Dreaming of living abroad without the burden of high taxes? Many countries offer surprisingly low tax rates or even tax-free incentives that help to attract foreign investors as well as reduces cost of living.

Whether you’re a remote worker, retiree, or entrepreneur, these low- to no-tax destinations provide financial advantages that can significantly boost your income and wealth-building potential.

From tropical islands to modern urban sprawls, here are 13 countries where expats can enjoy a laid-back lifestyle with low taxes:

13 Countries With the Lowest Taxes

1. The Cayman Islands

The Cayman Islands has become synonymous with foreign investors and international corporations looking to avoid paying taxes. In addition to a zero-income tax rate for individuals, it’s one of the best tax-free countries for businesses.

The country’s appealing tax structure has enabled investors and international companies to increase their wealth significantly while simultaneously protecting it through the country’s well-structured and regulated banking system.

While there may be a financial aspect to consider, residing in the Cayman Islands provides access to exceptional standards across various aspects, including healthcare, education, infrastructure, and the pristine preservation of natural surroundings.

2. United Arab Emirates

In the UAE, local and foreign-earned income, capital gains, and all other forms of personal wealth are tax-exempt. Beyond the advantages this provides each tax resident, the country has embraced trade liberalization within the Middle Eastern region and globally.

Significant investments in educational facilities, healthcare, business districts, public transport, and entertainment options have transformed the country into one of the most desirable places to live and conduct business without common obstacles.

3. Andorra

Nestled between Spain and France in the Pyrenees mountains, the Catalan-speaking microstate of Andorra is one of Western Europe’s prime low-tax jurisdictions. Residents earning an income of €24,000 (€40,000 under some circumstances) are exempt from paying taxes.

Corporations in Andorra are also in an advantageous position, with the tax rate mirroring personal income tax of just ten percent.

One might expect that other taxes compensate for the low tax rate but Andorra is amongst the lowest in VAT, imposing only 4.5 percent on the sale of goods. The country also has numerous double tax treaties with neighboring countries that helps maintain a favorable tax environment.

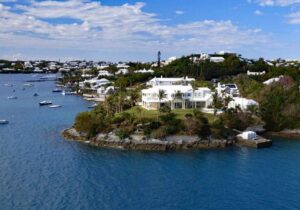

4. Bermuda

Located in the North Atlantic Ocean, the British Overseas Territory of Bermuda is the ideal foreign country for tax optimization. The Bermudan government doesn’t impose personal income taxes; however, employers and employees are liable to pay payroll taxes.

The tax rate ranges from 0.5 to 12.5 percent, with employees responsible for paying half.

Depending on the industry and position, an employer may absorb the entire payroll tax bill, meaning many working residents in Bermuda avoid paying taxes on their incomes altogether. Additionally, most businesses operating in Bermuda are exempt from corporate taxes.

5. Bahrain

Another Gulf tax haven country, Bahrain’s oil wealth has ensured it remains one of the best tax-free countries in Asia for residents and businesses. Unlike the UAE, there is currently no corporation tax in place for firms outside Bahrain’s oil and gas industry.

Corporation tax is still under discussion. Bahraini residents avoid paying all income-related taxes; the only taxes imposed are on selling and purchasing goods, such as VAT, import duties, and land tax.

6. St. Kitts and Nevis

St. Kitts and Nevis has established itself as the optimal choice when considering a location that offers a clear and uncomplicated route to low taxes and a second passport.

Compared to other countries offering citizenship by investment programs, St. Kitts and Nevis is amongst the best for tax reduction. The government employs a territorial taxation system, taxing only locally-sourced income. Additionally, income is taxed at a flat rate of five percent.

Businesses also receive favorable tax treatment. Companies are subject to a high 33 percent corporate income tax rate; however, the rate can be reduced to one percent by paying an annual license fee. Additional tax concessions allow businesses with overseas partners to pay taxes on corporate earnings at a significantly reduced rate.

7. Bulgaria

Bulgaria has garnered a reputation as a country with low taxes due to its universally reduced tax rates, attracting individuals looking to reside in one of Europe’s lowest tax countries. With its flat personal and corporate income tax rate of ten percent, Bulgaria offers one of the lowest tax rates of any European country.

This advantageous tax system has propelled the country’s reputation as an attractive destination for entrepreneurs, investors, and digital nomads.

