How are Dubai and Abu Dhabi attracting foreign direct investment?

Introduction

The United Arab Emirates (UAE) is a dynamic federation of seven emirates with a population of approximately 12 million people, of which a significant 88.5% are expatriates. This diverse demographic primarily includes South Asians, with Indian, Pakistani, and Bangladeshi nationals making up more than half of the population. The UAE’s economy, traditionally dominated by oil and gas, has significantly diversified into sectors such as tourism, finance, and technology.

In recent years, the UAE has become a major hub for foreign direct investment (FDI) in the Middle East and North Africa as legal reforms aimed at creating a more attractive investment environment have been instrumental in this success. Notable legislative changes include the removal of local sponsorship requirements for onshore companies, the expansion of the Golden Visa program, and the introduction of various long-term residency visas.

Among the UAE’s emirates, Dubai (also known as the 5th city of India) and Abu Dhabi have emerged as particularly attractive destinations for investment migration, each offering unique Golden Visa schemes. These programs provide long-term residency and a range of benefits, making them appealing to global investors, entrepreneurs, skilled professionals, and exceptional talents. The Golden Visa programs are a culmination of the UAE’s strategic efforts to attract and retain global talent and investment, reflecting the country’s commitment to becoming a global hub for business and innovation.

This article explores the intricacies of the investment migration schemes of Dubai and Abu Dhabi, comparing their respective Golden Visa programs, the benefits they offer, and their broader strategic visions. It also examines how applicants can benefit from being permanent residents in the UAE, mainly by gaining access to a vibrant and upscale market and enhancing their mobility when acquiring UAE citizenship. Through this comparison, we aim to provide a comprehensive understanding of how these two leading emirates attract and retain global talent and capital, contributing to the UAE’s overall economic resilience and development.

Legal reforms aimed at creating a more attractive investment environment for foreigners

The UAE is a federation of seven emirates with a population of approximately 12 million people.1 A significant characteristic of the UAE’s demographics is the high number of expatriates, who make up about 88,5% of the population. These expatriates come from diverse nationalities and socio-religious backgrounds, with a majority (59.4%) originating from South Asian countries such as India (38.2%), Pakistan (9.5%), and Bangladesh (2.3%).2 More than half of the population of the UAE is composed of these three nationalities, who play an important role in the workforce in the country. Emirati citizens are a minority, comprising only 11.6% of the population, yet they play a crucial role in governance and economic development.

