Transactions are quick, digital, secure, and worldwide, meaning record-keeping is done without the risk of pirating data. Nowadays, crypto can be used to pay for goods or services, invest in them, or exchange funds with someone else.

So, how does crypto tax work? In this ultimate guide, we will take you through the following:

- What is cryptocurrency?

- Are cryptocurrencies taxed?

- How do you pay taxes on cryptocurrency?

- What are the tax rules for cryptocurrency?

- How much is cryptocurrency taxed?

- Tax rates and brackets for 2025

- How do you calculate your gains and Losses?

- What are tax-free cryptocurrency transactions?

- What are the cryptocurrency tax-free countries?

What is cryptocurrency?

Cryptocurrency is a type of digital money. You can’t physically touch or see it, but it exists online. Instead of being stored as physical coins, cryptocurrencies are kept in digital wallets or on exchanges. Bitcoin and Ether are the most well-known types.

Cryptocurrencies work on a technology called blockchain, which is a secure digital ledger. Unlike traditional money, no bank or government controls cryptocurrencies. Instead, transactions are processed using cryptography.

The security of cryptocurrencies, like Bitcoin, comes from a process called “mining.” This ensures that every transaction is verified by solving complicated digital codes. The blockchain network checks and confirms all updates to the transaction records, making it secure.

Are cryptocurrencies taxed?

If you don’t do this, you might be committing tax fraud. Crypto users must report transactions as US dollars on their tax returns, which means they must establish their fair market value as of the transaction date. To determine the fair market value, you just need to convert the virtual currency into US dollars or another currency converted into US dollars.

How do you pay taxes on cryptocurrency?

To pay your taxes, you first need to know when to report them. American taxpayers have a yearly deadline. This year the date fell on 15 June 2024. However, it is important to note that you are responsible for keeping track of your transactions.

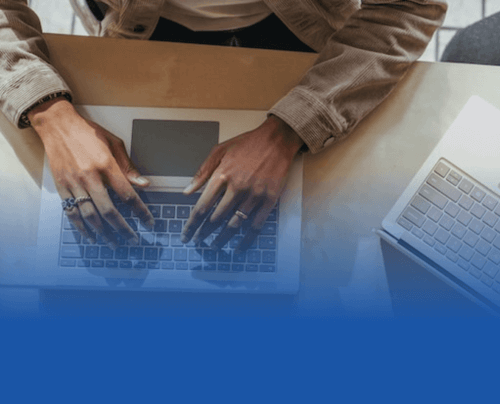

To avoid any tax mishaps, you can record your transactions through an app or software just for this purpose. You can also use cryptocurrency tax software to handle your tax reporting.

The software usually follows a simple process of selecting each exchange you’ve used and importing your history of transactions from that exchange. The software automatically generates your crypto tax forms based on the data supplied.

You are required to keep track of the following:

- Purchases or dates you received your crypto

- Dates when you sold or spent it

- Amounts of the transaction

The general rule of thumb is that gains or losses accumulated in periods of less than 12 months are considered other income when it comes time to file your taxes. Anything accrued over a year is ‘capital gains or losses’ on your tax form.

Follow these five steps to file your cryptocurrency taxes:

- Calculate your gains and losses.

- Complete the IRS Form 8949 (the form is used for reporting the sales and disposals of capital assets)

- Include your totals from 8949 on Form Schedule D (take your total net gain or net loss from 8949 and add it in Schedule D)

- Include any crypto income on Schedule 1 (or Schedule C if you are engaging in crypto taxes as self-employed)

- Complete the rest of your tax return.

What are the tax rules for cryptocurrency?

The tax rules for cryptocurrency are straightforward. If you use crypto like Bitcoin as an actual currency, it’s considered a taxable event. If a business owner accepts crypto as a payment option, as well as for the individuals who choose it as an actual currency rather than an investment, then each transaction — no matter how big or small — must be reported on annual taxes.

IRS introduced a new form 1040 inviting taxpayers to say whether they own virtual currencies.

