Global Passport Index 2024

Introduction

In an increasingly interconnected world, global mobility and cross-border opportunities have become paramount for those seeking a more flexible and enriched lifestyle. The demand for second citizenship and residency options continues to grow, driven by expats, retirees, digital nomads, and global investors who seek better living conditions, economic opportunities, and greater freedom of movement.

The Global Passport Index 2024, developed by Global Citizen Solutions (CGS), presents an innovative and comprehensive assessment tool designed to help Global Citizens make informed decisions. Unlike traditional passport rankings that focus primarily on visa-free access, the GCS passport index adopts a multi-dimensional approach that captures the broader appeal of a country as a second home, such as quality of life, cost of living, tax implications, among others.

What makes Global Citizen Solutions' Passport Index different?

The GCS Global Passport Index offers a comprehensive analysis that not only ranks passports based on international mobility but also highlights the most attractive countries for international relocation and second citizenship acquisition. This assessment is grounded in a multidimensional evaluation of quality of life, investment, economic factors, and mobility indicators. As such, the GPI stands as the most robust and reliable tool for identifying the optimal destinations for global citizens seeking to elevate their living standards and global mobility.

One of the standout features of the Global Passport Index (GPI) is its Enhanced Mobility dimension, which redefines how travel benefits are measured. Unlike traditional rankings that simply count the number of countries accessible without a visa, the GPI introduces a more nuanced approach. It factors in the desirability and strategic importance of the destinations, recognizing that the true value of a passport lies not just in travel access, but also the quality of travel options it provides. This update reflects the realities of global mobility today, where access to certain high-value regions or emerging markets can significantly impact one’s personal and professional prospects.

The Investment dimension of the Global Passport Index is also unique in that it focuses on the economic landscape of each country, an aspect other passport indexes fail to take into account., This dimension assesses how business-friendly a nation is, considering tax policies, regulatory environments, and overall investment attractiveness. For global investors, entrepreneurs, and those seeking financial diversification, this aspect of the index offers crucial insights into the best jurisdictions for wealth growth and preservation. The 2024 update places even greater emphasis on fiscal stability, market access, and the ease of doing business, ensuring that users can align their citizenship choices with their financial goals.

Equally important is the Quality of Living dimension, which takes into account a wide range of factors affecting everyday life. From healthcare, education, and environmental quality to personal freedoms, cultural openness, and cost of living, this index evaluates the overall living experience in each country. The 2024 update expands this dimension to include more granular data on social infrastructure and expatriate-friendliness, recognizing that the decision to acquire second citizenship or residency often hinges on lifestyle considerations. By focusing on what truly matters for long-term living, this dimension serves as a vital guide for families, retirees, and individuals seeking a higher quality of life.

Overall, the Global Passport Index offers a pioneering approach to passport rankings by integrating mobility, investment, and lifestyle factors into a single, cohesive framework. It provides a more comprehensive, robust and realistic picture for today’s global citizens, whose motivations extend far beyond just ease of travel. By considering the broader benefits of acquiring a second citizenship, the GPI caters to the diverse needs of those exploring global opportunities, making it a valuable resource for anyone looking to navigate the complex landscape of international living and investment.

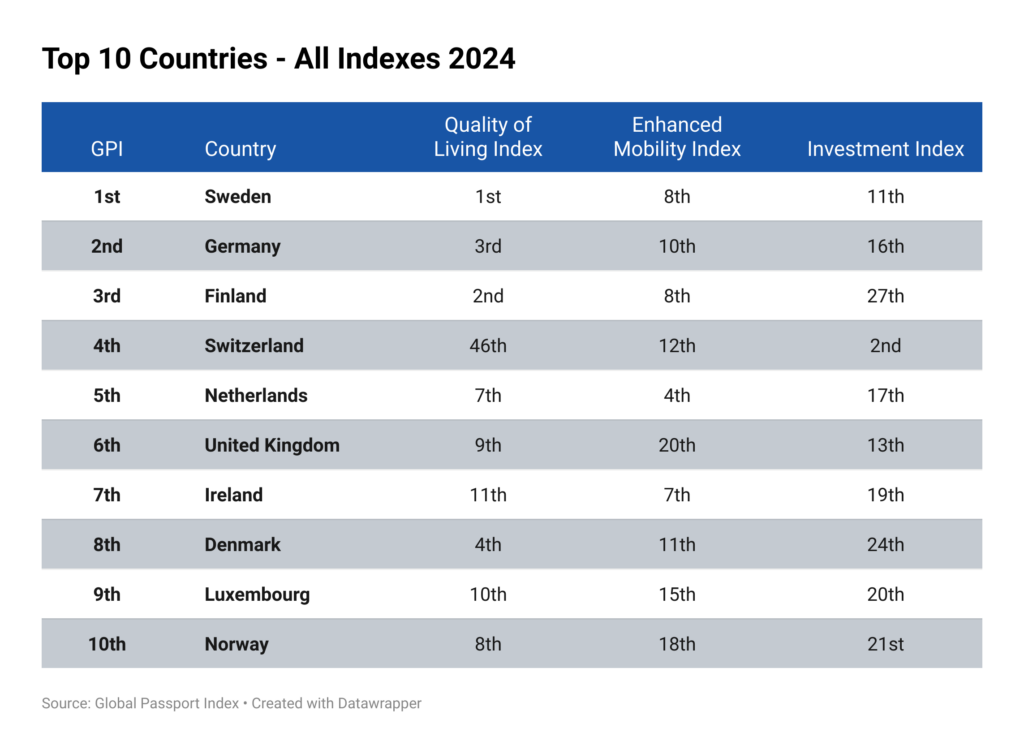

How the top 10 countries rank in all indexes in 2024 GPI

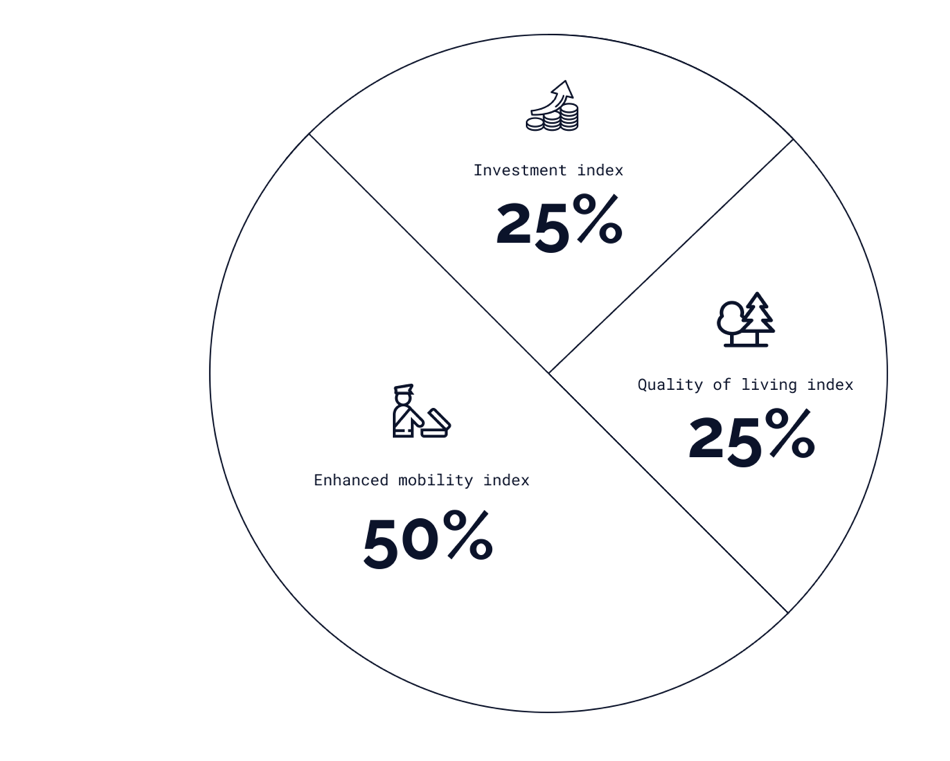

The table illustrates the top ten countries ranked by the 2024 GPI and their respective performances in various sub-indexes, including the Quality of Living Index, Enhanced Mobility Index, and Investment Index. Notably, nearly all countries that ranked well in the GPI also scored highly in the Quality of Living Index, which constitutes 25% of the GPI. Countries like Sweden, Germany, and Finland, which lead in the GPI, maintain strong positions in the Quality of Living category, reinforcing the correlation between these two dimensions.

