreign Ownership | 100% |

Tax Benefits | 10% corporate tax, free zones with tax exemptions |

Cost to Start | MKD 2,000 (USD 35) |

Time to Start | 1-2 weeks |

Remote Setup | Yes |

Visa Options | Business Visa |

Language & Culture | Macedonian and English; welcoming business policies |

16. United Arab Emirates

16. United Arab Emirates

- Ease of Doing Business Rank: 16

- Corporate tax rate: 9%

The UAE is a business-friendly hub with rapid business registration in one to three days, particularly in free zones. These zones offer tax exemptions and allow full foreign ownership, making it attractive for international entrepreneurs. The corporate tax rate is just 9%, one of the lowest globally, and the property registration process takes five to seven days. The UAE’s key industries include oil and gas, real estate, tourism, and technology.

Labor laws mainly focus on protecting employees through working-hour regulations, health insurance, and end-of-service benefits. The country also offers a UAE Golden Visa, which provides long-term residency to investors, entrepreneurs, and talented professionals. This visa offers benefits such as stability and the ability to live, work, and invest in the UAE without the need for a local sponsor, making it a strong option for investors looking to grow their enterprises in the Middle East.

Aspect | Details |

Economy | GDP of USD 503 billion (2023), driven by oil, trade, and tourism |

Foreign Ownership | 100% allowed in free zones |

Tax Benefits | 0% corporate tax (for most sectors), no personal income tax |

Cost to Start | AED 15,000 - 50,000 (USD 4,080 - 13,610) |

Time to Start | 1-2 weeks |

Remote Setup | Yes |

Visa Options | UAE Golden Visa |

Language & Culture | Arabic and English; global business hub |

15. Taiwan

15. Taiwan

- Ease of Doing Business Rank: 15

- Corporate tax rate: 20%

Taiwan is another country that makes it easy to do business. It offers an efficient business registration process that takes only about three days. The country’s technology-driven economy excels in electronics, semiconductors, and manufacturing, and the corporate tax rate is 20%, which is competitive compared to many other Asian economies.

Entrepreneurs can benefit from low business setup costs and supportive innovation policies, including tax incentives and grants for research and development in technology and manufacturing. Taiwan also provides strong protections for businesses through labor laws that include minimum wage, health insurance, and employee benefits. The country’s highly educated workforce, excellent infrastructure, and access to global supply chains make it a great location for businesses focused on innovation and technology.

Aspect | Details |

Economy | GDP of USD 940 billion (2023), known for high-tech manufacturing and semiconductors |

Foreign Ownership | 100% allowed in free zones |

Tax Benefits | 20% corporate tax, tax holidays for high-tech industries |

Cost to Start | TWD 1,000 (USD 32) |

Time to Start | 2-3 weeks |

Remote Setup | Yes |

Visa Options | Entrepreneur Visa |

Language & Culture | Mandarin and English; business-friendly policies |

14. Australia

14. Australia

- Ease of Doing Business Rank: 14

- Corporate tax rate: 30%

Australia offers a transparent business registration process that can be completed in three days. The corporate tax rate is 30%, but small businesses can benefit from tax incentives such as deductions for operational expenses and accelerated depreciation on capital investments. The country excels in the mining, finance, technology, and tourism sectors and has a stable economy, making it attractive for investors.

Labor laws in Australia focus on fair pay, workplace safety, and employee rights, which helps make sure that workers are protected through minimum wage standards and paid leave. Additionally, entrepreneurs can access various government grants and support programs, especially for startups and small businesses, with additional incentives like tax offsets and subsidies for innovation. Australia’s world-class infrastructure, skilled workforce, and access to Asia-Pacific markets provide a steady foundation for new businesses.

Aspect | Details |

Economy | GDP of USD 1.8 trillion (2023), driven by mining, finance, and tech |

Foreign Ownership | 100% allowed |

Tax Benefits | 30% corporate tax, tax incentives for small businesses |

Cost to Start | AUD 506 (USD 335) |

Time to Start | 1-3 days |

Remote Setup | Yes |

Visa Options | Business Innovation Visa |

Language & Culture | English; supportive and stable economy |

13. Mauritius

13. Mauritius

- Ease of Doing Business Rank: 13

- Corporate tax rate: 15%

Mauritius is not just a great holiday destination; it is also good for business. The country allows businesses to register in just one to two days. Known for its growing financial services, tourism, and technology sectors, Mauritius stands out with one of the lowest corporate tax rates in the region, at 15%, with exemptions for certain industries. Mauritius provides various incentives for foreign investors, including no capital gains tax, tax holidays, and the possibility of obtaining residency permits.