Additionally, Bulgaria does not impose wealth or inheritance taxes, further contributing to its appeal. The combination of a reduced tax obligation and competitive business costs makes Bulgaria an appealing choice for those looking to optimize their finances while enjoying the benefits of living in a European Union member state.

8. Vanuatu

The island nation of Vanuatu is widely recognized for its picturesque tropical beauty and has gained prominence as a tax haven paradise in recent years. With a population of just 300,000, the country is small in size but large in character, and its tax policies make it an ideal country to set up shop.

Despite consisting of a group of small islands, the country generates enough money from alternative sources, such as tourism, the Vanuatu citizenship by investment program, and industrial production, including beef and timber. Based on those measures, Vanuatu has maintained its zero-income tax policies for all employees and corporations.

9. Paraguay

A country in South America often overlooked for its low tax environment but deserving of recognition, Paraguay’s tax incentives and residence options make it a serious contender for alternative residency. With its territorial tax system, Paraguay imposes taxes only on income generated within its borders.

Furthermore, the maximum tax rate on local income for individuals is capped at ten percent, placing it among the lowest tax countries in South America. Concerning corporation tax, the government imposes a flat rate of ten percent on Paraguayan businesses, one of the lowest in the region.

10. Monaco

Monaco is home to the Monaco Grand Prix and some of the world’s wealthiest people. Because of its wealth, Monaco might be considered one of the highest-taxed countries, but it has a reputation as one of the lowest-taxed countries in Europe and around the world.

Monaco has no income or corporation taxes besides corporate taxes on businesses that predominantly operate and generate income outside the state.

While living costs in Monaco may be notably high and the prerequisites to establish residence are demanding, the country’s allure as an ideal destination for wealth preservation holds great significance, particularly for those with substantial financial assets.

11. Western Sahara

The African nation of Western Sahara is seldom found on travel bucket lists, much less one to consider for tax optimization. Nonetheless, understanding low-tax countries in depth will broaden your understanding of global taxation.

Despite the ongoing civil war, Western Sahara has managed to establish diplomatic relations with 42 countries and is recognized as a full-fledged member of the African Union.

Essentially considered a failed state, the country lacks alternative sources of revenue to offset the absence of imposed taxes. Furthermore, territorial disputes, coupled with unstable governance, prevent it from establishing standard economic and criminal laws.

12. The Maldives

Beyond its heavenly attributes of stunning idyllic beaches and turquoise waters, the Maldives boasts a tax setup that aligns with its paradisical appeal.

There is no oil wealth in the Maldives or the most desirable banking system for offshore banking, but the nation generates substantial income from tourism, thereby alleviating the need to impose heavy taxes on residents.

While it isn’t completely tax-free, the threshold for paying taxes is high at MVR 720,000 (about $47,000), and you will only pay 5.5 percent tax on additional income up to MVR 1,200,000 (about $78,000).

13. Antigua and Barbuda

Antigua and Barbuda is another attractive destination for individuals and businesses seeking tax relief, thanks to its zero-income tax rate. Like other tax-free countries, Antigua and Barbuda imposes no personal income taxes, making it an appealing choice for high-net-worth individuals and expatriates.

The nation’s revenue comes from alternative sources, such as indirect taxes and business-related fees. Antigua and Barbuda has also built a favorable environment for foreign investment by offering economic citizenship through its Citizenship by Investment Program (CIP), which makes it even more appealing to international investors.

In addition to its favorable tax policies, Antigua and Barbuda offers a high standard of living with modern healthcare, reliable infrastructure, and beautiful natural landscapes.

If you’re looking to settle in this sought-after low-tax haven, check out the Antigua and Barbuda Citizenship by Investment program.

Benefits and Drawbacks of Low Tax Countries

Countries with low- to no-taxes offer several benefits but can also come with drawbacks:

Benefits

1. Higher Disposable Income

With little to no income tax, residents and expats keep more of what they earn, increasing their savings and spending power.

2. Business and Investment Incentives

Low-tax environments attract businesses, entrepreneurs, and investors, leading to job creation and economic growth. As a result places like Dubai and Singapore are thriving as financial and business hubs.

3. Economic Freedom and Tax Efficiency

Many tax-free countries have streamlined tax codes, reducing bureaucracy and making financial planning easier for individuals and companies.

4. Appealing to Expats and Digital Nomads

Remote workers, retirees, and high-net-worth individuals often relocate to low-tax countries to maximize their wealth while still enjoying a high standard of living.