Switzerland, however, stands out as an exception. While ranked 4th in the GPI, it did not perform as strongly in the Quality of Living Index due to its high cost of living, which likely impacted its score in this area. Despite this, Switzerland excels in the Investment Index, another 25% contributor to the GPI, where it ranks particularly well, highlighting its strong investment attractiveness despite the higher living expenses.

Other countries, such as the Netherlands, the UK, and Germany, maintain consistency across all three indices, performing particularly well in the Quality of Living dimension, followed by their positions in the Enhanced Mobility Index and Investment Index. These results suggest a balanced performance across the board, with each country showing strength in various components of the GPI.

GPI Rankings

Overall Takeaways

- All top 10 countries are European: European countries dominate the top 10 rankings, reflecting strong performances in all three dimensions: Enhanced Mobility, Quality of Life and Investment metrics;

- Overall Improvement in the European Region: The European region has shown significant improvement across all indicators in the GPI, with an average increase of approximately 2 points from 2021 to 2024. This positive change reflects enhanced mobility (enlargement of Schengen Area member states), investment indexes and other favorable factors during this period;

- Europe and Asia Lead in Mobility and Investment Growth: Europe and Asia have seen consistent improvements in the Global Passport Index between 2021 and 2024. Countries like Germany, Ireland, and Singapore have bolstered their rankings through strategic reforms in enhanced mobility agreements, innovation ecosystems, and investment-friendly policies. These nations have successfully increased their appeal to investors and expatriates, contributing to their strong performance across mobility, quality of living, and investment indices.

- Sweden Takes the Top Spot: Among the top 10 countries in 2024, Sweden has moved to the top position, largely due to an improved investment score.

- Switzerland Rises Despite Quality of Life Challenges: Despite a drop in its Quality of Life ranking, largely due to a high cost of living, Switzerland has improved its overall position from 10 to 4, thanks to higher scores in both Mobility and Investment.

- US and Canada Exit the Top 10: Both the U.S. and Canada have fallen out of the top 10 rankings. This shift raises questions about the factors contributing to their decline, particularly in Enhanced Mobility and Quality of Living;

- Ireland and Luxembourg Enter the Top 10: Ireland and Luxembourg have both entered the top 10, driven by significant improvements in their investment scores. In Ireland's case, enhancements in Mobility also contributed to this rise

- Notable Improvements in Other Countries: Estonia (from 27 to 17), Japan (from 24 to 16), and Portugal (from 31 to 24) also saw notable improvements in their GPI rankings, primarily due to enhanced Investment scores.

- Africa and Oceania Face Challenges: Both Africa and Oceania have experienced notable declines in their GPI rankings. Countries such as Kenya and Nigeria struggled due to limited global connectivity, economic instability, and weaker mobility agreements. Even traditionally strong performers like Australia and New Zealand saw declines in mobility, attributed to a combination of tightening immigration policies and challenges in maintaining economic momentum post-pandemic.

- Mixed Performance in the Americas: The Americas show a diverse performance, with some countries like Chile and Uruguay improving their global mobility and investment appeal, while others like Argentina and Venezuela have struggled with economic volatility and political instability. These variations highlight the critical role of economic resilience and political stability in improving global rankings and maintaining competitiveness on the world stage.

- Singapore Maintains 1st both in Enhanced Mobility and Investment Indexes: Singapore continues to hold the top position in the Enhanced Mobility Index, which supports its strong overall rankings in other indices. Meanwhile, the U.S. dropped 16 positions, the UAE dropped 15 positions, and South Korea plummeted 39 positions in the Enhanced Mobility Index. In contrast, Italy and France improved by 5 and 4 positions, respectively, in this ranking.

Quality of Living Index

The 2024 GPI rankings reveal consistent performers at the top of the Quality of Living (QoL) subindex, with Sweden holding the number one position across both in 2021 and 2024. This stability reflects Sweden's robust social welfare systems, high-quality healthcare, and strong economic performance, factors that contribute to its superior living conditions. Similarly, Finland and Denmark have remained in the top three with minor fluctuations, sustained by their renowned education systems, healthcare, and comprehensive public services.

Some countries, like Germany and Portugal, are notable climbers in the QoL dimension. Germany has improved from 6th place in 2021 to 4th in 2024, likely driven by its strong economy, enhanced infrastructure, and improvements in Quality of Life indicators such as healthcare and environmental sustainability. Portugal’s rise from 12th to 10th could be attributed to its economic recovery after the pandemic, sustainability initiatives, foreign investments and improvements in public services, signaling a positive trajectory in living conditions.

Conversely, certain countries have seen declines in their rankings. The Netherlands, once ranked 7th in 2021, has dropped to 9th place in 2024. This decline could be linked to economic challenges, particularly related to housing affordability and living costs. Japan's drop from 18th to 20th may be related to demographic issues, such as its aging population, which places pressure on public services and impacts overall quality of life.

Several countries, such as Canada and Austria, have shown remarkable stability, maintaining their positions within the top 10 of the QoL with only slight fluctuations. The United Kingdom and Spain, while also relatively stable, have experienced minor shifts in rankings, reflecting both their resilience and the challenges they face in maintaining higher GPI scores. These slight fluctuations may be linked to economic and social changes affecting overall living standards in these nations.

Insights:

- Economic Stability: Countries that have managed to maintain or improve their rankings, like Sweden, Finland, and Germany, likely benefit from strong and resilient economies. These countries typically have low unemployment, strong social safety nets, and high levels of public services, contributing to overall well-being.

- Healthcare and Education: High-quality healthcare and education systems are significant factors in the QoL Index. Countries like Sweden, Denmark and Finland, which are known for their excellent healthcare and education, have maintained high rankings.

- Social Policies: Progressive social policies, including support for families, work-life balance, and gender equality, contribute significantly to a country's quality of life. This is evident in the consistent performance of Scandinavian countries.

- Economic Challenges: Countries like Japan, which face significant demographic challenges, or the Netherlands, which might be grappling with housing costs, show that economic challenges can directly impact quality-of-life rankings.

- Switzerland paradox in the QoL: Despite its overall strong performance in various areas, its ranking is negatively impacted by its high cost of living and housing issues. Switzerland's expensive housing market and high living expenses, particularly in major cities, pose significant challenges for residents, which in turn affect the country's Quality of Living score. While Switzerland excels in other aspects like healthcare, education, and infrastructure, these economic pressures reduce its ability to rank higher in this dimension of the GPI.

Enhanced Mobility Index

The Enhanced Mobility Index (EMI) for 2024 reveals key trends in global mobility, with several countries experiencing notable shifts in their rankings. Singapore continues to dominate, maintaining its 1st place position from 2021 to 2024. This consistent performance reflects Singapore’s unmatched global mobility, granting access to strategically important and highly desirable regions across the world.

France has seen a dramatic rise in the rankings, moving from 15th place in 2021 to 2nd in 2024. This substantial improvement suggests that France has gained access to more strategically important regions or significantly enhanced the desirability of its mobility, possibly through diplomatic efforts and international partnerships. Italy also made an impressive leap, climbing from 23rd to 3rd place. This jump could be attributed to new visa agreements or enhanced strategic partnerships, further increasing the value of its passport and boosting Italy’s global mobility.

The USA and Germany have experienced significant declines in their mobility rankings. The USA dropped from 10th place in 2021 to 33rd in 2024, reflecting a significant reduction in the strategic value of its passport. This decline could be due to more stringent visa requirements or changing international relations that have limited access to key regions.

Germany fell from 4th to 10th place, indicating a decrease in its global mobility. Similar to Spain, this decline can partly be explained by the relative rise of other countries, such as France and Italy, whose improved rankings have reshuffled the top positions, pushing Germany lower despite maintaining strong mobility metrics.

Insights:

- Strategic Shifts: The notable rises of France and Italy suggest that these countries have significantly enhanced their global mobility by gaining access to high-value regions or forming strategic partnerships that make their passports more desirable on the global stage.