Labor laws in Mauritius ensure fair wages, paid leave, and employee protections, making the country attractive for businesses looking to maintain a stable workforce. The country’s location in the Indian Ocean and business-friendly policies make it a good place for entrepreneurs looking to access both African and Asian markets.

Aspect | Details |

Economy | GDP of USD 14 billion (2023), driven by tourism, finance, and sugar |

Foreign Ownership | 100% allowed |

Tax Benefits | 15% corporate tax, no capital gains tax |

Cost to Start | MUR 3,000 (USD 67) |

Time to Start | 3-5 days |

Remote Setup | Yes |

Visa Options | Premium Visa |

Language & Culture | English and French; known for ease of doing business |

12. Malaysia

12. Malaysia

- Ease of Doing Business Rank: 12

- Corporate tax rate: 24%

In Malaysia, you can register your business in just two days. The country is particularly known for its manufacturing, electronics, agriculture, and tourism industries and provides a corporate tax rate of 24%. In addition, Malaysia offers several tax incentives for startups and small businesses, especially in sectors such as technology and renewable energy.

Malaysia’s strong infrastructure, skilled workers, and trade agreements, like the Regional Comprehensive Economic Partnership (RCEP), make it a great choice for businesses. The RCEP is a deal between 15 countries, including ASEAN nations, China, Japan, and Australia. It helps businesses by reducing tariffs, making trade easier, and supporting economic growth across the region.

Aspect | Details |

Economy | GDP of USD 435 billion (2023), driven by manufacturing, tech, and palm oil |

Foreign Ownership | 100% allowed |

Tax Benefits | 24% corporate tax, exemptions for certain industries |

Cost to Start | MYR 1,000 (USD 215) |

Time to Start | 1-2 weeks |

Remote Setup | Yes |

Visa Options | Malaysia My Second Home Program |

Language & Culture | Malay and English; multicultural society |

11. Lithuania

11. Lithuania

- Ease of Doing Business Rank: 11

- Corporate tax rate: 15%

Lithuania offers a fast business registration process that can be completed in two to three days through its online registration system. The country is known for its IT, financial services, manufacturing, and logistics sectors. Lithuania has a corporate tax rate of 15%, with additional incentives for specific industries.

When it comes to registering property, the process can be completed in about a week. The country also offers various government incentives for innovation, including tax exemptions for research and development and subsidies for tech start-ups. Lithuania’s focus on innovation, technology-driven industries, and its position in the European Union make it an appealing choice for entrepreneurs looking to expand in the European market.

Aspect | Details |

Economy | GDP of USD 85 billion (2023), strong in tech and logistics |

Foreign Ownership | 100% allowed |

Tax Benefits | 15% corporate tax, no capital gains tax |

Cost to Start | EUR 57 (USD 60) |

Time to Start | 1-3 days |

Remote Setup | Yes |

Visa Options | Startup Visa |

Language & Culture | Lithuanian and English; tech-driven and entrepreneur-friendly |

10. Sweden

10. Sweden

- Ease of Doing Business Rank: 10

- Corporate tax rate: 22%

Sweden is another European nation that has been listed as one of the best for entrepreneurship. It grants a straightforward business registration process, which takes about one to three days. The corporate tax rate is 22%, and the government offers tax credits and incentives for technology and green energy startups.

Sweden is one of the best countries to start a business due to its tax reliefs for companies focused on innovation and sustainability. The government also supports businesses through programs like Vinnova, which funds research and development projects. With thriving industries such as technology, green energy, and manufacturing, Sweden offers a stable, progressive environment for international entrepreneurs.

Aspect | Details |

Economy | GDP of USD 720 billion (2023), driven by manufacturing and tech |

Foreign Ownership | 100% allowed |

Tax Benefits | 20.6% corporate tax, innovation grants |

Cost to Start | EUR 57 (USD 60) |

Time to Start | 1-2 weeks |

Remote Setup | Yes |

Visa Options | Self-Employment Visa |

Language & Culture | Swedish and English; known for innovation and equality |

9. Norway

9. Norway

- Ease of Doing Business Rank: 9

- Corporate tax rate: 22%

Norway offers a fast business registration process, which can be completed in two to three days. The corporate tax rate is 22%, and like in Sweden, additional tax breaks exist for green energy and sustainability businesses.