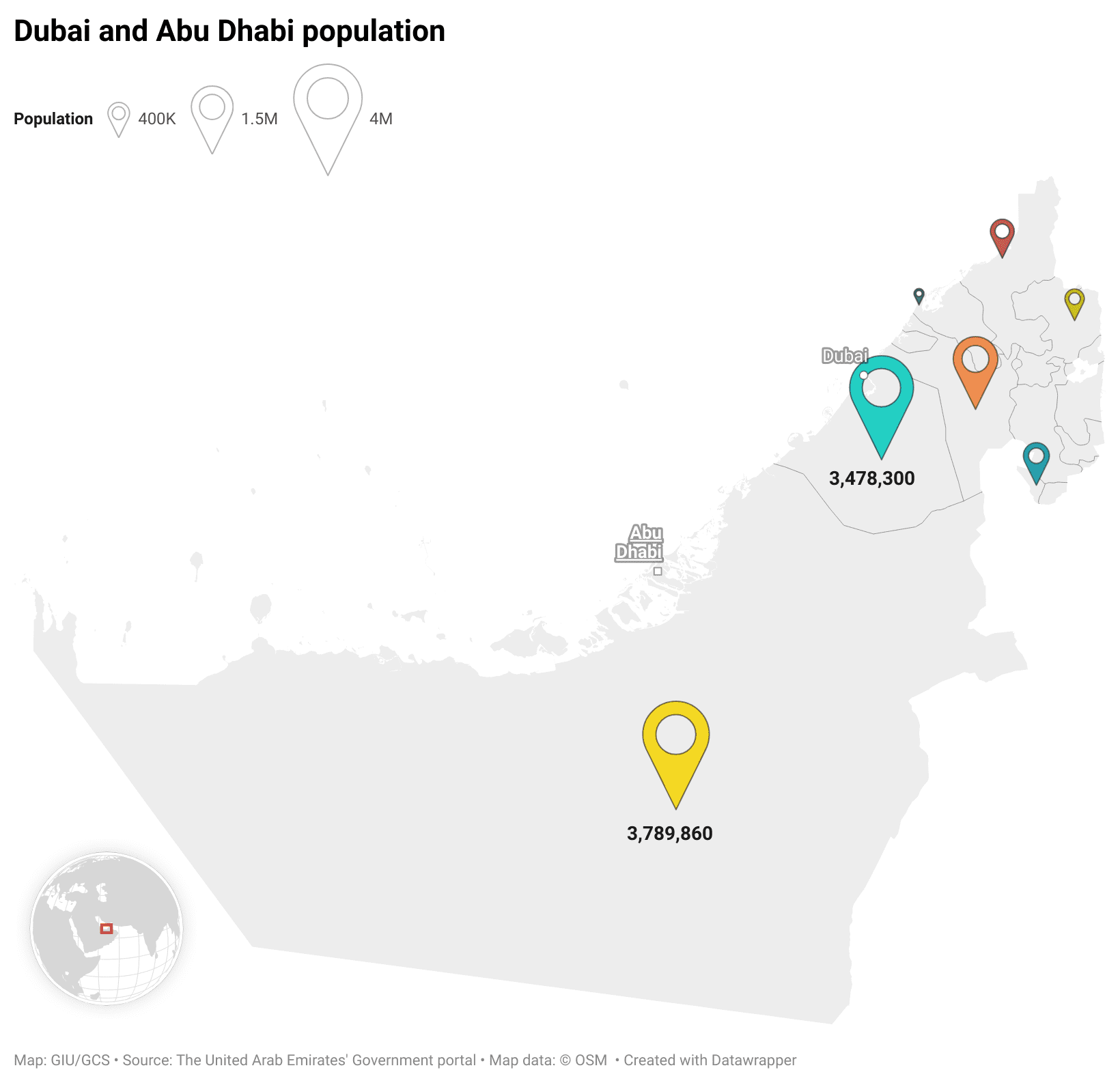

According to data the figure, Abu Dhabi has a population of approximately 3,789,860, while Dubai’s population is about 3,478,300. These two emirates have the largest populations in the UAE, significantly shaping the country’s demographic landscape. Over the past decades, Abu Dhabi’s population grew from around 930,000 in the early 2000s to 1.6 million by 2010, and Dubai’s population increased from about 1.2 million to 1.9 million during the same period.3 This rapid development and economic growth have led to their current substantial populations.

The UAE’s economy is diversified, though traditionally dominated by the oil and gas sector, which contributes around 30% of the GDP.4 Efforts to diversify have led to significant investments in tourism, finance, and technology sectors. Additionally, the UAE’s strategic location as a trade hub between Asia, Africa, and Europe further enhances its attractiveness, making it a prime destination for businesses looking to expand their reach globally.

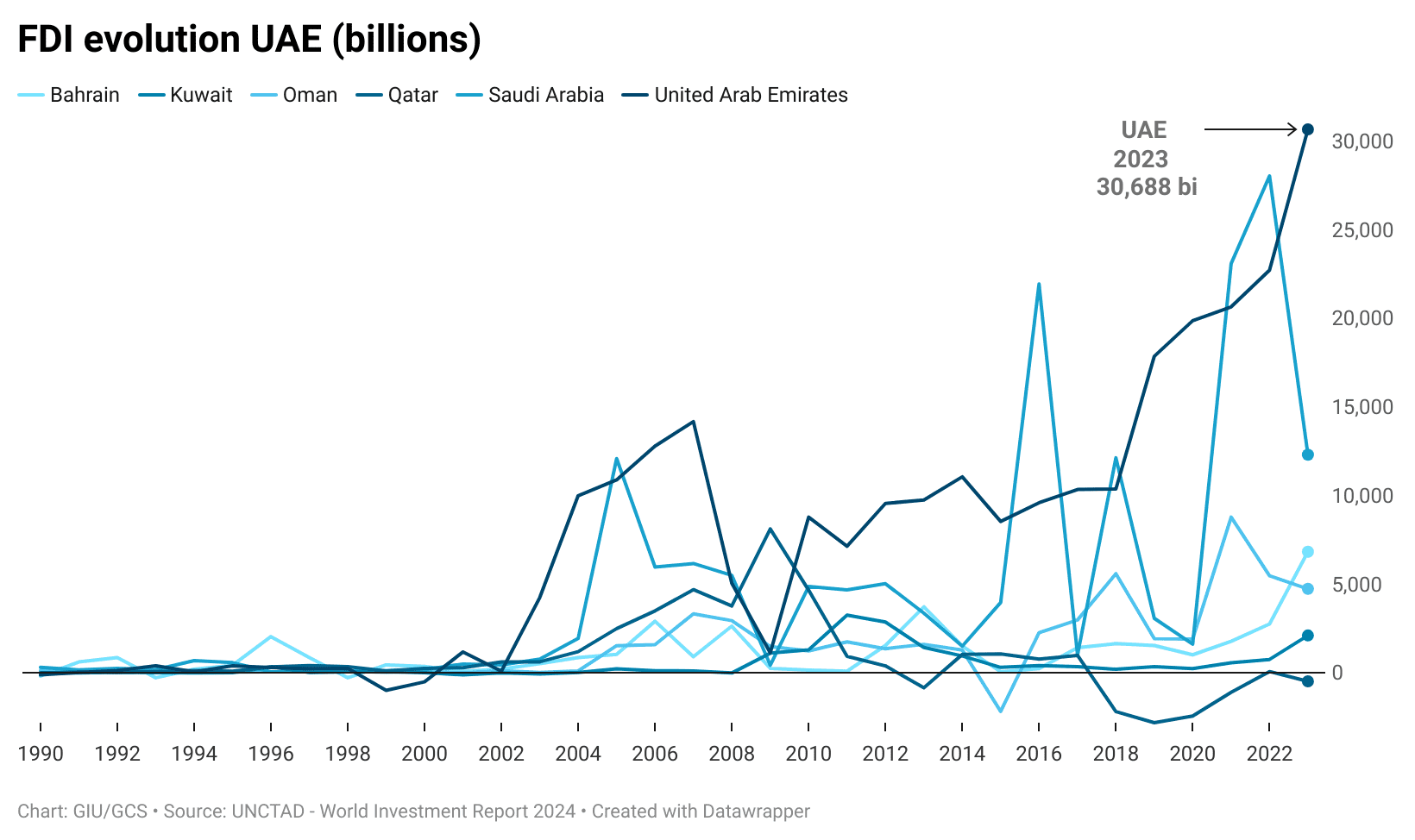

A major hub for foreign direct investment (FDI) in the Middle East and North Africa (MENA), the UAE is attracting 31% of the region’s FDI, amounting to $30,688 billion in 2023, surpassing Saudi Arabia.