Therefore, to answer the question, when are cryptocurrencies taxed? This question does not have a straightforward answer; things may vary based on countries and other factors. However, cryptocurrency is typically taxed in the following scenarios:

- Selling or exchanging crypto

- Trading crypto

- Receiving crypto as income

- Using crypto for purchases

- Gifting or donating crypto

How much is cryptocurrency taxed?

The amount of cryptocurrency that is taxed varies depending on your income tax bracket and the holding period of your crypto asset. This means the tax implications for longer-term and short-term capital gains differ depending on when the transactions took place.

Additionally, how much tax is paid may vary for each investor as they can be affected by sources of income like stocks, income from a job, or other investments. But generally speaking, you owe taxes every time you earn or sell cryptocurrency.

However, here is a general overview of how cryptocurrencies are taxed.

Capital gains tax

- Short-term Capital Gains: Holding cryptocurrency for one year or less before selling or trading is considered a short-term capital gain and is typically taxed at the same rate as ordinary income (10% to 37% in the US, depending on your income bracket).

- Long-term Capital Gains: If you hold cryptocurrency for more than one year, it is considered a long-term capital gain, which usually benefits from a lower tax rate (0%, 15%, or 20% in the US, depending on your income level).

Ordinary income tax

- Earning cryptocurrency as payment for goods or services through mining, staking, or airdrops is taxed as ordinary income. The amount taxed is the cryptocurrency’s fair market value when you receive it.

- This income is taxed according to your regular income tax rate, which varies based on your total income and filing status (10% to 37% in the US).

Tax Rates and Brackets for 2025

The Internal Revenue Service (IRS) updates income tax rates and brackets annually to account for inflation and other economic factors. These adjustments are usually announced at the end of each year and take effect for the following tax year.

These are the 2024 tax rates and income brackets:

Tax Bracket | Single Filers | Married Couples Filing Jointly |

Up to $11,000 | Up to $22,000 | |

$11,001 to $44,725 | $22,001 to $89,450 | |

$44,726 to $95,375 | $89,451 to $190,750 | |

$95,376 to $182,100 | $190,751 to $364,200 | |

$182,101 to $231,250 | $364,201 to $462,500 | |

$231,251 to $578,125 | $462,501 to $693,750 | |

Over $578,125 | Over $693,750 |

How do you calculate your gains and losses?

Sale price, also known as fair market value, is the value you receive when you use or trade your crypto asset and the cost basis is the original purchase price plus any added fees.

Here is an example:

If you buy 1 Bitcoin (BTC) for $20,000 and you sell 1 BTC for $30,000.

Based on the formula: Sale Price−Cost Basis, you would calculate:

30,000−20,000=10,000. This means there is a capital gain of $10,000.

What are tax-free cryptocurrency transactions?

In some cases, cryptocurrency transactions may be tax-free or not subject to capital gains tax. Here are some common examples of tax-free cryptocurrency transactions in the US:

1. Buying and holding cryptocurrency

Buying and holding cryptocurrency without selling, trading, or using it does not trigger a taxable event. You do not owe taxes on the value increase until you sell, trade, or use the cryptocurrency.

2. Transferring cryptocurrency between wallets

Moving cryptocurrency between your own wallets (e.g., from an exchange to a personal wallet) is not taxable, as there is no sale or disposal of the asset. Ensure you maintain the transfer records to prove it was not a sale.

3. Donating cryptocurrency to a qualified charity

Donating cryptocurrency to a registered charitable organization is not a taxable event. Additionally, you may be eligible for a charitable deduction based on the fair market value of the donated cryptocurrency at the time of donation, provided you have held the cryptocurrency for more than one year.

4. Buying cryptocurrency with fiat currency

Purchasing cryptocurrency with fiat currency (such as USD) is not taxable. Taxes are only triggered when you dispose of the cryptocurrency by selling, trading, or using it.

What are the cryptocurrency tax-free countries?