- Geopolitical and Economic Dynamics: The dramatic decline of the USA could be due to changes in global geopolitics, which may have made certain regions less accessible or less strategically important. This decline could also reflect growing global restrictions or decreased desirability of its passport due to geopolitical tensions with important countries such as Russia, China and some of their allies.

- Desirability vs. Quantity: The Enhanced Mobility Index highlights that it’s not just about the number of countries a passport grants access to, but the strategic value of those countries. Countries that have formed new, high-value alliances or improved access to emerging markets have seen the most significant improvements.

Investment Index

The Investment Index (II) provides a detailed look at the economic and competitive landscape of key countries. These metrics offer insights into each country's innovation capacity, economic stability, and tax policies, which collectively shape their investment attractiveness.

Singapore has maintained its top position, a testament to its high (Gross National Income) GNI, strong Global Competitiveness Index (GCI) performance, and continued innovation leadership, now reflected in the Global Investment Index (GII). Furthermore, Singapore's favorable tax policies significantly enhance its global investor appeal.

Switzerland, climbing to 2nd place, owes much of its success to its consistently high rankings in the Global Competitiveness Index and Global Investment Index, coupled with its strong GNI per capita. Known as a global innovation hub, Switzerland’s tax policies also contribute to its investment attractiveness, offering a stable and conducive environment for growth. Monaco’s rise to 3rd place is primarily driven by its favorable tax environment, which makes it a popular destination for wealth preservation, despite not competing in the GCI or GII. Its high GNI further supports its strong performance in the Investment Index, particularly for high-net-worth individuals. Estonia’s jump can be attributed to its exceptional digital infrastructure, strong GCI and GII performances, and a very favorable tax environment, particularly for tech and innovation-driven investments. Finally, Ireland’s rise is strongly linked to its favorable tax environment, high GCI scores, and increasing role as an innovation hub. The country's strategic tax policies and pro-business environment have made it a preferred destination for multinational companies and investors.

While some countries, like the USA, remain stable, others have declined in the ranking. Hong Kong’s drop to 5th place can be attributed to political uncertainties that impacted its GCI performance. Despite retaining a favorable tax environment, concerns about long-term stability and a lower GII score have likely reduced its appeal to global investors. Andorra’s improvement to 7th place, by contrast, reflects its favorable tax policies and regulatory improvements that have enhanced its investment attractiveness, even though it does not perform as strongly in the GCI as larger economies.

Several countries have experienced significant declines, reflecting the challenges they face in maintaining investor confidence. Saudi Arabia’s drop to 25th in the Investment Index likely results from slower-than-expected progress on its Vision 2030 reforms, which might have impacted its GCI scores. Although Saudi Arabia's tax environment is improving, it still lags behind more developed economies. Taiwan’s sharp decline to 36th can be linked to geopolitical tensions that affect its GCI and GII performance. Similarly, Brunei and Palau experienced dramatic declines, reflecting their limited GNI, weaker GCI scores, and relatively unattractive tax policies.

Insights:

- Economic Stability and High GNI Drive Investment Appeal: Countries with consistently high GNI per capita, such as Singapore, Switzerland, and Monaco, tend to attract more global investors. Their economic stability, well-developed infrastructure, and capacity for wealth preservation make them prime destinations for long-term investment.

- Innovation as a Competitive Edge: Strong performance in innovation indices, particularly the GCI (Global Competitiveness Index) until 2023 and the GII (Global Innovation Index) starting in 2024, is crucial for maintaining a high investment ranking. Countries that lead in innovation, like Singapore and Switzerland, are seen as more competitive and better positioned for future growth, which appeals to investors in technology-driven sectors.

- Tax Policies as a Strategic Advantage: Favorable tax environments play a significant role in investment attractiveness. Countries like Monaco, Singapore, and Ireland have climbed the rankings due to their investor-friendly tax policies, which make them attractive destinations for high-net-worth individuals and multinational companies seeking favorable conditions for business operations and wealth preservation.

- Geopolitical and Regulatory Stability are Critical: The decline of countries like Hong Kong, Taiwan, and Saudi Arabia highlights the importance of political and regulatory stability in maintaining investment attractiveness. Geopolitical uncertainties or unstable regulatory environments can deter investors, even if a country has strong economic fundamentals or favorable tax policies.

- Reforms and Strategic Partnerships Boost Rankings: Countries like Andorra and Ireland have improved their rankings by making targeted regulatory and tax reforms, as well as enhancing their competitiveness through strategic partnerships. These changes have helped them become more attractive to global investors, even if they do not perform as strongly in innovation or economic output as larger economies.

The 2024 GPI Winners

Europe

The 2024 Global Peace Index (GPI) highlights the continued dominance of European countries in the top rankings for Quality of Life and Investment, with all top 10 positions occupied by nations from this region. This strong performance is underpinned by significant improvements across key metrics, particularly in Enhanced Mobility, which has been bolstered by the expansion of the Schengen Area. The European region as a whole has experienced a notable increase in its GPI scores, with an average improvement of approximately 2 points from 2022 to 2024. These positive developments reflect the region’s robust focus on fostering quality of life, attracting investment, and facilitating greater mobility, thereby contributing to its overall stability and growth.

Sweden

Sweden has climbed one position from its 2022 ranking and has reclaimed the top spot in the 2024 Global Passport Index. The country continued to perform strongly in the Quality of Living and Enhanced Mobility Indexes. However, its remarkable ascent in the Investment Index—rising from 31st in 2021 to 11th in 2024—was a key factor in Sweden’s return to the top position in the GPI. This improvement can be attributed to strategic enhancements in its policies and regulations across various sectors. These advancements have reinforced Sweden’s leading positions in business sophistication, infrastructure, and human capital and research, solidifying its reputation as a top destination for investment.

One of the critical areas where Sweden has excelled is business sophistication. The Swedish Innovation Strategy, was revisited in recent years to emphasize even more on public-private collaborations and support for startups. Additionally, the tax incentives for R&D, introduced in 2014, have been further optimized, offering greater benefits to companies investing in innovation. The continued strengthening of intellectual property laws has ensured that Sweden remains a safe and lucrative environment for businesses to develop new products and technologies, directly contributing to its top position in business sophistication globally.

Sweden’s infrastructure development has also seen significant advancements. The focus on public-private partnerships has enabled large-scale investments in critical infrastructure, including transportation and digital connectivity. The government’s commitment to sustainable infrastructure, guided by the Swedish Environmental Code, ensures that these developments are environmentally friendly, positioning Sweden as a leader in green infrastructure. These efforts have maintained Sweden’s position as a global leader in infrastructure and have further enhanced its attractiveness to investors.

In the realm of human capital and research, Sweden’s Higher Education Act and the Research Bill have undergone significant updates to increase funding and focus on cutting-edge technology and innovation. The Employment Protection Act (LAS) has been revised to support lifelong learning and skill development, ensuring that Sweden’s workforce remains among the most knowledgeable and adaptable globally.

Additionally, the REPowerEU Plan is significantly boosting the Swedish economy by accelerating its green and digital transitions, which are essential for long-term sustainability and resilience. With a robust investment of €3.5 billion, including €198.4 million in REPowerEU grants, Sweden’s updated Recovery and Resilience Plan, approved in November 2023, introduces measures that will enhance energy efficiency, particularly in multi-dwelling buildings and student housing.

Relocation in Sweden:

While there is no dedicated investment migration program, there are other pathways that might be of interest to potential investors:

- Self-Employment Visa: If you wish to start a business in Sweden, you can apply for the Self-Employment Visa. This visa is suitable for entrepreneurs who want to establish and operate a business in Sweden. It requires a viable business plan, proof of financial means, and relevant experience.

- Business Visa (Temporary): For those who need to visit Sweden for business purposes (e.g., to explore investment opportunities, attend meetings, or negotiate contracts), a short-term business visa can be obtained. However, this does not lead to residency.

Key Points to Consider:

- Sweden’s immigration policies prioritize contributions to the economy through active participation in the labor market or through entrepreneurship.

- There are no specific financial thresholds or direct investment routes to obtain residency or citizenship in Sweden.

- Potential investors are encouraged to explore business and self-employment options as alternative routes to residency.

