When you’re nearing the end of your professional career, choosing the best places to retire in Europe becomes a top priority. Europe offers a wide range of options, from stunning architecture to a lavish lifestyle and excellent healthcare access. The continent has popular retirement destinations year-round, with sunshine, beautiful beaches, and picturesque landscapes where you can comfortably enjoy your golden years.

This guide covers the ten best places to retire in Europe, ranked on the Global Citizen Solutions Global Retirement Index and the Quality of Life Index. Many European countries already top these rankings. The article also provides information on the average cost of living, healthcare costs, and visa options to help ensure a smooth transition.

Choosing the Best Places to Retire in Europe

When planning to retire abroad in Europe, consider factors like culture, housing prices, healthcare quality, and retirement visas. Many European countries offer retirement visas with extended stays and lower living costs, helping savings stretch further. Metrics like the Global Citizen Solutions (GCS) retirement guide and the Quality of Life Index can help you choose the best places to retire.

According to the research done by the GCS Global Intelligence Unit, the world’s population is aging quickly and has put pressure on retirement systems. Over 770 million people, which is 10% of the world’s population, are now 65 or older. By 2050, this could reach 16% (about 2.1 billion people).

In the U.S., more than 17% of people are already 65 or older—up almost 40% in the past 30 years. This rapid aging makes retirement security a major challenge for the coming decades. Therefore, with the demand for retirement security, these indices evaluate factors like healthcare costs, safety, cost of living, and environmental quality, helping retirees find locations that align with their lifestyle, budget, and health needs.

The 10 Best Places to Retire in Europe

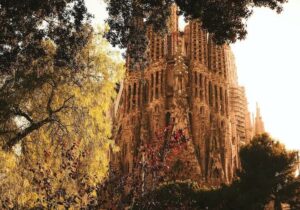

1. Spain

- Global Retirement Index ranking: 1

- Quality of Life Index ranking: 5

- English Proficiency Index ranking: 36

Spain has it all: beautiful scenery, stunning architecture, delicious cuisine, a lower cost of living, an incredible healthcare system, and more than one UNESCO World Heritage Site have earned its top one position as one of the best places to retire in the world and Europe.

According to our retirement report conducted by our Global Intelligence Unit, Spain is loved because it rarely faces any extreme weather. “This consistency in mild weather throughout the year makes both island groups particularly attractive for people considering relocation, providing a comfortable and stable environment conducive to a high quality of life.”

Non-EU citizens can retire in Spain with the Spain Non-Lucrative Visa or the Spain Golden Visa. The Spain Golden Visa requires a €500,000 real estate investment and minimal stay, while the Spain Non-Lucrative Visa suits retirees with €2,400 monthly passive income for full-time residence. Living costs range from €1,200 to €1,500 per month, with private healthcare premiums between €50 and €200. Popular retirement spots like Valencia, Málaga, Alicante, and the Costa del Sol offer mild climates and English-speaking communities.

Category | Details |

Residency options | Spain Golden Visa and Spain Non Lucrative visa |

Taxes | Retirement income is taxed progressively, ranging from 19% to 47%, depending on the income amount. However, certain exemptions may apply for specific types of income. |

Real Estate Restrictions | Expats can purchase property in Spain without restrictions |

2. Portugal

- Global Retirement Index ranking: 2

- Quality of Life Index ranking: 6

- English Proficiency Index ranking: 6

Portugal is loved for its sandy beaches, unique culture, and liberal approach to life, making it one of the best countries and a perfect place for your retirement years.

There are two ways non-EU citizens can retire in Portugal: the D7 Visa and the Golden Visa. Both options provide individuals with residency rights in Portugal and can eventually lead to Portuguese citizenship. The Portugal Golden Visa offers residency with a €250,000+ investment, requiring just seven days of residency in the first year. It’s ideal for retirees wanting flexibility. On the other hand, the Portugal D7 Visa suits those with passive income like pensions or rentals.