The ease of doing business, quick registration processes, and supportive services in free zones have made the UAE an attractive destination for entrepreneurs and investors. The country actively seeks FDI and has implemented several legal reforms to create a more attractive investment climate.

In 2021, as part of its 50th-anniversary celebrations, the UAE government announced ambitious programs aimed at attracting $150 billion (about $460 per person in the US) in foreign investment over the next decade. Key legislative changes have been instrumental in this initiative:

- Federal Decree Law N (26) of 2020 – Commercial Companies Law5: removed the requirement for onshore UAE companies to have a UAE or Gulf Cooperation Council (GCC) national as a majority shareholder; Joint stock companies no longer need to be chaired by an Emirati or have Emiratis as the majority on their boards; Local branches of foreign companies no longer need a UAE national or UAE-owned company as an agent. Additionally: The Abu Dhabi Department of Economic Development (ADDED) published a list of 1,105 commercial and industrial activities eligible for 100% foreign ownership from June 2021. This includes a diverse range of sectors such as automobile manufacturing, pharmaceuticals production, general contracting, and civil engineering services. Additionally, the list covers retail sale of electronics, software development, legal consultancy, private hospitals and clinics, as well as hotel and resort management. These opportunities aim to attract international investors and boost economic growth in the region.

- Federal Law No (3) of 2022 – Regulating Commercial Agencies6: Allows international companies to act as agents for their products, expanding business opportunities and reducing the reliance on Emirati agents.

- Federal Law No (25) of 2022 – Industrial Sector Law7: Encourages both domestic and foreign investment in key sectors such as food processing, steel, aluminum, plastics, hydrogen, aerospace, petrochemicals, pharmaceuticals, medical technology, and agricultural technology.

- Amendments to the Golden Visa Program (April 2022)8: The UAE expanded the ten-year Golden Visa program to include additional categories such as scientists, professionals with certain educational qualifications, real estate investors, outstanding students, exceptional talents, and entrepreneurs generating substantial revenues. It attracts a broader range of highly skilled professionals and investors, offering greater stability and long-term residency options.

- Executive Regulations of the Decree Law on Entry and Residence of Foreigners (April 2022)9: These regulations expanded the five-year residence track for skilled employees, freelancers, and self-employed individuals. They also introduced new visa types such as job exploration entry visas, five-year multi-entry tourist visas, and study and training entry permits.

These reforms have made the UAE a more attractive destination for foreign businesses and skilled professionals, resulting in a significant boost to relocation. The removal of local sponsorship and shareholding requirements has simplified the process for foreign investors to establish and operate businesses in the UAE, while the introduction of online platforms, such as Invest in Dubai, has streamlined business registration and licensing processes.10

Additionally, significant reductions in business setup fees and lease contract requirements have lowered the cost of starting and operating businesses. The introduction of long-term residency visas, such as the amended Golden Visa program, has provided greater stability for expatriates and their families, allowing for more extended stays and easier mobility, which has attracted professionals from countries like China, Pakistan, and other South Asian nations.