- In Sweden, the general rule for applying for citizenship is that you must have lived in the country with permanent residency for at least five consecutive years. This applies to most foreign nationals.

Switzerland

In 2024, Switzerland is experiencing the benefits of several key legal reforms and policy changes implemented since 2021, which have played a significant role in boosting the country’s global standing. These reforms, which focused on enhancing the investment climate, fostering innovation, and improving regulatory transparency, have led to Switzerland’s climb from 11th to 4th in the Global Passport Index. The most notable improvements have been in the Investment Index, where Switzerland performs exceptionally well due to its high economic stability, competitive tax policies, and strong innovation capacity. This rise in the rankings highlights the effectiveness of the changes made over the past few years, positioning Switzerland as a top destination for global investors and high-net-worth individuals (HNWIs).

Switzerland’s high ranking in the Investment Index is largely driven by its economic stability and high GNI per capita. Like other top performers such as Singapore and Monaco, Switzerland has long been a magnet for long-term investment due to its robust infrastructure, well-established financial sector, and capacity for wealth preservation. These elements, combined with its strategic location in Europe, make Switzerland an ideal destination for global investors seeking stability in uncertain times. The country’s ability to provide a secure environment for wealth management and financial services is further underscored by its well-developed banking sector and its role as a hub for private wealth.

One of Switzerland’s most significant competitive edges comes from its strong performance in innovation, particularly through its performance in the Global Competitiveness Index (GCI) until 2023 and the Global Innovation Index (GII) starting in 2024. Switzerland consistently ranks as one of the most innovative economies in the world, with a focus on high-tech industries, pharmaceuticals, and research and development. The DLT (Distributed Ledger Technology) law passed in 2021, which fostered blockchain and fintech innovation, has also contributed to Switzerland’s attractiveness in cutting-edge technology sectors. It is no surpise the country ranked top position in the 2024 Global Crypto Friendly Nations Report from Global Citizen Solutions. This focus on innovation positions Switzerland as a forward-looking economy, appealing to investors in technology-driven industries who are looking for stable, long-term growth prospects.

Another crucial factor contributing to Switzerland’s rise in the global rankings is its favorable tax policies. The reforms to Switzerland’s corporate tax regime, particularly the introduction of the Federal Act on Tax Reform and AHV Financing (STAF), have made the country even more attractive to multinational companies and high-net-worth individuals. By providing tax incentives such as the patent box regime and R&D super-deductions, Switzerland has successfully maintained its competitiveness while adhering to international tax standards.

However, despite its strong performance in the Investment Index, Switzerland does not perform as well in the Quality of Life Index, mainly due to its high cost of living and housing availability struggles. While Switzerland offers exceptional healthcare, education, and public services, its major cities like Zurich and Geneva are among the most expensive in the world. Housing shortages in urban areas further exacerbate the cost of living, which can be a barrier for some expatriates and investors seeking to relocate. Although Switzerland excels in terms of economic stability and wealth protection, the high cost of living limits its attractiveness in this specific dimension of the Global Passport Index.

Overall, Switzerland’s reforms and strategic focus on innovation, investment, and tax competitiveness have significantly boosted its global standing. The country’s climb to 4th place in the Global Passport Index is a demonstration its ability to adapt to global trends, making it one of the most sought-after destinations for global investors.

Relocation in Switzerland:

- Swiss Investor Visa (Cantonal Program): This visa is aimed at foreign nationals who wish to relocate to Switzerland by making a substantial financial investment. The minimum investment amount varies by canton but is typically set at CHF 1 million. This investment can be directed towards a local business, real estate, or other approved financial instruments. Applicants must demonstrate sufficient financial resources to support themselves and their dependents.

- Residence by Investment (Lump-Sum Taxation Program): This program allows wealthy individuals to obtain residency in Switzerland based on their tax contribution rather than direct investment. Successful applicants receive a residence permit, which can be renewed annually. After 10 years of continuous residence, they may apply for permanent residency, and eventually, citizenship.

Key Points to Consider:

- Swiss Immigration Policies: Switzerland’s immigration policies are designed to attract wealthy individuals and entrepreneurs who can contribute to the local economy through investment or business activities.

- Investment Thresholds: The financial thresholds for investment visas are relatively high, and the requirements vary significantly depending on the canton.

- Lump-Sum Taxation: This program is particularly attractive to high-net-worth individuals who prefer not to disclose their global income and assets but are willing to pay a negotiated tax amount.

- Path to Citizenship: After acquiring permanent residency and living in Switzerland for at least 12 years (including time on temporary permits), individuals may apply for Swiss citizenship, provided they meet all the necessary conditions.

Luxembourg

Luxembourg’s rise in the Global Passport Index from 13th place in 2021 to 9th in 2024 can be attributed to significant reforms and policy changes since 2021, particularly those that have improved its Quality of Life Index, boosting its ranking from 19th to 10th. One of the key drivers behind this improvement is Luxembourg’s sustained focus on enhancing its public services, social welfare, and environmental sustainability. The 2022 Sustainable Development Plan introduced initiatives aimed at reducing emissions, increasing renewable energy use, and improving urban mobility, making Luxembourg a more attractive destination for expatriates and international professionals seeking a high quality of life.

Several legislative reforms have also played a crucial role in enhancing Luxembourg’s appeal. In 2021, the government passed the Housing Pact 2.0, which aimed to address the country’s housing shortage by incentivizing municipalities to build affordable housing. This law helped alleviate one of the major quality-of-life concerns in Luxembourg—housing availability and affordability—thereby contributing to the country’s climb in the Quality of Life Index. Additionally, the 2023 Labor Market Reform introduced flexible work arrangements, further enhancing Luxembourg’s attractiveness by improving work-life balance and aligning with global trends for more remote and flexible work environments.

Luxembourg’s tax policies have also continued to contribute to its high ranking in the Investment Index, particularly with the 2021 Corporate Tax Reform, which maintained favorable conditions for multinational corporations and high-net-worth individuals. By keeping corporate taxes competitive while focusing on sustainability and innovation, Luxembourg has created a balanced environment that supports both economic growth and social well-being.

Like Switzerland, Luxembourg has solidified its position as a leader in blockchain and cryptocurrency innovation through strategic legislative efforts, particularly with the passage of Blockchain Law (Bill 7363) in 2021, which provided a legal framework for using distributed ledger technology (DLT) in financial services.

These factors, combined with excellent healthcare, education, and public services, have solidified Luxembourg’s position as one of the most desirable countries for expatriates and investors alike, reflected in its 2024 top 10 passport ranking.

Relocation Luxembourg:

Investor Residence Permit: This visa is aimed at non-EU nationals who wish to invest in Luxembourg’s economy, typically by creating a business, investing in an existing business, or making other significant financial contributions. Investment Threshold: €500,000 EUR (Approx. $537,000 USD) in a Luxembourg company or an investment fund or real estate After five years of continuous residence, investors may apply for permanent residency. Citizenship can be applied for after ten years of residence, provided other conditions, such as language proficiency and civic integration, are met.

Ireland

Ireland’s remarkable climb from 30th to 19th in the Investment Index impacted the countries jump from 14th to 7th in the GPI between 2021 and 2024. It can be largely attributed to a series of strategic legislative reforms aimed at fostering investment, innovation, and economic competitiveness. One of the most significant pieces of legislation was the Investment Limited Partnership (ILP) Amendment Act 2021, which enhanced Ireland’s appeal as a hub for private equity and venture capital. This law modernized the legal framework for investment funds, making Ireland an attractive destination for global investors. Additionally, the 2022 Finance Act introduced tax incentives for foreign direct investment (FDI), further boosting the country’s attractiveness as a location for multinational corporations. These changes have positively impacted Ireland’s GCI by improving the regulatory environment and increasing the country’s capacity to attract global capital.

In terms of innovation, Ireland has made significant strides by passing the National Digital Strategy in 2022, which aims to position the country as a leader in digital transformation and technology innovation. The government has prioritized investment in research and development (R&D), particularly in sectors such as fintech, artificial intelligence, and biotechnology. This has been complemented by tax credits for R&D activities and grants aimed at fostering collaboration between academia and industry. These initiatives have improved Ireland’s performance in the GII by enhancing its innovation capacity, infrastructure, and knowledge creation. The focus on innovation has also contributed to Ireland’s higher ranking in the Investment Index, as global investors increasingly seek out countries that prioritize cutting-edge technology and innovation-driven growth.