The cryptocurrency tax-free countries are basically crypto-friendly countries that have gone out of their way to attract cryptocurrency traders to their shores. However, to further highlight the progressive nature of these countries when it comes to cryptocurrency, we featured information from experts and our Global Crypto-Friendly Nations Report. This informative report analyzes 75 nations based on factors like tax policies, renewable energy, and cybersecurity to identify places that support crypto adoption.

Portugal

- Global Crypto-Friendly Nations Report ranking: 6

Portugal has long been a crypto-friendly hub for trading and mining. In 2017, the government introduced pro-crypto policies, including favorable tax treatment for crypto trades and investments, and established strong support for blockchain startups.

The Portugal D7 Visa program and the Portugal Golden Visa further encouraged individual investors and professionals to live in the country without immigration restrictions.

Our Global Intelligence Unit has emphasized that Portugal has been recognized as a crypto tax haven for many years. For instance, the country exempts all crypto activities from capital gains and income tax. However, in 2023, due to increasing crypto activity, Portugal began taxing short-term gains on crypto holdings (less than one year) at 28%. Gains from cryptocurrency issuance and mining are now treated as income and taxed accordingly.

While this change might weaken Portugal’s status as a tax haven, it remains a favorable environment for long-term crypto investment. Additionally, Portugal is among the first countries to allow real estate purchases with cryptocurrency through an initiative by the Order of Notaries (ON).

Malta

- Global Crypto-Friendly Nations Report ranking: 9

While Malta does not tax long-held digital currencies for capital gains or VAT, crypto trades executed within the day are treated similarly to day trading in stocks and foreign exchange. This means you must pay some tax as business income, typically at 35%.

Tax residency is determined by whether you are considered an EU/Swiss/EEA citizen. If you aren’t, you must first pursue residency in Malta to enjoy the tax-free privileges for your crypto. The best way to do this is to apply for Malta Citizenship by Investment or the Malta Residency by Investment program.

Germany

- Global Crypto-Friendly Nations Report ranking: 10

Germany is known for its financial stability, with highly-rated banks making it a safe haven for investors. Its strong economy and political stability further enhance its appeal as a reliable investment destination.

Germany is also attractive to crypto investors due to its favorable tax laws. Like Portugal, crypto assets held for more than a year are not subject to capital gains tax, allowing long-term holders to realize significant gains tax-free, which promotes long-term investment rather than short-term speculation.

Cryptocurrencies in Germany are classified as private money, which has specific tax implications. If sold within a year and the total gains exceed 600 euros, profits are subject to progressive income tax rates (0% to 45%). However, if the profit is less than 600 euros, it is tax-exempt, encouraging careful timing of transactions.

Belarus

- Global Crypto-Friendly Nations Report ranking: 55

“Any country that has a crypto-friendly tax regime will be offering tax benefits for people that are doing crypto trading, for companies, for investors in the space.”

Therefore, Belarus’s progressive initiative makes it a good candidate for crypto-friendly nations, as it promotes cryptocurrency adoption and integration into the national economy while providing financial incentives for market participants.

Individuals and businesses are also exempt from capital gains tax on income from cryptocurrency transactions, which helps stimulate investment and trading. Additionally, income from mining, buying, and selling cryptocurrencies is exempt from personal income tax for individuals. Similarly, businesses involved in cryptocurrency activities like trading, mining, and ICOs do not pay corporate income tax on their earnings.

Switzerland

- Global Crypto-Friendly Nations Report ranking: 1

Switzerland is a crypto tax haven and home to Crypto Valley, the world’s largest blockchain ecosystem. It is also a renowned financial center with globally recognized banks. Switzerland is highly attractive to cryptocurrency investors due to its favorable regulatory environment and tax minimization opportunities.

Switzerland’s federal tax system operates at the cantonal level, with each of the 26 cantons having its own tax laws, though some general principles apply nationwide.