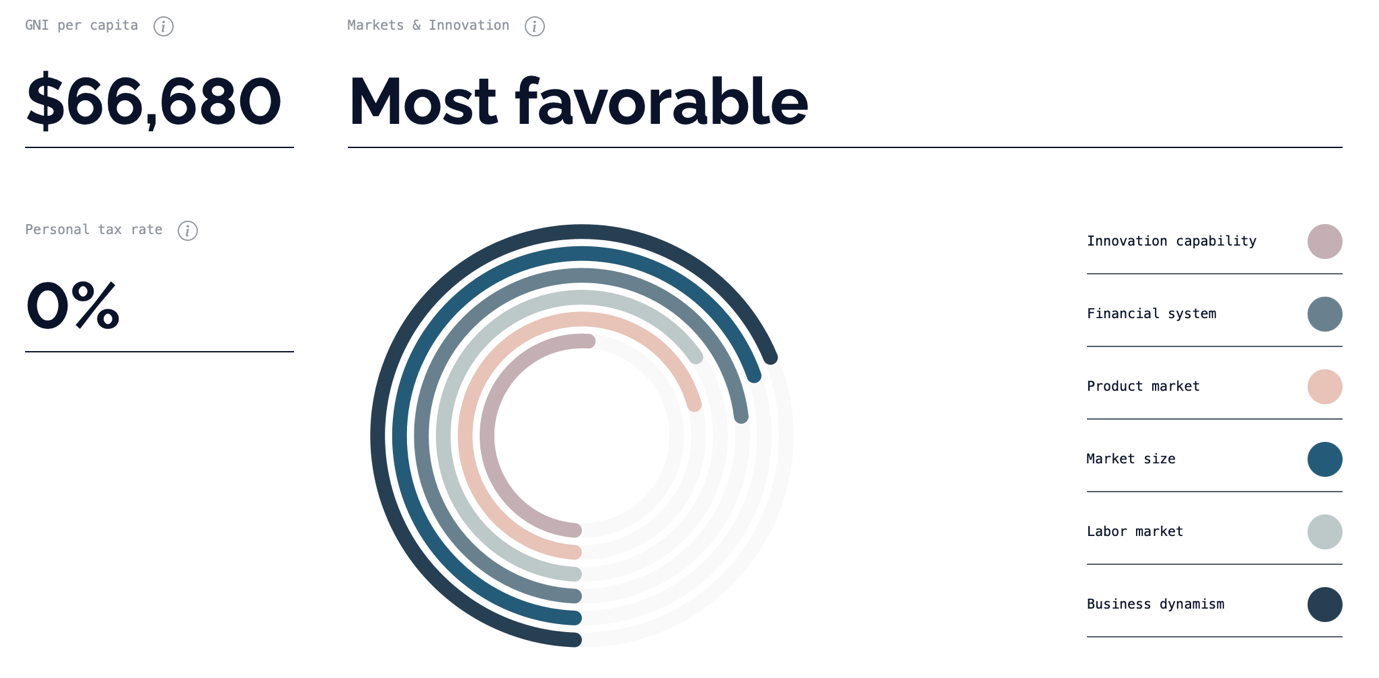

Regarding taxes, the context for expatriates in the UAE is exceptionally favorable, making it a major draw for foreign talent and investment. One of the most appealing aspects is the absence of personal income tax on salaries, which allows expatriates to enjoy their full earnings without deductions. Additionally, there are no capital gains taxes on the sale of investments such as real estate or stocks, nor are there any withholding taxes on dividends, interest, or royalties. This tax-friendly environment extends to wealth and inheritance as well, with no taxes imposed on personal wealth or inheritance transfers, enabling expatriates to accumulate and pass on their assets without any tax burden.

In 2018, the UAE introduced a 5% Value Added Tax (VAT) on most goods and services, which, while affecting consumption, is relatively low compared to global standards. Corporate tax is not levied federally except on specific sectors like oil and gas and foreign banks, although a new federal corporate tax of 9% on business profits exceeding AED 375,000 (approximately USD 100,000) was introduced in June 2023, aligning with international norms. Small businesses and start-ups benefit from a 0% rate on profits below this threshold. Furthermore, excise taxes are imposed on certain goods harmful to health and the environment, such as tobacco products and sugary drinks. The UAE has also signed numerous double taxation agreements (DTAs) with other countries, preventing double taxation and fostering international economic cooperation. This comprehensive yet lenient tax regime significantly enhances the UAE’s attractiveness as a global business and living destination.

Regulation | Rate | Details |

Corporate Tax | 0% - 9% | Introduced from June 1, 2023, with a standard rate of 9% for profits exceeding AED 375,000 (approximately USD 100,000). |

Value Added Tax (VAT) | 5% | Applied to the supply of goods and services. |

Personal Income Tax | 0% | No personal income tax is levied on individuals. |

Excise Tax | 50% - 100% | 50% on carbonated drinks, 100% on tobacco products and energy drinks. |

Customs Duty | 5% | Levied on the import of most goods, with some exceptions. |

Property Transfer Tax | 2% - 4% | Varies by emirate; generally, 4% in Dubai and 2% in Abu Dhabi. |

Moreover, the UAE is a leader in innovation within the Arab world, ranking 31st globally in the 2022 Global Innovation Index. Furthermore, Global Citizen Solutions classifies the UAE as a “most favorable” country for investment and ranks it in the 6th position in the Investment segment of the Global Passport Index.

In general, the UAE offers a high quality of life with advanced infrastructure, healthcare, and education systems, and is ranked remarkably high in the Human Development Index (HDI) with a score of 0.937, making it the best-ranked Arab state. According to Numbeo, the UAE is positioned 20th globally in terms of life quality. In terms of literacy, 95% of the country’s population is literate, and the UAE is home to several top-ranking universities, including the United Arab Emirates University, Khalifa University, and the American University of Sharjah. These institutions are recognized for their ambitious standards in research and education, contributing to the UAE’s reputation as a hub for academic excellence.

Additionally, despite regional challenges, the UAE recorded the largest improvement in peacefulness in the Middle East and North Africa, rising 31 places to 53rd in the Global Peace Index 2024. This significant advancement underscores the UAE’s status as the safest country in the region, reflecting its ongoing efforts to enhance security and stability through effective governance and strategic initiatives aimed at promoting peace and safety for its residents and expatriates. The UAE’s commitment to maintaining a secure and harmonious environment has been a key factor in its attractiveness as a destination for foreign investment and international talent, further bolstering its reputation on the global stage.

Furthermore, the UAE’s luxury real estate market, featuring prime properties in locations like Dubai Marina, Palm Jumeirah, and Abu Dhabi’s Saadiyat Island, continues to attract global investors with its high-end offerings and innovative projects by developers such as Emaar and DAMAC Properties

For all these reasons, in the last years the UAE (mainly Dubai and Abu Dhabi) have been attracting migrants through investment migration and Golden Visa schemes due to several compelling factors.