The combination of investment-friendly tax reforms, modernization of financial regulations, and a focus on digital innovation has bolstered Ireland’s position in the GPI. By improving its performance in key indicators like GCI and GII, Ireland has successfully enhanced both its global mobility and investment attractiveness. The continued focus on strengthening its regulatory framework and fostering an innovation-driven economy has made Ireland a prime destination for both capital investment and skilled professionals, significantly improving its standing in global rankings.

Relocation in Ireland:

Ireland offers the Immigrant Investor Program (IIP) for high-net-worth individuals, providing a pathway to residency and citizenship through substantial financial investment. The Immigrant Investor Program (IIP) is designed for high-net-worth individuals who wish to obtain residency in Ireland through significant financial investments (€1 million EUR invested in an Irish enterprise, an investment fund or a Real Estate Investment).

Austria and Belgium

Austria’s rise from 22nd to 14th in the Investment Index and from 16th to 10th in the Global Passport Index (GPI) between 2021 and 2024 can be attributed to targeted legislative measures aimed at enhancing its investment landscape and innovation ecosystem. The introduction of the Foreign Direct Investment (FDI) Control Act in 2021 established a more transparent and secure framework for foreign investments, which increased investor confidence. Furthermore, the 2022 Tax Reform Act offered substantial incentives for research and development, particularly in high-growth sectors such as renewable energy and biotechnology.

These reforms significantly improved Austria’s standing in the Global Competitiveness Index (GCI), while its growing focus on sustainability and technological innovation bolstered its performance in the Global Innovation Index (GII). Austria’s forward-thinking policies in these areas have made it an increasingly attractive destination for global capital and innovation-driven enterprises, contributing to its enhanced global rankings.

Belgium made similar strides by advancing from 24th to 15th in the Investment Index and from 17th to 11th in the Global Passport Index (GPI), driven by its focus on digital transformation and financial reform. The passage of the Digital Services Act in 2024 played a pivotal role in modernizing Belgium’s digital infrastructure, fostering investments in cutting-edge technologies such as artificial intelligence and blockchain. Coupled with the 2023 Corporate Tax Reform, which provided tax relief for tech-driven companies, these initiatives strengthened Belgium’s competitiveness and innovation capacity, as reflected in its improved GCI and GII rankings. For instance, one key reform was the adjustment to the R&D tax credit and the wage withholding tax exemption for qualifying researchers, which significantly boosted the attractiveness of Belgium’s business environment, particularly in the tech and innovation sectors.

In comparison to Austria, Belgium’s emphasis has been more on technology and digital finance, while Austria has focused on sustainability and green technologies. Both countries, however, have succeeded in creating environments conducive to investment and innovation, contributing to their upward mobility in global indices.

Relocation in Austria and Belgium:

Austria’s Investor Visa, forming part of its residence by investment program, allows high-net-worth individuals to obtain residency by making a significant economic contribution to the country. The program typically requires an investment of at least €10 million in an Austrian business or a minimum of €3 million in government bonds. This visa provides a pathway to permanent residency and, potentially, citizenship after 10 years.

Belgium’s Investor Visa, also known as the Residence by Investment program, allows non-EU nationals to obtain residency through substantial investments in the country. Typically, applicants must invest between €350,000 to €500,000 in a Belgian business or start a company that contributes to the local economy. Benefits include visa-free access to the Schengen Area and potential citizenship after five years of continuous residence. Belgium’s central location in Europe, competitive tax incentives, and strong innovation economy make it an attractive destination for investors

Estonia

Estonia’s significant rise in global rankings, moving from 30th to 12th in the Investment Index and from 19th to 11th in the Global Passport Index (GPI) between 2021 and 2024, is driven by a series of key legislative reforms that have accelerated its transformation into a global hub for technology, innovation, and investment. One of the most impactful laws was the Digital Services Act passed in 2021, which aimed to strengthen Estonia’s already advanced digital infrastructure and expand its e-governance capabilities. This law focused on enhancing data protection, improving the efficiency of public digital services, and ensuring that Estonia remained at the forefront of digital innovation. These initiatives played a major role in Estonia’s strong performance in the Global Innovation Index (GII), further cementing the country’s reputation as a global leader in e-governance and digital transformation.

In addition, the country is leveraging technology and has stablished itself as a cryptocurrencies friendly nation ranking 8th in the 2024 Global Crypto-Friendly Nations Report. Estonia passed the Blockchain Regulation Act in 2022, which provided a legal framework for the integration of blockchain technology into both the public and private sectors. This legislation allowed for the secure use of distributed ledger technology (DLT) in sectors such as finance, healthcare, and voting, making Estonia one of the most advanced countries in terms of applying blockchain for public services. The regulatory clarity for blockchain and cryptocurrency businesses attracted a surge of tech startups and venture capital investment, contributing significantly to Estonia’s climb in the Investment Index.

Estonia has also improved its quality of life through laws aimed at fostering sustainability and innovation in urban development. The Smart Cities Act, passed in 2023, focused on developing smart infrastructure in major cities like Tallinn, improving public transportation, and integrating digital technologies into urban planning. This law, combined with Estonia’s advanced digital healthcare and education systems, has contributed to a better standard of living for both locals and expatriates. While challenges remain in the housing market due to rising demand, Estonia’s emphasis on tech-driven solutions and a forward-thinking governance model has helped attract remote workers, investors, and global talent. These legislative reforms have played a crucial role in Estonia’s transformation, driving its impressive rise in both the Investment Index and Global Passport Index.

Relocation in Estonia:

Estonia’s focus on attracting global talent has also been enhanced by progressive immigration policies. The Digital Nomad Visa, introduced in 2020 but gaining momentum after 2021, has drawn an increasing number of remote workers and tech professionals from around the world, allowing them to live and work in Estonia while maintaining employment abroad. The coutry ranked 4th in the Global Digital Nomad Report that analyses best countries for digital nomad to work and live. The success of this visa program was further supported by the 2022 Start-up Visa Program Expansion, which streamlined the process for tech entrepreneurs and investors to establish businesses in Estonia.

Kosovo, Croatia and Albania

When analyzing Kosovo’s performance in the Enhanced Mobility Index and the Quality of Living Index, it’s clear that the country has made considerable strides, particularly in mobility. In 2024, Kosovo gained access to the Schengen Area, significantly boosting its mobility prospects. The Schengen visa liberalization has allowed Kosovar citizens to travel freely across the 26 European countries in the Schengen zone, greatly improving their access to international markets, educational opportunities, and tourism. This development is critical for Kosovo, which had been previously restricted in its movement due to its partial international recognition. The Enhanced Mobility Index reflects this newfound freedom of movement, positioning Kosovo more favorably as a country with improving global connectivity and market access.

In contrast, Kosovo still faces challenges in the Quality of Living Index, primarily due to its ongoing efforts to build stable infrastructure and improve public services. While the country has made progress in certain areas like affordability and economic growth, it lags in key factors such as healthcare, education, and environmental sustainability, which are crucial for boosting overall living conditions. The Schengen access, however, is likely to have a positive indirect impact on Kosovo’s quality of life in the coming years, as improved mobility brings in more business opportunities, foreign investment, and access to international collaborations that can spur development and improve public services.

In terms of Croatia and Albania, both countries have also improved in these indices, though for different reasons. Croatia, for example, has significantly benefited from its position in the Schengen Area and its strong ties to the European Union, reflected in its steady performance in the Enhanced Mobility Index. The introduction of its Digital Nomad Visa and ongoing improvements in quality of life have led to a positive trend, attracting a growing number of remote workers and international professionals. Similarly, Albania’s Golden Visa Program, combined with its improving infrastructure and efforts to boost international trade, has started to improve its position in both mobility and quality of life, particularly as it seeks deeper integration with the EU.