Portugal is one of Europe’s most affordable countries, with monthly living costs from €1,000 to €1,500. Private health insurance costs €40 to €100. Popular retirement spots are Lisbon, Porto, Cascais, and the Algarve, which offer great amenities, English-speaking communities, and vibrant culture.

Category | Details |

Residency options | Portugal Golden Visa and Portugal D7 Visa |

Taxes | Pension income for non-habitual residents is taxed at a flat rate of 10%, but the taxation can vary for other types of retirement income. |

Real Estate Restrictions | Expats can purchase property in Portugal without restrictions |

3. Italy

- Global Retirement Index ranking: 7

- Quality of Life Index ranking: 27

- English Proficiency Index ranking: 46

Italy is considered one of the best European countries to retire in. It is celebrated for its rich history, stunning landscapes, outstanding culinary traditions, and slow-paced lifestyle. Retirees interested in becoming legal residents can apply for the Italy Golden Visa, which requires a €250,000 investment in an innovative Italian startup.

The are many reasons Italy is considered the best place to retire in Europe. According to a study conducted by GCS’ Global Intelligence Unit (GIU), expats in Italy appreciate the country’s “welcoming environment, particularly in regions with higher international exposure and cosmopolitan attitudes.” English-speaking expats often settle in cities like Rome, Florence, and Milan, where active expat communities and many services are available in English. Living costs vary by region, but €1,500 to €2,300 per month is enough for comfort. Private health insurance costs around €1,200 per year.

Category | Details |

Residency options | Italy Golden Visa |

Taxes | Retirement income is taxed at a flat rate of 7% on foreign pensions. |

Real Estate Restrictions | Expats can purchase property in Italy without restrictions |

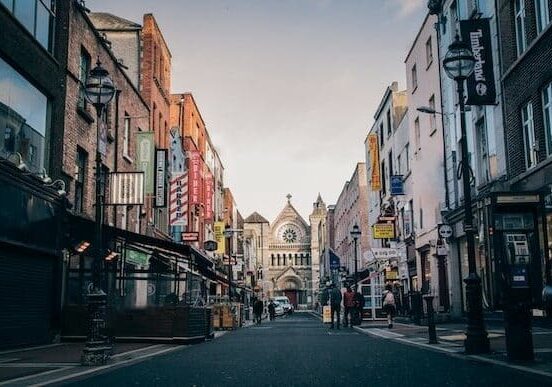

4. Ireland

- Global Retirement Index ranking: 9

- Quality of Life Index ranking: 11

- English Proficiency Index ranking: –

Ireland, often called the Emerald Isle, mixes old landscapes with lively cities. It’s famous for its rugged coastlines, green hills, and friendly people. You can find many castles and monasteries across the country that tell stories of its past. Cities like Dublin and Cork combine traditional pubs, modern food, and a love for books.

Ireland has a mixed public-private healthcare system. Public healthcare is available to all residents but often has long wait times. Many retirees choose private insurance, which costs about €1,200–€2,500 per year. Living costs range from €2,000 to €3,000 per month, depending on lifestyle and location. Retiring in Ireland is different from other countries. Applicants must first apply for permission to retire, even if they don’t need a visa. This involves submitting a form and proving financial self-sufficiency before moving forward with visa formalities if required.

Category | Details |

Residency options | Applicants must first apply for permission to retire. |

Taxes | Retirement income is taxed at progressive rates from 20% to 40%, depending on the income amount. Tax credits and deductions may reduce overall taxation. |

Real Estate Restrictions | Expats can purchase property in Ireland without restrictions. |

5. France

- Global Retirement Index ranking: 10

- Quality of Life Index ranking: 19

- English Proficiency Index ranking: 49

France will grab your attention with its art, history, and food. It offers a mix of landscapes—from Paris’ charming streets to Bordeaux’s vineyards, the snowy Alps, and the Mediterranean coast. Known for its love of fine dining, fashion, and culture, France’s landmarks like the Eiffel Tower and the Louvre highlight its rich heritage. You can enjoy the beautiful country with a monthly budget of €1,800 and €2,500.