Dubai and Abu Dhabi Golden visa schemes

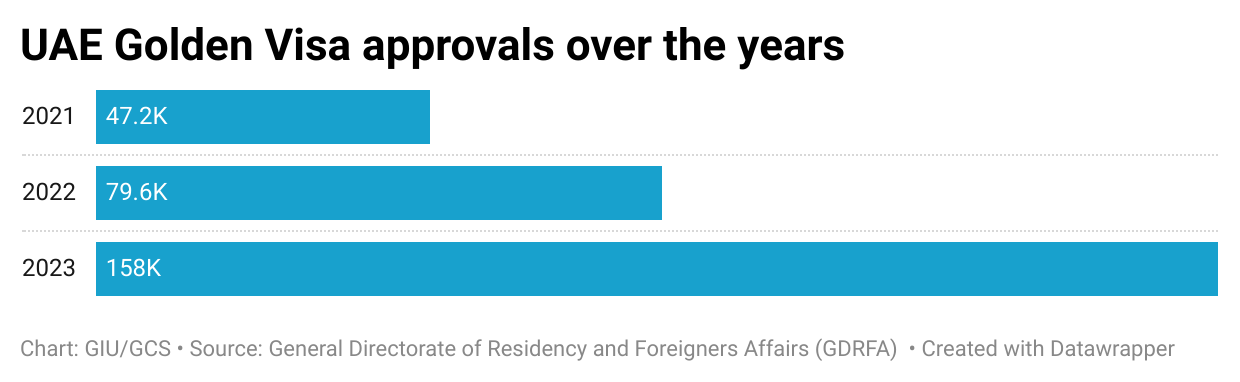

Data on UAE Golden Visa approvals from 2021 to 2023 reveals a remarkable upward trend, displaying the program’s growing popularity and success. In 2021, there were 47,200 approvals, which increased to 79,600 in 2022, and surged to 158,000 in 2023. The tripling of approvals over three years underscores the effectiveness of the UAE’s initiatives to attract investors, entrepreneurs, and highly skilled professionals. The substantial year-on-year growth highlights the strategic efforts by the UAE to diversify its economy, enhance its global competitiveness, and establish itself as a prime destination for talent and investment. The Golden Visa scheme’s increasing appeal reflects its role in boosting foreign direct investment and contributing to the country’s economic resilience and development.

Abu Dhabi and Dubai, the two largest and most prominent emirates in the United Arab Emirates (UAE), have become highly attractive destinations for investment migration. Through a combination of strategic economic diversification, robust infrastructure, and favorable business environments, both cities offer a range of Golden Visa programs aimed at attracting global investors, entrepreneurs, skilled professionals, and exceptional talents. These programs provide long-term residency and numerous benefits, making them appealing to individuals seeking stability, growth opportunities, and a high quality of life in the UAE.

The concept of investment migration in the UAE has evolved significantly over the past few decades. Initially, the UAE’s economy was heavily reliant on oil and gas, with limited avenues for foreign investment outside the energy sector. However, with the realization that sustainable economic growth required diversification, the UAE began implementing strategic reforms in the late 20th and early 21st centuries. Abu Dhabi and Dubai spearheaded these efforts, developing world-class infrastructure, establishing free zones, and introducing favorable business policies (see above).

The Golden Visa programs, launched in 2019, are a culmination of these efforts, reflecting the UAE’s commitment to attracting and retaining global talent and investment. These programs offer long-term residency to investors, entrepreneurs, and skilled professionals, aligning with the UAE’s vision of becoming a global hub for business and innovation.

The allure of Abu Dhabi and Dubai’s investment migration programs lies in the comprehensive benefits they offer to investors and their families. Firstly, these programs provide long-term residency, typically ranging from 5 to 10 years, with the possibility of renewal. This provides a higher degree of stability compared to standard work visas, which are usually valid for 1 to 3 years and are tied to employment contracts. Stability allows investors to plan for the future and integrate into the local economy and community. Secondly, the UAE’s favorable tax environment, which includes no personal income tax, makes it an attractive destination for high-net-worth individuals and businesses. Additionally, the Golden Visa programs cover investors’ immediate family members, ensuring that their spouses and children also benefit from the same privileges, including access to high-quality education and healthcare services.

Abu Dhabi and Dubai’s strategic locations at the crossroads of Europe, Asia, and Africa further enhance their appeal. These cities offer unparalleled connectivity through world-class airports and seaports, facilitating global trade and travel. Moreover, both emirates boast vibrant, cosmopolitan environments with a high standard of living, modern infrastructure, and a wide range of recreational and cultural activities. Investors can enjoy a luxurious lifestyle, with access to premier shopping, dining, and entertainment options. The safety and security of the UAE, combined with its political stability, provides a conducive environment for both personal and professional growth.

The investment migration programs of Abu Dhabi and Dubai, as highlighted, are integral to the UAE’s broader strategic vision of becoming a global leader in innovation, sustainability, and economic diversification. When comparing both schemes, Dubai has a highly diversified economy, with significant contributions from tourism, finance, real estate, and trade. While also diversified, Abu Dhabi’s economy remains more heavily reliant on oil and gas compared to Dubai. However, significant investments have been made in sectors such as renewable energy, tourism, and finance.

Dubai is known for its vibrant business environment and extensive free zones that encourage foreign investment. Free zones in Dubai offer numerous advantages for foreign businesses, making them highly attractive for international investors. One of the primary benefits is the allowance for 100% foreign ownership, eliminating the need for a local sponsor or partner. Additionally, companies operating within these zones enjoy significant tax benefits, such as exemptions from corporate and income taxes for a specified period. Businesses also benefit from simplified customs procedures, facilitating smoother and more cost-effective international trade. Furthermore, free zones allow for the repatriation of 100% of profits and capital, providing investors with financial flexibility. There are no currency restrictions enabling businesses to operate in multiple currencies freely. Finally, these zones are equipped with state-of-the-art infrastructure, catering to various industries, and enhancing the overall business environment.