Relocation in Kosovo, Croatia and Albania:

When comparing the relocation options in Kosovo, Albania, and Croatia, it is clear that each country offers unique opportunities for investors, digital nomads, and expatriates, although their levels of development and available programs vary. Kosovo, while lacking a formal Digital Nomad Visa or structured Golden Visa Program, offers residency options through significant investments in businesses or real estate, typically around €250,000 EUR. However, its newly gained Schengen visa liberalization in 2024 enhances its attractiveness by allowing free movement across 26 European countries, a critical advantage for investors and remote workers seeking greater mobility within Europe. The absence of a formal investment migration program may present more administrative hurdles, but Kosovo’s developing market offers opportunities for growth at a relatively low cost.

Albania, on the other hand, has formalized its offerings with the introduction of the Golden Visa Program in 2023, allowing investors to gain residency through investments in real estate or key sectors like tourism and energy. While Albania’s Digital Nomad Visa is still in development, the country already attracts remote workers with its low cost of living, scenic landscapes, and improving digital infrastructure. Albania’s Golden Visa offers a clear pathway for HNWIs to gain residency, which has become particularly attractive as Albania moves closer to full European Union integration. Investors benefit from the country’s strategic location in the Balkans, with favorable tax policies and strong incentives in sectors like renewable energy and tourism, making it a competitive destination for those seeking both investment opportunities and quality of life.

Croatia stands out as the most developed in terms of relocation options, with its Digital Nomad Visa introduced in 2021. It leads the way in attracting remote workers, particularly in coastal cities like Split and Dubrovnik. Croatia’s visa allows non-EU citizens to live in the country for up to a year while working remotely for foreign companies, making it a popular destination for tech professionals and freelancers. Although Croatia lacks a formal Golden Visa Program, residency can still be obtained through significant investments, particularly in real estate. Croatia’s Foreigners Act makes it relatively easy for foreign investors to secure temporary residency, with pathways to permanent residency over time. Its status as an EU member, combined with its robust infrastructure and natural beauty, places Croatia ahead of Kosovo and Albania in terms of attractiveness for both nomads and investors looking to relocate within Europe.

Americas

Barbados, Bahamas, Antigua and Barbuda and Saint Kitt and Nevis:

Barbados, Bahamas, Antigua and Barbuda, and Saint Kitts and Nevis have shown notable improvement in global indices, particularly the Investment Index, Enhanced Mobility Index, and Quality of Life Index, thanks to forward-thinking public policies, technological advancements, and strategic mobility agreements implemented since 2021.

For instance, Barbados made waves with its Barbados Welcome Stamp, a Digital Nomad Visa that became instrumental during the COVID-19 pandemic by attracting high-skilled remote workers. This innovation, combined with investments in digital infrastructure, helped to boost the country’s economic activity and global standing. Barbados also improved its Quality of Life by enhancing healthcare, sustainability efforts, and its digital infrastructure, making it an attractive destination for both investors and professionals.

Similarly, Bahamas has embraced technology and mobility agreements to enhance its attractiveness. The Bahamas Immigration Act was reformed in 2021, simplifying the process for obtaining permanent residency and making it more accessible to global investors. The country’s focus on modernizing its financial services sector through technology and innovation, including the expansion of digital banking and fintech services, further strengthened its global appeal. Combined with its tax-friendly environment and a rising Quality of Life, including improvements in healthcare and safety, these factors have contributed to the Bahamas’ better performance in the Investment Index.

In the case of Antigua and Barbuda, strategic mobility agreements and a focus on green technology have played a major role in improving its rankings. Antigua has expanded its visa-free agreements to over 150 countries, offering significant Enhanced Mobility benefits to its citizens. At the same time, the government has enacted policies that promote sustainable tourism and investment in renewable energy, positioning the country as a top destination for environmentally conscious investors. Antigua’s efforts to improve its Quality of Life, such as increased access to healthcare, cleaner energy initiatives, and safety measures, have made it more attractive for foreign investors and international citizens alike, which is reflected in its Investment Index performance.

Saint Kitts and Nevis has also seen improvements driven by public policy, technology, and expanded mobility agreements. The country’s focus on developing its financial services sector and leveraging blockchain technology has enhanced its investment climate. Moreover, Saint Kitts and Nevis has strengthened its Quality of Life through improved infrastructure, healthcare services, and efforts to make the island more sustainable and livable. Expanding visa-free travel agreements and introducing more efficient processes for investors have bolstered Saint Kitts and Nevis’ rankings, especially in mobility, investment, and quality of life.

Relocation in the Islands: Legislative Reforms and Investment Migration

Beyond technological advancements and mobility agreements, legislative reforms in investment migration have been critical in improving the global rankings of these island nations. Barbados, for example, streamlined its Special Entry and Reside Permit (SERP) in 2021 to attract high-net-worth individuals (HNWIs), offering long-term residency for substantial investments. The country’s Investment Index has benefited significantly from these changes, as Barbados positioned itself as a prime relocation destination for both HNWIs and professionals. Its strategic focus on improving public infrastructure and environmental sustainability has also contributed to a better Quality of Life Index score.

Bahamas made significant reforms to its Economic Permanent Residency Program, lowering the real estate investment threshold to $750,000 in 2021. These legislative adjustments have attracted more foreign investors and HNWIs seeking tax advantages and a desirable living environment. The Bahamas’ improvements in housing, safety, and healthcare have directly impacted its Quality of Life Index, making it a sought-after destination. Moreover, reforms in 2022 to streamline Foreign Direct Investment (FDI) regulations have boosted the Bahamas’ attractiveness, particularly in terms of improving its Investment Index ranking.

For Antigua and Barbuda, the Citizenship by Investment Program (CIP) remains central to its success in attracting foreign investment. Legislative reforms in 2021 reduced the minimum investment threshold, making the program more accessible to a broader range of global investors. These changes, coupled with policies that improve healthcare, education, and public infrastructure, have contributed to Antigua’s rise in both the Investment Index and Quality of Life Index. Antigua’s focus on sustainable energy and environmental conservation has made it a popular destination for investors who prioritize sustainability.

Saint Kitts and Nevis, known for pioneering the CIP in 1984, updated its program in 2021 to offer more flexible investment options. These modifications included reducing the minimum investment required for real estate, which has broadened the program’s appeal. The government has also improved the efficiency of the application process, making Saint Kitts and Nevis a top destination for individuals looking to obtain second citizenship. These legislative reforms, alongside efforts to enhance public services and infrastructure, have significantly contributed to its rise in the Investment Index and Quality of Life Index, particularly among those looking for strategic relocation options.

Uruguay and Colombia

Uruguay and Colombia have made significant strides in global rankings, particularly in the Investment Index, through strategic public policies, technological advancements, and mobility agreements implemented since 2021. Both countries have capitalized on their robust economies, public policy reforms, and technological innovations to position themselves as key players in attracting foreign investment and enhancing global mobility.

Uruguay has focused on promoting itself as a hub for foreign direct investment (FDI) and innovation. Key public policies, such as the 2020 Tax Residency Law, which was updated in 2021, have made it easier for foreign investors to establish residency by lowering the tax burdens for both individuals and businesses. Uruguay has also developed its tech and innovation ecosystem, notably through investments in fintech, agritech, and renewable energy projects. These efforts have helped the country climb the Investment Index, as Uruguay becomes a sought-after destination for global investors looking for stable returns, innovation, and a strong business-friendly environment.

Colombia, meanwhile, has leveraged technological advancements and mobility agreements to improve its Investment Index standing. The country has been focusing on enhancing its digital economy through a series of initiatives aimed at increasing internet access, fostering innovation, and encouraging entrepreneurship. The Orange Economy Law of 2020, which provides tax exemptions and benefits for creative and digital industries, has been instrumental in driving investment in the tech sector. Additionally, Colombia has signed new mobility agreements with various countries, making it more accessible for international business and professionals, further enhancing its global appeal. These efforts have made Colombia an attractive destination for investors, especially in industries such as tech, manufacturing, and green energy.

Relocation in Uruguay and Colombia:

Both Uruguay and Colombia have introduced legislative reforms that have significantly improved their attractiveness for foreign investors and high-net-worth individuals (HNWIs), as reflected in their rising Investment Index rankings. In Uruguay, the 2021 updates to the Tax Residency Law offer substantial benefits to foreign individuals investing in real estate or businesses. This legislative change has reduced tax obligations for investors, making Uruguay a low-tax jurisdiction that appeals to both HNWIs and businesses seeking a strategic location in Latin America. Additionally, Uruguay’s emphasis on improving quality of life, including public safety, healthcare, and a growing green energy sector, has made it a prime destination for relocation.