Therefore, Norway is one of the best countries for businesses because the government supports small and medium-sized enterprises. The country is particularly notable for its clear legal framework and very low corruption, which makes it safe and reliable for business owners. Therefore, it is no surprise that labor laws also protect workers with fair working hours, paid leave, and health benefits. This way, business owners can enjoy Norway’s focus on work-life balance and access to a skilled and multilingual workforce.

Aspect | Details |

Economy | GDP of USD 550 billion (2023), with strengths in energy, shipping, and tech |

Foreign Ownership | 100% allowed |

Tax Benefits | 22% corporate tax, deductions for R&D |

Cost to Start | NOK 6,000 (USD 570) |

Time to Start | 5-7 days |

Remote Setup | Yes |

Visa Options | Entrepreneur Visa |

Language & Culture | Norwegian and English: environmentally focused society |

8. United Kingdom

8. United Kingdom

- Ease of Doing Business Rank: 8

- Corporate tax rate: 22%

The United Kingdom is known for being one of the fastest-growing financial sectors. Fortunately, the country also makes it easy to register a business in just three days. The corporate tax rate is 19%, and various tax reliefs and incentives are available for startups, particularly those in technology, creative industries, and research and development sectors.

This is one of the best countries for entrepreneurs because the UK offers grant schemes like the Innovation Grant Program and tax credits for small and medium businesses. The business environment is supportive, with a strong infrastructure, an extensive venture capital network, and a reputation for being business-friendly. The government is also determined to encourage innovation and international market expansion, making it a perfect choice for entrepreneurs across the globe.

Aspect | Details |

Economy | GDP of USD 3.8 trillion (2023), driven by finance, healthcare, and tech |

Foreign Ownership | 100% allowed |

Tax Benefits | 19% corporate tax, R&D tax relief |

Cost to Start | GBP 12 (USD 15) |

Time to Start | 1-2 days |

Remote Setup | Yes |

Visa Options | Innovator Founder visa |

Language & Culture | English; a multicultural business hub |

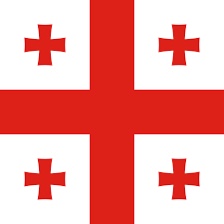

7. Georgia

7. Georgia

- Ease of Doing Business Rank: 7

- Corporate tax rate: 15%

Georgia has a fast business registration process, typically completed in one to two days. The corporate tax rate is 15%, one of the lowest in Europe, and there are additional tax incentives for foreign investors. The country offers tax exemptions for mining, agriculture, and export businesses, which is great for entrepreneurs interested in these sectors.

Georgia’s political stability and favorable business environment make it an attractive location for international entrepreneurs. A standout feature is Georgia’s Deep and Comprehensive Free Trade Area (DCFTA) with the European Union. This agreement eliminates most customs duties on goods and provides businesses with easier access to the EU market, one of the largest in the world. It reduces trade costs and opens up significant opportunities for Georgian exporters, making it especially beneficial for business owners looking to expand internationally.

Aspect | Details |

Economy | GDP of USD 3.8 trillion (2023), driven by finance, healthcare, and tech |

Foreign Ownership | 100% allowed |

Tax Benefits | 19% corporate tax, R&D tax relief |

Cost to Start | GBP 12 (USD 15) |

Time to Start | 1-2 days |

Remote Setup | Yes |

Visa Options | Temporary Residence Permit |

Language & Culture | English; a multicultural business hub |

6. United States

6. United States

- Ease of Doing Business Rank: 6

- Corporate tax rate: 21%

The United States has one of the largest business markets, with a fast registration process of three to five days. The corporate tax rate is 21%, and many tax incentives exist for startups, small businesses, and tech firms. Government programs like the Small Business Administration (SBA) provide loans, grants, and tax credits to support growth. Key industries include technology, entertainment, and manufacturing, offering diverse opportunities for entrepreneurs.