The city is also renowned for its openness to new businesses, with numerous initiatives to attract startups and international companies. The ease of doing business, quick registration processes, and supportive policies make it an ideal destination for entrepreneurs and investors.

Abu Dhabi is steadily increasing its openness to new businesses, with initiatives like Hub71, which supports tech startups and innovation. However, the emirate is more prone to offer substantial governmental support for large-scale investments and long-term economic projects. Abu Dhabi has developed a robust framework to attract and support large-scale investments and long-term economic projects through various initiatives and programs. A cornerstone of this strategy is the Abu Dhabi Economic Vision 2030, which aims to diversify the emirate’s economy and reduce its reliance on oil. This comprehensive plan focuses on developing key sectors such as tourism, aviation, real estate, and manufacturing, thereby encouraging substantial investments.

To stimulate economic growth, the Abu Dhabi government offers a range of incentives including tax exemptions, subsidies, and grants. These financial supports are designed to attract FDI and stimulate growth in strategically important sectors. Significant investments in infrastructure projects, such as the development of airports, seaports, and road networks, facilitate efficient logistics and make Abu Dhabi an attractive destination for large-scale investments.

These incentives are intricately linked to the Golden Visa program, which is aimed at attracting substantial investments into the emirate. Investors who commit more than AED 10 million to public investments, deposits, company establishments, or partnerships are eligible for the Investor Golden Visa. This visa provides long-term residency benefits not only to the investors but also to their families, including spouses, children, an executive director, and an advisor. The alignment of investment incentives with the Golden Visa program underscores Abu Dhabi’s strategy to create a stable and attractive environment for high-net-worth individuals and their families.

The cost of living in Abu Dhabi is generally lower than in Dubai, especially concerning housing. This can make it a more attractive option for families and individuals looking for a high standard of living at a more affordable cost. Additionally, many expatriates are drawn to Abu Dhabi due to the attractive remuneration packages, which are significantly enhanced by the absence of income tax, property taxes, or VAT. This fiscal advantage allows expatriates to retain a larger portion of their earnings compared to many other countries, where such taxes can substantially reduce take-home pay. Consequently, real wages in Abu Dhabi are far higher, making it a highly appealing destination for skilled professionals and workers seeking lucrative employment opportunities.

Comparison of Golden Visa Schemes in Dubai and Abu Dhabi:

Golden Visa Typology | Dubai | Abu Dhabi |

Investor Golden Visa (non-real estate) | Criteria: AED 2 million investment in non-real estate projects or companies. Proof of AED 250,000 (approximately USD 70,000) annual tax payment for 2 years Benefits: Covers investor, spouse, children, one advisor, and one executive director Duration: 10 years | Criteria: AED 10 million investment (approximately USD 2.72 million) in public investments, deposits, company establishment, or partnerships Benefits: Covers investor, spouse, children, one executive director, and one advisor

|

Investor Golden Visa (real estate) | Criteria: AED 2 million investment in real estate approximately USD 545,000) Benefits: Same as above Duration: 10 years | Criteria: AED 2 million investment in real estate (approximately USD 545,000) Benefits: Same as above Duration: 10 years |

Entrepreneur Golden Visa | Criteria: Ownership or partnership in a UAE-registered startup SME with annual revenues of at least AED 1 million (approximately USD 275,000) Benefits: Includes entrepreneur, spouse, and children Duration: 5 years | Criteria: Ownership or partnership in a UAE-registered startup SME with annual revenues of at least AED 1 million (approximately USD 275,000) Benefits: Includes entrepreneur, spouse, and children Duration: 5 years |

Skilled Professionals Golden Visa | Criteria: Specialized skills in fields like science, medicine, engineering, IT. Valid employment contract in a priority field in the UAE Benefits: Includes skilled professional, spouse, and children Duration: 10 years | Criteria: Specialized skills in fields like science, medicine, engineering, IT. Valid employment contract in a priority field in the UAE Benefits: Includes skilled professional, spouse, and children Duration: 10 years |

Researchers and Scientists Golden Visa | Criteria: Recognized contributions to scientific research. PhD or Master's in engineering, technology, life sciences, or natural sciences. Recommendation from relevant authority. Benefits: Covers researcher, spouse, and children Duration: 10 years | Criteria: Recognized contributions to scientific research. PhD or Master's in engineering, technology, life sciences, or natural sciences. Recommendation from relevant authority. Benefits: Covers researcher, spouse, and children Duration: 10 years |

Exceptional Students Golden Visa | Criteria: Outstanding academic performance (95%+ in secondary school). UAE university graduates with GPA of 3.8 Benefits: Includes student and family Duration: 5 years | Criteria: Outstanding academic performance (95%+ in secondary school). UAE university graduates with GPA of 3.8 Benefits: Includes student and family Duration: 5 years |

Humanitarian Pioneers Golden Visa | Criteria: Recognized for humanitarian efforts and contributions Benefits: Covers humanitarian pioneer, spouse, and children Duration: 10 years | Criteria: Recognized for humanitarian efforts and contributions Benefits: Covers humanitarian pioneer, spouse, and children Duration: 10 years |

Cultural and Creative Individuals Golden Visa | Criteria: Exceptional talents in culture, arts, and creative industries. Achieved international acclaim or significant cultural contributions Benefits: Includes cultural or creative individual, spouse, and children Duration: 10 years | Criteria: Exceptional talents in culture, arts, and creative industries. Achieved international acclaim or significant cultural contributions Benefits: Includes cultural or creative individual, spouse, and children Duration: 10 years |

Both Abu Dhabi and Dubai offer robust Golden Visa programs with attractive benefits for various categories of applicants. The choice between the two depends on individual preferences, investment capacities, and specific personal or professional goals. Dubai may be more appealing for those seeking a dynamic, fast-paced environment with a diverse range of opportunities, while Abu Dhabi offers a more serene and culturally rich setting with strong governmental support for large-scale investments and research initiatives.