Colombia, on the other hand, has focused on creating a more attractive environment for foreign direct investment (FDI) through its Investment Promotion Law, passed in 2021. This law provides tax incentives and legal protections for foreign investors, especially in high-growth sectors like technology and renewable energy. The law has positioned Colombia as a key destination for global investment, and its growing infrastructure and focus on improving security and economic stability have helped it attract more foreign capital. This legal framework has enabled Colombia to improve its Investment Index ranking, making it one of the rising stars in Latin America for investors looking for high returns and innovation.

In addition to investment migration reforms, both Uruguay and Colombia have taken steps to improve their Quality of Life Index scores, further enhancing their appeal as relocation destinations. Uruguay, known for its political stability and safety, has invested heavily in public health and education, making it an attractive option for families and retirees. The country’s focus on green energy initiatives and sustainability has also made it popular among environmentally conscious investors. Uruguay’s relatively low cost of living, compared to other Latin American countries, combined with high-quality healthcare and public services, has enhanced its quality of life, drawing both investors and digital nomads.

Colombia has also prioritized improving the quality of life for its citizens and expatriates alike. Significant investments in public infrastructure, including transportation, healthcare, and education, have made Colombian cities more livable and appealing to foreigners. Additionally, the government’s focus on digital transformation and expanding access to technology has improved the country’s Quality of Life Index score. Colombia’s burgeoning startup scene, supported by the Orange Economy Law and other pro-business policies, has attracted a younger demographic of entrepreneurs and remote workers, further boosting its image as an investment and relocation destination.

Asia

Singapore

Singapore has consistently ranked at the top of the Enhanced Mobility Index and the Investment Index for several years, and 2024 is no exception. Due to its consistent top positions in those subindexes, and recent improvements in the Quality of Life Index, Singapore has steadily climbed from 15th to 11th place in the GPI 2024. Its strategic location, pro-business environment, and extensive global trade agreements have enabled Singapore to maintain a leadership position in global mobility. The city-state’s access to highly desirable and strategically important regions, through extensive visa-free and visa-on-arrival agreements, grants its passport holders some of the best mobility in the world. This unrivaled access makes Singapore a prime hub for international business and investment, attracting global talent and businesses to set up operations within its borders. Additionally, Singapore’s investment-friendly tax policies and strong financial sector contribute significantly to its top ranking in the Investment Index, providing global investors with a stable, low-risk environment for wealth preservation and business growth. This makes Singapore the most capitalist country in 2024, according to the Heritage Index of Economic Freedom.

Moreover, Singapore’s innovation-driven economy, supported by its world-class infrastructure, also plays a key role in its continued dominance in these indices. The city-state’s focus on digital transformation, fintech, and smart city development makes it a global leader in technology, drawing high levels of FDI into sectors such as financial services, healthcare, and technology. Singapore’s regulatory stability, competitive tax structure, and government incentives make it particularly attractive to multinational corporations seeking a secure, efficient business environment. As a result, Singapore remains one of the most attractive destinations for global investors and corporations looking to establish or expand their presence in Asia.

While Singapore excels in mobility and investment, it has faced challenges in the Quality of Living Index. This index evaluates various factors, including healthcare, education, environmental quality, personal freedoms, cultural openness, and cost of living, which together define the overall living experience in a country. According to the Cost of Living Index by Country 2023 Mid-Year, Singapore ranks among the most expensive cities globally, particularly when it comes to housing, transportation, and healthcare. High living costs, especially in the private housing market, have significantly impacted the city-state’s performance in the Quality of Living Index, making it less accessible to a broader population, especially for expatriates and middle-income families.

Another factor affecting Singapore’s quality of life score is its environmental quality. Although the government has made strides toward becoming a sustainable city, Singapore still faces challenges related to urban density and pollution. According to the Environmental Performance Index (EPI) 2024, while Singapore scores well in areas like water and sanitation, it struggles with waste management and air pollution, particularly due to its heavy industrial and urban activities. These environmental challenges, coupled with the high cost of living, make Singapore’s overall quality of life less competitive compared to other leading global cities.

Singapore’s healthcare and education systems are globally renowned for their efficiency and effectiveness, contributing to its relatively high standing in the Sustainable Development Report 2023: Implementing the SDG Stimulus. The city-state has made significant progress in areas such as healthcare access, universal education, and technological innovation, with its healthcare system regularly cited as one of the best in the world. However, the World Happiness Index 2024 reflects that while Singaporeans enjoy high-quality healthcare and education, there are broader societal issues that affect personal well-being and satisfaction. Factors such as long working hours, stress related to high living costs, and limited personal freedoms contribute to Singapore’s lower ranking in happiness compared to other advanced economies.

Singapore has long been known for its cultural diversity and openness to foreign talent, a key factor in its global mobility and investment success. According to the Migrant Acceptance Index, Singapore has been moderately successful in integrating its migrant workforce, who make up a significant portion of the population. Migrants, particularly highly skilled expatriates, are attracted to Singapore for its economic opportunities and political stability. However, there remain concerns about social integration, with some reports indicating that low-wage migrant workers face challenges in terms of social mobility and acceptance, which may hinder Singapore’s score in this index. This gap between economic openness and social acceptance can limit Singapore’s ability to improve in areas related to quality of life and social cohesion.

Despite its leadership in global mobility and investment, Singapore’s performance in the Quality of Living Index indicates that there is a need to balance economic success with improvements in personal well being and environmental sustainability. Addressing the high cost of living, improving environmental quality, and enhancing personal freedoms will be crucial for Singapore to achieve a more balanced overall ranking. The government’s focus on initiatives such as the Green Plan 2030, which aims to create a more sustainable and livable urban environment, is a step in the right direction, but further efforts are required to improve the day-to-day living conditions for all residents, including expatriates and local citizens alike.

Relocation in Singapore: Investment Migration and Nomad Visa Opportunities

As Singapore continues to rise in global rankings, particularly in the Global Passport Index, it has also become an attractive destination for investment migration and relocation, offering various pathways for high-net-worth individuals (HNWIs), professionals, and entrepreneurs.

Singapore has long been a preferred destination for HNWIs seeking to relocate through investment migration programs. The Global Investor Programme (GIP), launched by the Economic Development Board (EDB), allows foreign investors to obtain permanent residency by investing a minimum of S$2.5 million in either a new business, an existing business in Singapore, or an approved GIP fund. The GIP is particularly attractive due to Singapore’s stable regulatory environment, favorable tax policies, and its role as a global financial hub, offering excellent opportunities for wealth preservation and business growth.

Investors benefit from Singapore’s strong legal framework, strategic location within Asia, and comprehensive financial services sector, which make it one of the safest and most profitable places for investment. The program has seen increased interest since the onset of the COVID-19 pandemic, as HNWIs look for secure locations with high-quality healthcare, political stability, and robust infrastructure. Additionally, the GIP provides a pathway for families to settle in Singapore, with access to world-class education and healthcare systems, making it a top choice for global relocation.

To obtain Singaporean citizenship, foreign nationals must first become permanent residents, a status achievable through various schemes like the GIP, Professional, Technical Personnel and Skilled Workers Scheme (PTS), or through family connections. Typically, PR holders must live in Singapore for two to five years before applying for citizenship. The naturalization process is highly selective, considering factors such as the applicant’s economic contribution, integration into society, and long-term commitment to Singapore. Additionally, since Singapore does not allow dual citizenship, applicants must renounce their original nationality if they wish to become Singaporean citizens.

Japan

Japan has demonstrated significant progress in both the Quality of Life Index and the Enhanced Mobility Index, which contributed to its notable climb in the Global Performance Index (GPI). From 2021 to 2024, Japan moved from 24th to 16th place in the Quality of Life Index, driven by improvements in healthcare, public infrastructure, and social welfare policies. These changes have resulted in a more robust social support system, addressing key issues such as the aging population and rising living costs. Investments in sustainable urban planning and green infrastructure have also played a critical role in elevating the quality of life, making Japan an increasingly attractive destination for residents and expatriates alike.