The U.S. also attracts international entrepreneurs through the EB-5 Visa, which grants a green card to foreign investors. Another unique advantage is the strong Intellectual Property (IP) protection in the U.S., which ensures that business owners can protect their innovations, trademarks, and patents. This protection promotes innovation and provides security for companies investing in research and development.

Aspect | Details |

Economy | Largest in the world, GDP of USD 26.8 trillion (2023), strong in tech, finance, and energy |

Foreign Ownership | 100% allowed |

Tax Benefits | 21% corporate tax, incentives for R&D and sustainability |

Cost to Start | USD 200-800, depending on state |

Time to Start | 1-2 weeks |

Remote Setup | Yes |

Visa Options | EB-5 Investor Visa |

Language & Culture | English; diverse and competitive |

5. South Korea

5. South Korea

- Ease of Doing Business Rank: 5

- Corporate tax rate: 22%

South Korea provides a favorable environment for businesses, with a fast registration process of two to three days. The corporate tax rate is 22%, but businesses in sectors like technology, electronics, and research and development (R&D) can access many tax incentives. These include tax breaks for R&D expenses, investment tax credits, and incentives for export businesses. Companies involved in advanced technologies can also benefit from additional financial support.

The country is known for its strong IT, semiconductors, and automotive industries, which are key drivers of economic growth. South Korea ranks in the top five for special programs like TIPS (Tech Incubator Program for Start-ups), a government-backed initiative that provides funding, mentorship, and market connections to innovative start-ups. This program helps entrepreneurs scale their businesses while gaining access to South Korea’s advanced tech ecosystem.

Aspect | Details |

Economy | Industrialized, GDP of USD 2.1 trillion (2023), driven by electronics and automobiles |

Foreign Ownership | 100% allowed |

Tax Benefits | 10-25% corporate tax, incentives for green energy and tech |

Cost to Start | KRW 10,000,000 (USD 7,700) |

Time to Start | 1-2 weeks |

Remote Setup | Yes |

Visa Options | D-8 Investor Visa |

Language & Culture | Korean; business innovation is key |

4. Denmark

4. Denmark

- Ease of Doing Business Rank: 4

- Corporate tax rate: 22%

Denmark is one of the top-ranked countries when it comes to starting a business. The country has efficient processes to help entrepreneurs register a business in three to five days. The corporate tax rate is 22%, with tax breaks available for businesses in green technologies, innovation, and sustainability. Denmark offers tax incentives for startups focused on cleantech and sustainability, and the country’s reputation for being a top business-friendly environment is driven by its strong infrastructure and policies that support small and medium enterprises (SMEs).

A unique advantage is Denmark’s flexible labor market, known as the Flexicurity Model, which combines easy hiring and firing rules for employers with strong social security benefits for employees. This system helps businesses adapt quickly to market changes while ensuring a stable workforce. The nation’s high quality of life and transparent legal framework make it one of the most attractive European countries for motivated entrepreneurs worldwide.

Aspect | Details |

Economy | Advanced GDP of USD 410 billion (2023), driven by pharmaceuticals and renewable energy |

Foreign Ownership | 100% allowed |

Tax Benefits | 22% corporate tax, grants for sustainability |

Cost to Start | DKK 670 (USD 100) |

Time to Start | 1-3 days |

Remote Setup | Yes |

Visa Options | Startup Denmark Visa |

Language & Culture | Danish and English; strong work-life balance |

3. Hong Kong

3. Hong Kong

- Ease of Doing Business Rank: 3

- Corporate tax rate: 16.5%

Hong Kong is another country with one of the fastest business registration processes, which can be completed within a day or two. The corporate tax rate is 16.5%, and offshore businesses are exempt from this rate. Hong Kong’s favorable tax reliefs for businesses in sectors such as technology, finance, and e-commerce make it one of the best countries to start a business.

Hong Kong is also loved for its free trade system and simple tax structure, which includes no sales tax or capital gains tax. This makes it an ideal place for entrepreneurs looking to maximize profits and engage in international trade. The country’s political stability, great location in Asia, and its focus on industries like logistics, finance, and technology provide ample opportunities for businesses to expand.