Dubai: Ideal for Small and Medium Startups

Support for Startups:

- Free Zones: Dubai hosts numerous free zones, such as Dubai Silicon Oasis and Dubai Internet City, which provide excellent support for small and medium-sized enterprises (SMEs). These zones offer benefits like 100% foreign ownership, tax exemptions (for a period of 15 to 50 years, which can often be renewed), and simplified business setup processes.

- Accessibility: With a lower investment threshold for its non-real estate Golden Visa (AED 2 million – approximately USD 545,000), Dubai is accessible to a broader range of investors looking to start or grow SMEs.

Abu Dhabi: Focus on Large-Scale Structural Projects

Government Support and Investment:

- High Investment Threshold: Abu Dhabi’s requirement of AED 10 million (approximately USD 2.72 million) for its non-real estate Golden Visa reflects its focus on attracting substantial investments. This threshold is indicative of the emirate’s strategy to drive large-scale projects that can significantly impact its economy.

- Strategic Projects: Abu Dhabi is known for its large-scale structural projects and significant government initiatives. For example, investments in renewable energy through projects like Masdar City, and significant infrastructure developments such as the expansion of the Abu Dhabi International Airport.

- Support for Innovation and Tech: Initiatives like Hub71 demonstrate Abu Dhabi’s commitment to fostering tech startups and innovation. This ecosystem supports larger projects that require substantial capital and government backing.

Path to citizenship

The UAE has stringent naturalization laws, making citizenship challenging to obtain. However, recent legislative changes have made it more accessible for exceptional individuals and investors. In 2021, the UAE introduced reforms allowing for the nomination of exceptional talents and investors for citizenship.

According to the UAE Cabinet Law No. 16 of 2021, candidates can be nominated for citizenship in several categories.

- Investors must own property in the UAE and significantly contribute to the economy.

- Doctors and specialists need at least 10 years of experience in a high-demand scientific discipline, alongside notable contributions, and recognition in their field.

- Scientists must be active researchers with over 10 years of practical experience, acknowledged by prestigious scientific institutions, and have significant research contributions.

- Inventors must hold one or more patents approved by the UAE Ministry of Economy or an international body, accompanied by a recommendation from the UAE Ministry of Economy.

- Intellectuals and creative individuals must be pioneers in culture and the arts, with international awards and endorsements from relevant government bodies.

All candidates must have valid residency in the UAE, comply with UAE laws, and pledge allegiance to the UAE, with the possibility of retaining their original nationality. Nominations are typically made by UAE Rulers’ and Crown Princes’ courts, executive councils, and the Cabinet.