France’s healthcare system is recognized as one of the best in the world. It provides comprehensive coverage through a combination of public and private contributions. It ensures access to high-quality medical services for all residents, with costs largely subsidized by the government. Those who want private health insurance pay about €1,200 to €2,000 a year. To live in France, retirees can apply for the Long-Stay Visa for Retirement (Visa de Long Séjour pour Retraite), which requires proof of sufficient financial resources and health insurance. The temporary residence permit is only valid for a year but can be renewed.

Category | Details |

Residency options | Long-Stay Visa for Retirement |

Taxes | |

Real Estate Restrictions | Expats can buy property in France without restrictions, but additional taxes and fees apply. |

6. Malta

- Global Retirement Index ranking: 13

- Quality of Life Index ranking: 34

- English Proficiency Index ranking: –

Arguably, Malta is the best country in Europe to retire in and one of the best countries for Americans to retire. It has an incredible healthcare system, attractive property prices, fantastic tax exemptions and incentives, political stability, and a wide range of entertainment options. It also has the best year-round weather and a large English-speaking population, among other things.

Malta’s cost of living is moderate, with monthly expenses ranging from €1,800 to €2,400, while private health insurance premiums range from €1,200 to €2,000 annually.

The country also has different ways for retirees to live there. The Malta Retirement Program gives residency to people over 55 who receive a pension, send at least 75% of it to Malta, own or rent a home, and have health insurance. Another option is the Malta Residency by Investment Program, where buying a property for at least €375,000 or renting for €14,000 a year can lead to permanent residency. For those wanting citizenship, Malta’s Citizenship by Investment program offers a passport for 12 to 36 months with a contribution of at least €600,000 for 36 months or €750,000 for 12 months.

Category | Details |

Residency options | Malta Retirement Programme, Malta Citizenship by Investment and Malta Residency by Investment. |

Taxes | 5% tax on foreign pension income for qualifying retirees under the Malta Retirement Programme.. |

Real Estate Restrictions | Expats can purchase property in Malta without restrictions, but there is a minimum property value requirement. |

7. Greece

- Global Retirement Index ranking: 14

- Quality of Life Index ranking: 36

- English Proficiency Index ranking: 8

Greece is known for its rich culture, beautiful Mediterranean views, and easy access to the EU and Schengen Area. Retirees are attracted to its warm climate, affordable living, and English-speaking communities in cities like Athens and Thessaloniki. Monthly expenses range from €1,500 to €2,100, with healthcare costing €1,000 to €3,000 annually.

Individuals can plan for their retirement in Greece in two ways: by applying for the Greek Golden Visa or the Greek retirement visa, otherwise known as the Financially Independent Person (FIP) visa. For the retirement visa, retirees must provide proof of a steady income. At the same time, the Golden Visa requires a real estate investment of €250,000, grants residency, and comes with the flexibility of not being tied down to one place and freedom of movement.

Category | Details |

Residency options | Greece Golden Visa, Greece Retirement Visa |

Taxes | Retirement income is taxed progressively, ranging from 22% to 45%, depending on the income level. There are some exemptions for foreign pension income. |

Real Estate Restrictions | Expats can purchase property in Greece without restrictions. |

8. Turkey

- Global Retirement Index ranking: –

- Quality of Life Index ranking: 129

- English Proficiency Index ranking: 65

Turkey, located between Asia and Europe, blends Eastern and Western cultures. It offers a rich history, stunning coastlines, and affordable living. Retirees can apply for a Long-Term Residence Permit, which requires proof of income and health insurance, or choose citizenship through investment.