Aspect | Details |

Economy | Advanced GDP of USD 370 billion (2023), driven by finance, trade, and tourism |

Foreign Ownership | 100% allowed |

Tax Benefits | 16.5% corporate tax, offshore tax exemptions, no capital gains tax |

Cost to Start | HKD 9,053 (USD 1,162) |

Time to Start | Less than a week |

Remote Setup | Yes |

Visa Options | Investment Visa |

Language & Culture | Cantonese and English; multicultural society |

2. Singapore

2. Singapore

- Ease of Doing Business Rank: 2

- Corporate tax rate: 17%

Singapore has been placed second in the Ease of Doing Business rank for many reasons. One is that business registration takes only one to two days. The corporate tax rate is 17%, with tax exemptions available for companies in their first three years of operation. Singapore also offers numerous tax incentives for startups, particularly in technology and financial services.

Singapore is an excellent place for international entrepreneurs because it has strong infrastructure, political stability, and business-friendly government policies. The country encourages innovation with programs like the Productivity and Innovation Credit (PIC). This program allows businesses to claim tax deductions or cash payouts for qualifying investments in innovation, such as research and development, automation, and training. It is designed to help businesses improve productivity and competitiveness, making it easier for entrepreneurs to innovate and grow.

Aspect | Details |

Economy | Highly developed, GDP of USD 615 billion (2023), with strengths in finance, trade, and tech |

Foreign Ownership | 100% allowed |

Tax Benefits | 17% corporate tax, start-up tax exemptions, no capital gains tax |

Cost to Start | SGD 315 (USD 230) |

Time to Start | 1-2 days |

Remote Setup | Yes |

Visa Options | Entrepreneur Pass |

Language & Culture | English, Mandarin, Malay, Tamil; multicultural society |

1. New Zealand

1. New Zealand

- Ease of Doing Business Rank: 1

- Corporate tax rate: 28%

In first place, we have New Zealand, another country that makes life easier for business owners. For example, the highly efficient business registration process takes a day or two. The corporate tax rate is 28%, which is competitive in the global market.

New Zealand stands out as one of the top countries to start a business because of programs like the Callaghan Innovation Program, which offers research and development grants to innovative businesses. These grants help companies in the high-tech and science sectors access funding to develop new products and technologies. This initiative gives entrepreneurs the financial support they need to drive innovation and expand their businesses.

The country’s political stability, innovative economy, and seamless access to global markets make it an ideal destination for international entrepreneurs aiming to start and expand their businesses.

Aspect | Details |

Economy | GDP of USD 285 billion (2023) |

Foreign Ownership | 100% allowed, restrictions on sensitive land |

Tax Benefits | 28% corporate tax |

Cost to Start | NZD 150 (USD 90) |

Time to Start | 1-2 days |

Remote Setup | Yes |

Visa Options | Entrepreneur Work Visa |

Language | English and Maori |

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions About the Best Countries to Start a Business

What is the best country to move to for entrepreneurs?

Singapore is often considered the best country for entrepreneurs due to its business-friendly environment, low tax rates, and strong support for innovation. Other top choices include the United States for its access to capital and large market, and New Zealand for its ease of starting a business and entrepreneurial support programs.

How does a country's reputation impact the decision to start a business there?

Which country has the easiest business startup process for foreigners?

According to the World Bank, some of the easiest countries to start a business in Europe include Denmark, the United Kingdom, and Estonia. These countries have streamlined business registration processes, favorable tax systems, and supportive government policies that facilitate new business operations.

What are the best countries to start a tech startup?

The best countries to start a tech startup include the United States, with its strong tech hubs like Silicon Valley, and Estonia, known for its digital-friendly environment and e-Residency program. Singapore is also great for tech startups due to its innovation support and access to Southeast Asian markets.

Which country is best for starting a business?

The United States is often considered the best for starting a business due to its robust economy, access to capital, innovation-driven culture, and supportive legal framework. Other great options include Singapore, known for low taxes and ease of doing business, and the UAE, offering tax-free benefits and a strategic global location.

Which countries have the fastest company registration process?

Countries like Singapore, New Zealand, and Hong Kong have some of the fastest company registration processes, often taking just a few days to complete. These countries have streamlined systems, minimal red tape, and online registration options, making it easy for entrepreneurs to start their businesses quickly.

9. Norway

9. Norway 7. Georgia

7. Georgia

4. Denmark

4. Denmark 3. Hong Kong

3. Hong Kong 2. Singapore

2. Singapore