5. Strong Infrastructure and Services

Wealthy, resource-rich nations tend to reinvest in infrastructure, healthcare, and public services despite no personal income taxes. However, note that this may not be the case in all instances.

Drawbacks

1. High Cost of Living

Many tax-free countries (like Monaco, UAE, and the Cayman Islands) offset the lack of income tax with higher costs for housing, goods, and services.

2. Heavy Reliance on Alternative Revenue Sources

Some nations depend on volatile sources like tourism or natural resources, making their economies vulnerable to downturns.

3. Expensive Residency or Citizenship Programs

Gaining residency in these countries often requires significant investment and high-income earners, making it difficult for average earners to qualify.

4. Hidden Taxes and Fees

While income tax might be zero, governments impose high VAT, import duties, real estate taxes, and service charges to compensate, leading to hidden costs.

5. Limited Social Benefits

Some tax-free nations, such as the Bahamas or Panama, have weaker public healthcare, social security, and welfare programs compared to high-tax countries like Canada or those in Europe.

How Low-to No-Tax Countries Sustain Their Economies

Many people might think that taxes are the only way for countries to maintain things like infrastructure but alongside planning government spending more efficiently, these countries do the following to compensate:

1. Natural Resource Wealth

United Arab Emirates and Qatar, among others, generate massive revenue from oil and gas exports. These profits allow them to fund public services without needing income tax from citizens.

2. Tourism and Hospitality

Luxury tourism, casinos and high-end real estate are other ways to generate income for countries like the Maldives and Monaco. Tourism taxes, VAT, and service charges help fund infrastructure and public services.

3. Financial Services and Offshore Banking

Tax havens like the Cayman Islands and Bermuda attract businesses with financial incentives, making money through licensing fees, banking services, and corporate registrations.

4. High Value-Added Taxes (VAT)

Many low-tax nations impose significant VAT, sales taxes, or import duties. For example, the Bahamas has no income tax but charges a high VAT rate on goods and services.

5. Special Economic Zones and Business Incentives

Business incentives are created to attract multinational companies to invest in countries like Singapore and Hong Kong. These incentives come in the form of low or reduced corporate taxes.

6. Wealth and Luxury Taxes

Countries like Monaco tax real estate transactions, luxury goods, and high-value assets rather than income. These indirect taxes target wealthy residents and visitors without burdening the average citizen.

7. Sovereign Wealth Funds

Nations like Norway (although it does still tax residents) and the UAE invest resource profits into sovereign wealth funds, which generate returns that help sustain public spending.

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions about Countries with Low Taxes

Which countries have the lowest income tax rates?

Cyprus, Andorra, Malta, Montenegro and Singapore are among the countries with the lowest tax rates in the world.

Antigua and Barbuda is another low tax country where individuals are also free from paying taxes on wealth, capital gains, and inheritance.

What are the benefits of living in a low-tax country?

Low tax rates raise the amount of disposable income of consumers, allowing them to spend more and this, in turn, increases the gross domestic product (GDP) and boosts the economy. It also allows citizens to enjoy a lower cost of living and save more money.

What are the drawbacks of living in a low-tax country?

While the benefits are numerous, a low-tax country may be hiding other costs in the form of high import tariffs or expensive utilities. Furthermore, these countries may seem more laid-back but it might come with a slower pace and limited infrastructure.

How is it possible for Dubai to be a tax-free country?

The discovery of oil in the UAE has ensured that the government had no incentive to levy direct taxes. Local governments receive royalties from their emirate-owned oil companies, which local governments in turn use to fund the federal government.

Which EU country has the lowest income tax?

Bulgaria and Romania (10 percent) levy the lowest rate at 10 percent. They are followed closely by Moldova (12 percent).

Which countries have the simplest tax systems?

The following countries have simplified tax systems:

- UAE and Monaco: Individual residents are exempt from taxes so it’s technically the simplest as there is no filing required.

- Estonia: Income tax is assessed on a monthly basis and only when profits have been distributed. A flat tax applies to individuals.

- Bulgaria: A flat tax rate is applied to both individuals and businesses.

Which country has the highest taxes in the world?

The country with the highest taxes in the world is the Ivory Coast, which imposes a 60 percent income tax.

How do low-tax countries sustain their economies without high tax revenues?

Low- or no-income tax jurisdictions tend to supplement lost government revenues by imposing tariffs, also known as customs and import duties. They also rely on natural resource revenues and foreign investment while prioritizing efficiency in government spending.

Gizane Campos

Gizane Campos