In addition to quality of life, Japan’s Enhanced Mobility Index has shown significant improvement. The country’s mobility score, which reflects ease of travel and visa-free access to key destinations, has bolstered its global standing. This has allowed Japan to climb from 24th to 16th in the GPI between 2021 and 2024. Japan’s strong diplomatic relationships and its focus on international cooperation have improved its global mobility, offering residents greater access to desirable regions. Together, these advances in quality of life and mobility have helped Japan rise in international rankings, reflecting its continued adaptation to the evolving socio-economic and geopolitical landscape.

Vietnam

Vietnam has experienced remarkable progress across multiple dimensions, significantly improving its standing in global rankings. The most notable gains were made in the Quality of Life and Enhanced Mobility sub-indices, contributing to its rise in the Global Performance Index (GPI). From 2021 to 2024, Vietnam’s position in the Quality of Life Index saw steady improvement, bolstered by enhancements in public services, urban development, and living standards. The government’s increased investments in infrastructure and social welfare have been pivotal in raising the overall well-being of its citizens. Similarly, the Enhanced Mobility Index saw progress as Vietnam expanded visa-free access and strengthened its international connections, making it easier for citizens to travel to key regions.

In addition to these gains, Vietnam has shown improvements in its Investment Index, reflecting a more favorable business environment and attracting greater foreign investment. This is due to Vietnam’s focus on economic diversification, regulatory reforms, and its growing role as a manufacturing hub in Southeast Asia. Collectively, the advancements in the Quality of Life, Enhanced Mobility, and Investment sub-indices have propelled Vietnam’s overall rise in the GPI, climbing from 38th in 2021 to 30th in 2024. These improvements signal Vietnam’s growing appeal as a destination for both living and business, as the country continues to strengthen its global presence and economic potential.

Saudi Arabia

Saudi Arabia has demonstrated significant progress in recent years across key sub-indices, which have collectively propelled its rise in the Global Performance Index (GPI). The most notable improvements have occurred in the Quality of Life and Enhanced Mobility sub-indices. Between 2021 and 2024, Saudi Arabia made strides in enhancing the living conditions of its citizens, reflected in its improved Quality of Life Index ranking. This progress is attributed to the government’s Vision 2030 initiative, which has focused on expanding public services, improving healthcare, and developing social infrastructure. These efforts have led to higher standards of living and increased access to recreational and cultural amenities, contributing to Saudi Arabia’s climb in this area.

Additionally, Saudi Arabia’s Enhanced Mobility Index has seen notable gains, supported by the kingdom’s expansion of visa-free travel and the diversification of its international partnerships. This improvement has made travel more accessible for Saudi citizens, contributing to the country’s global mobility ranking. Furthermore, the country has strengthened its Investment Index, attracting foreign investment through economic diversification and regulatory reforms aimed at reducing dependence on oil. These combined advancements in the Quality of Life, Enhanced Mobility, and Investment sub-indices have led to Saudi Arabia’s overall rise in the GPI, moving from 46th in 2021 to 38th in 2024. This reflects the country’s successful efforts to modernize its economy and improve its global standing.

Countries that dropped in the 2024 GPI

The Americas

The United States

From 2021 to 2024, the United States experienced a significant drop in the Global Passport Index (GPI), falling from the 1st position in 2021 to the 13th position in 2024. This decline can be primarily attributed to deteriorations in two critical components of the GPI: the Enhanced Mobility Index and the Quality of Living Index. These two elements, which collectively account for 75% of the overall GPI score, saw substantial declines during this period, reflecting broader geopolitical tensions, domestic challenges, and shifting global dynamics.

The Enhanced Mobility Index, constitutes 50% of the GPI, and measures the number of countries a passport holder can enter without a visa or with a visa on arrival. The U.S. saw a dramatic fall in this sub-index, from the 1st position in 2021 to the 33rd position in 2024. This drop was largely due to new or intensified visa requirements imposed by countries such as Russia, China, Belarus, Afghanistan, Venezuela, and Cuba. These changes were driven by escalating geopolitical tensions and diplomatic disputes, which led to reciprocal visa restrictions. The lingering effects of the COVID-19 pandemic also played a role, with countries like China maintaining stringent entry requirements that continued to complicate travel for U.S. citizens.

In addition to mobility issues, the U.S. also suffered a decline in the Quality of Living Index, which accounts for 25% of the GPI. This index includes various indicators such as the cost of living, the Freedom in the World Index, and the Environmental Performance Index. From 2021 to 2024, the U.S. dropped from 10th to 38th place in the Quality of Living Index. Key factors contributing to this decline include a significant increase in the cost of living, which has made the U.S. a more expensive place to live, and a drop in the Freedom in the World Index. The latter was due to growing concerns over political polarization, challenges to democratic institutions, and civil liberties. These factors combined to erode the overall quality of life for U.S. residents, further dragging down the country’s GPI ranking.

Despite these setbacks, the U.S. maintained its position in the Investment Index, holding steady at 4th place from 2021 to 2024. This index, which contributes 25% to the overall GPI, measures the attractiveness of a country for business and investment. The U.S.’s consistent performance in this area reflects its relatively low levels of bureaucracy, strong legal protections for investors, and its position as a global economic leader. However, while the Investment Index remained a strong point, it was not enough to counterbalance the declines in mobility and quality of living.

It is important to note that the GPI is a relative ranking system, meaning that the U.S.'s decline is not solely due to its own performance but also to improvements in other countries. While the U.S. faced significant challenges, many other nations improved their mobility, quality of living, and investment environments during the same period. Countries that were previously lower in the rankings may have implemented reforms or experienced economic growth that enhanced their GPI scores, thereby pushing the U.S. down the list.

In conclusion, the U.S. passport’s fall from the top position in the Global Passport Index between 2021 and 2024 can be attributed to substantial declines in the Enhanced Mobility and Quality of Living indices. Geopolitical tensions, increased visa restrictions, rising costs of living, and domestic political challenges all contributed to this downward trend. While the U.S. remains a strong destination for investment, its overall GPI ranking reflects the broader challenges it faces in maintaining its global mobility and quality of life in a competitive and rapidly changing world.

Canada

From 2021 to 2024, Canada experienced a notable decline in its ranking on the Global Passport Index, falling from 3rd place in 2021 to 14th place in 2024. This significant drop reflects challenges across multiple dimensions, particularly in the areas of quality of living and investment attractiveness. The decline in these critical indicators underscores the shifting dynamics within Canada and its global standing.

One of the key factors contributing to Canada’s lower ranking is the drop in its Quality of Living Index. In 2021, Canada held a strong position at 4th place, reflecting its high standard of living, healthcare, and social services. However, by 2022, the country had fallen to 15th place, driven by rising costs of living and concerns over housing affordability. Although there was a slight recovery by 2024, bringing Canada back up to 12th place, the fluctuations in this index indicate ongoing challenges in maintaining the high quality of life that Canada is known for.

The most significant decline for Canada, however, was seen in the Investment Index. In 2022, Canada was ranked 9th, reflecting its reputation as a favorable destination for investment with relatively low bureaucratic barriers. By 2024, however, the country had plummeted to 18th place in this index. This sharp decline is attributed to an increase in bureaucratic hurdles and regulatory complexities that have made Canada less attractive to investors. Meanwhile, other countries have improved their investment climates, further contributing to Canada’s relative decline in this area.

While these challenges have been significant, Canada has experienced only minor fluctuations in the Enhanced Mobility Index during this period. This suggests that, despite the country’s broader economic and quality of life challenges, its global mobility remains relatively stable.

Africa

Nigeria

From 2021 to 2024, Nigeria's performance in the Global Prosperity Index (GPI) saw a steady decline, particularly in the areas of investment, mobility, and innovation. The country ranked 172nd in the GPI in 2024, down from 158th in 2022, reflecting broader struggles in economic and social indicators. While Nigeria made modest improvements in certain aspects of quality of life, its sharp decline in the Investment Index and Enhanced Mobility significantly contributed to its overall drop in global rankings. This downward trend indicates that Nigeria’s economic and regulatory challenges are having a profound impact on its ability to attract and sustain investment.