For example, capital gains from cryptocurrency investments are tax-free at the federal level, and cantons can set their own policies on crypto assets. Generally, the tax rate on crypto capital gains is lower than on other income forms.

Switzerland also offers special tax regimes to reduce taxes on crypto transactions and investments, such as the “Qualified Investor” regime, which exempts certain types of income from taxation and offers reduced rates on capital gains or dividends.

While Switzerland does impose a wealth tax on worldwide assets, the tax liability for crypto investments depends on the wealth tax rate, threshold, and any eligible tax relief benefits.

Singapore

- Global Crypto-Friendly Nations Report ranking: 2

Large crypto exchanges like KuCoin and Phemex are based in Singapore due to the lack of capital gains tax on crypto investments. Cryptocurrencies are classified as intangible property; spending them on goods and services is treated as barter trade, not a payment. Consequently, while goods or services may be subject to Goods and Services Tax (GST), the cryptocurrency used is not.

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions About Cryptocurrency Taxes

How is cryptocurrency taxed?

If you receive crypto as payment for goods or services or through an airdrop, the amount you receive will be taxed at ordinary income tax rates. If you’re disposing of your crypto, the net gain or loss amount will be taxed as capital gains.

Where is Bitcoin not taxed?

Bitcoin is not taxed in the following countries (with some exceptions of course): Malta, Portugal, Belarus, Switzerland, Germany, Georgia, Singapore.

What is tax on cryptocurrency?

Tax on cryptocurrency in the United States basically means declaring your tax derived from the capital gains and losses of your crypto transactions.

This is because the IRS treats crypto as property for tax purposes. Just like other types of property then (stocks, bonds, real estate) you must report your tax at the end of the financial year.

How do crypto tax avoidance and dual citizenship work together?

Crypto tax avoidance works by applying for dual citizenship in another country.

Once you acquire a second passport through an initiative like citizenship by investment, you can then renounce your US citizenship. Like this, it’s possible to avoid certain taxes on your cryptocurrency.

Malta, for example, offers passports to qualifying investors. You must first make an investment and then get the passport in one of the world’s most crypto-friendly countries.

How to keep track of my tax cryptocurrency?

You must do some accurate bookkeeping if you’re planning to use crypto. There are several accounting solutions for this like QuickBooks.

Start keeping records from the start, since digging through years of past transactions could be extremely difficult.

Are cryptocurrencies taxed?

Yes, all cryptocurrencies are taxed in some form or manner, depending on the nature of your transaction.

What countries are considered crypto-friendly?

Some of the most crypto-friendly countries include Portugal, Malta, Cyprus, the US, and Australia.

Do you have to pay taxes on crypto if you reinvest?

In most jurisdictions, including the U.S., you generally owe taxes on cryptocurrency transactions regardless of whether you reinvest the proceeds.

How does crypto tax work if I gift cryptocurrency to someone?

Gifting cryptocurrency incurs no capital gains tax for the giver (unless it exceeds the annual limit and triggers a gift tax). At the same time, the recipient owes no immediate tax but inherits the giver’s cost basis or fair market value if depreciated.

Are all crypto transactions taxable?

Not all cryptocurrency transactions may be taxable, but many are. Here’s a general overview:

- Taxable Transactions:

- Selling or Exchanging Crypto.

- Using Crypto for Purchases.

- Receiving Crypto as Income.

- Mining or Staking.

- Non-Taxable Transactions:

- Transferring Crypto Between Wallets:

- Gifting Crypto

How does crypto tax work?

You pay taxes on cryptocurrency if you sell or use your crypto in a transaction, and it is worth more than it was when you purchased it. This is because you trigger capital gains or losses if its market value has changed. If you receive crypto as payment for business purposes, it is taxed as business income.

When Is Cryptocurrency taxed?

Cryptocurrency is taxed when it is sold, traded, or used to purchase goods or services, triggering capital gains tax on profits. Additionally, mining and staking rewards are considered income and taxed as such. Holding cryptocurrency without transactions typically does not incur taxes.