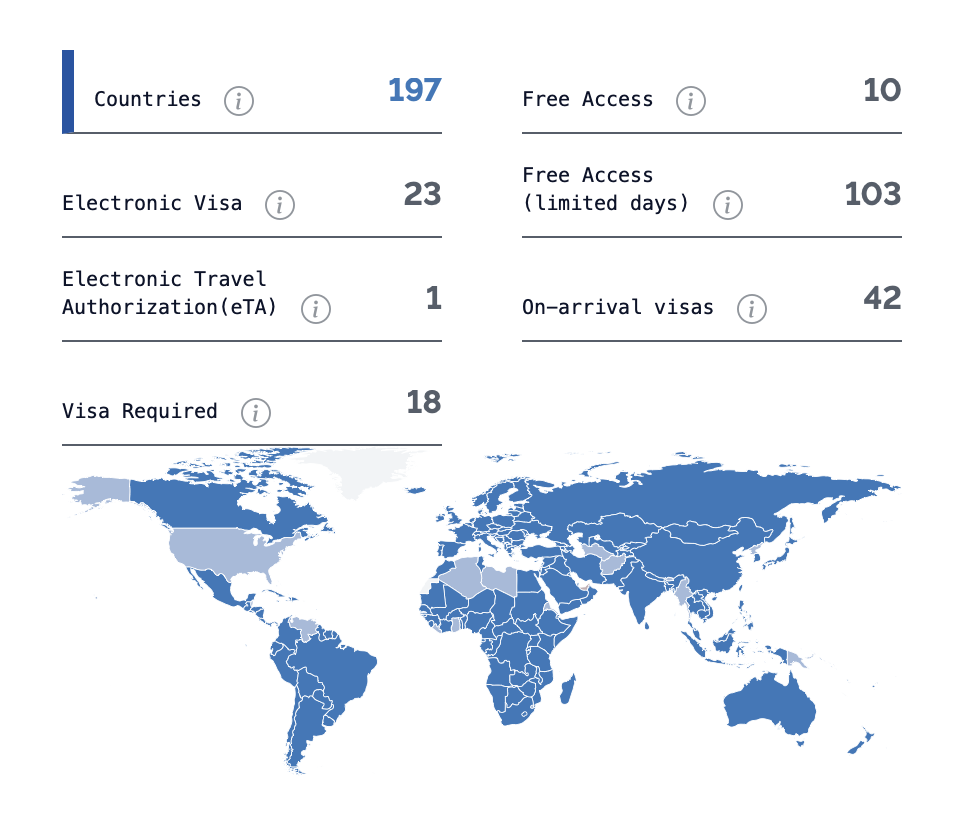

The process involves a thorough evaluation of the candidate’s contributions and potential value to the country. For those granted UAE citizenship, the UAE passport provides significant mobility, allowing visa-free or visa-on-arrival access to over 177 countries, according to Global Passport Index (GPI), greatly enhancing global travel and business opportunities.

Case Studies: Increasing Mobility Through UAE Citizenship

Consider a successful entrepreneur from India, who acquires UAE residency through a significant investment in a tech startup in Dubai. Previously, with their Indian passport, the investor had limited visa-free access to 92 countries (GPI). After five years of residency, their substantial contributions to the tech sector led to their nomination for UAE citizenship under the new legislation for exceptional talents and investors. Upon receiving UAE citizenship, their mobility increases dramatically. With a UAE passport, they gain visa-free or visa-on-arrival access to over 177 countries. This transformation not only facilitates easier and more frequent international business travel but also opens numerous personal and professional opportunities globally, significantly enhancing their ability to operate on a worldwide scale.

The investors’ family also benefits significantly from their new UAE citizenship. Their spouse and children, now also eligible for UAE citizenship, experience a similar enhancement in their travel freedom. This increased mobility allows the family to travel more freely for leisure, education, and business purposes, providing them with greater global opportunities and improving their quality of life. This example underscores the profound impact that UAE citizenship can have, not just for individual investors, but for their families as well.

In the case of an accomplished professor from South Africa, relocating to the UAE under the Golden Visa scheme, is an opportunity to benefit from country’s professional growth opportunities, enhanced research funding, and superior quality of life. This move offers her long-term residency, family sponsorship, and a significant increase in global mobility, enabling travel to 177 countries compared to the 116 accessible with her South African passport. The UAE’s strategic location and advanced infrastructure will facilitate her participation in international conferences and collaborative projects, thereby advancing her academic influence and research endeavors. This relocation underscores the UAE’s appeal to top global talent through progressive visa policies, fostering an environment ripe for innovation and scholarly excellence.

For a renowned medical doctor from Lebanon relocating to the UAE under the Golden Visa scheme, the move provides him with long-term residency, family sponsorship, and a significant increase in global mobility, allowing travel to 177 countries compared to the 64 accessible with his Lebanese passport. The UAE’s strategic location and state-of-the-art medical facilities will enhance his ability to participate in international medical conferences and collaborative research projects, thereby expanding his professional influence and expertise. Dr. Haddad’s relocation highlights the UAE’s capacity to attract top global talent through its progressive visa policies, creating an environment conducive to medical innovation and excellence.

Conclusion

In the last five years, the UAE has emerged as a magnet for foreign direct investment (FDI) and wealth relocation due to the implementation of numerous laws that have both stimulated FDI by relaxing company ownership restrictions and imposing business-friendly tax regimes. Central to this strategy has been the introduction of attractive Golden Visa schemes, which provide long-term residency to investors, entrepreneurs, skilled professionals, and their families. These initiatives have significantly enhanced the UAE’s appeal, making it an attractive destination for global talent and capital. The ease of doing business, combined with substantial governmental support, and streamlined processes, has positioned the UAE as a leading hub for international investment.

Dubai and Abu Dhabi, the two primary emirates, offer remarkably similar Golden Visa schemes in terms of applicant typology and requirements. Both emirates cater to investors, entrepreneurs, and professionals, providing long-term residency options that ensure stability and security. However, the key distinction lies in the investment threshold and focus of the projects. Dubai’s Golden Visa for non-real estate investors requires an investment of AED 2 million (approximately USD 545,000), whereas Abu Dhabi’s program demands a significantly higher investment of AED 10 million (approximately USD 2.72 million). This difference reflects the respective strategic priorities of each emirate, with Dubai emphasizing tech and innovation-driven startups, while Abu Dhabi focuses more on large-scale structural projects supported by substantial public funding to diversify its GDP.

Another pivotal reform has been the UAE’s recent relaxation of its naturalization laws, allowing expatriates to obtain citizenship after 30 years of residency. This is a bold move, particularly in a country where 88.5% of the population consists of foreigners. By offering a path to citizenship, the UAE is fostering a more inclusive society and providing long-term residents with a greater sense of belonging and security. This change is expected to attract even more interest from global investors and skilled professionals, further enhancing the UAE’s position as a leading destination for international talent and capital.

These reforms are particularly attractive to wealthy families, especially those from Southeast Asia, who are drawn to the UAE by the promise of a better quality of life, enhanced mobility, and improved future prospects for their children. The UAE’s high rankings in global indices for innovation, quality of life, and safety, combined with its world-class education and healthcare systems, make it an ideal place for families to live and thrive. The comprehensive benefits provided by the Golden Visa programs, including long-term residency and access to superior amenities, ensure that the UAE remains a top choice for those seeking a stable and prosperous environment to invest, work, and raise their families.