For Turkish citizenship by investment, a minimum property purchase of $400,000 qualifies you and your family for Turkish citizenship, with the property held for at least three years. This option is popular among investors due to Turkey’s diverse real estate options, from coastal areas to big cities like Istanbul. Monthly living costs range between €1,200 and €1,800, while private health insurance costs between €600 and €1,500 annually.

9. Germany

- Global Retirement Index ranking: –

- Quality of Life Index ranking: 3

- English Proficiency Index ranking: 10

Germany is one of the best places to retire in Europe, offering excellent healthcare, safety, and modern infrastructure. Its mix of scenic landscapes and well-connected cities provides a high quality of life. Retirees moving to cities like Berlin, Munich, and Frankfurt will find English-speaking communities that make settling in easier.

Residency for retirees in Germany is possible through a Long-Term Residence Permit. Retirees with sufficient retirement savings or steady passive income can apply for a residence permit, often granted under the “Freelancer” or “Self-Employment” categories. While Germany has a great public healthcare system, there is still the option of opting for private health insurance, which can cost about €1,500 to €3,000 per year. Monthly expenses can add up to €2,000 to €3,000, with Munich and Berlin being more costly.

Category | Details |

Residency options | Long-Term Residence Permit |

Taxes | Retirement income is taxed progressively, ranging from 0% to 45%, depending on the income level. The effective tax rate may vary based on deductions and exemptions. |

Real Estate Restrictions | Expats can purchase property in Germany without restrictions. |

10. Switzerland

- Global Retirement Index ranking: –

- Quality of Life Index ranking: 46

- English Proficiency Index ranking: 31

Switzerland is renowned for offering a high standard of living, political stability, and world-class healthcare, making it one of the best European countries for retirees. Although living in Switzerland can be costly, with a monthly budget averaging €3,500 to €5,000, the country’s stunning natural beauty, including majestic mountains and beautiful lakes, adds significant value to the retirement experience.

The country offers a wide range of recreational opportunities year-round, from skiing in the Alps during winter to hiking and cycling in the countryside during warmer months. When looking for cities with big expat communities and English speakers, visit Zurich, Geneva, and Lausanne. Additionally, retirees with sufficient retirement savings can enjoy the benefits of the Swiss healthcare system, which is known for its efficiency and quality. Those who want private health insurance can expect to pay between €3,000 and €6,000 annually.

Category | Details |

Residency options | Retirement visa |

Taxes | Retirement income is taxed at the federal level (0% to 11.5%) and at the cantonal level (which varies by canton, ranging from 0% to around 20%). |

Real Estate Restrictions | Expats can purchase property in Switzerland, but there are restrictions on the type of property and purchase amounts, especially for non-EU nationals. |

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions about the Best European Places to Retire

Which is the best European country to retire to?

Portugal is one of the best European countries for retirement, offering a warm climate, affordable living costs, and a high quality of life. Its healthcare system is excellent, and many regions have vibrant expat communities.

Where is the cheapest place to retire in Europe?

Some of the cheapest places to retire in Europe include Malta, Spain, Portugal, Turkey and Greece.

What is the cheapest and safest country to retire?

Portugal is one of the cheapest and safest countries to retire. It is actually ranked as the 6th safest country in the world according to World Population Review and the Global Peace Index. Other countries include Malta, and Spain.

How to retire in Europe as an American?

Americans planning on retiring in Europe can either do so by applying for a retirement visa, or by applying to the respective country’s Golden Visa program. The latter is more suitable if you’re considering placing a real estate investment in Europe.

Which European country is easiest to retire in?

Greece and Malta are some of the best and easiest places to retire in Europe, as they have large English-speaking communities. Other European destinations that are also suitable for retirement are Portugal, Spain, and Turkey.

What are the best places to retire in Europe?

The 10 best places to retire in Europe are:

- Tavira, Portugal

- Annecy, France

- Ljubljana, Slovenia

- Cascais, Portugal

- Paphos, Cyprus

- Kotor Bay, Montenegro

- County Clare, Ireland

- Paris, France