Why the Golden Visa presents an opportunity to solve the housing crisis in Spain and Portugal

Introduction

Spain and Portugal are grappling with severe shortages in affordable housing, particularly in major urban centers like Madrid, Barcelona, Lisbon, and Porto. Rising property prices, driven by increasing demand and insufficient supply, have left middle- and lower-income families with few affordable options.

The Golden Visa programs in both Spain and Portugal, launched after the aftermaths of the 2008 financial crisis to boost the deflated housing market in both countries, have historically been accused of centering around real estate investments, potentially contributing to escalating prices in urban centers. However, data does not entirely confirm this narrative.

Recent policy shifts—especially in Portugal—aimed to steer investments away from real estate and into other sectors. In October 2023, Portugal made a sweeping reform by eliminating real estate-related investments, including those directed at funds pursuing real estate activities, from its Golden Visa program missing the opportunity to redirect a portion of foreign direct investment to the construction of affordable housing.

While the intent behind the reform was to alleviate housing market pressures, it oversimplified the issue by overlooking the role of real estate-focused funds as a potential solution to the affordable housing crisis. Data reveals that direct real estate investment, particularly under Golden Visa programs in both Portugal and Spain, has not been the primary cause of housing stock shortages or inflation. Instead, these challenges stem from deeper structural issues, such as supply bottlenecks and a disproportionate focus on luxury developments. Investments through financial instruments like venture capital and real estate funds, however, present a strategic opportunity to address these challenges by channeling capital into the construction and rehabilitation of affordable housing units, increasing supply and stabilizing the market.

Rather than completely removing the eligibility of real estate investments, a more strategic and nuanced approach could have redirected Golden Visa funds toward green, affordable housing projects. This would not only address housing shortages by increasing the availability of affordable units but also align with sustainability objectives by promoting eco-friendly construction practices. Such an approach would leverage foreign investment to tackle both pressing social issues and long-term environmental goals, making it a more balanced and effective solution to the challenges facing the housing market.

Section 1: Affordable Housing Crisis in Spain and Portugal

1.1 Inflation as a main driver for housing prices is soaring in the EU, Spain and Portugal

While it is commonly stated that both Spain and Portugal have experienced housing crises in their urban centers, the narrative that foreign demand, particularly from non-EU investors attracted by Golden Visa programs, has been a primary driver of skyrocketing real estate prices is not fully supported by concrete data.

Nevertheless, in early 2023, former Portuguese Prime Minister António Costa, from the Socialist Party, announced the government’s plan to phase out the Portuguese Golden Visa (GV) program, citing its contribution to the country’s housing crisis. This argument was somewhat misplaced, as property acquisitions in major cities like Lisbon and Porto—where housing inflation was most pronounced—had already been excluded from eligibility under the Golden Visa program since January 2022. Moreover, of the 170,000 properties sold in 2022, only 11% were new constructions, and property acquisitions through the Golden Visa program represented a mere 0.6% of these transactions (and 1.6% of the overall transaction value)1Serviço de Estrangeiros e Fronteiras. (2023). Relatório de Autorização de Residência para Atividade de Investimento (ARI). https://www.sef.pt/pt/Documents/SET_2023_ARI_CUMULATIVO.pdf, indicating a limited impact on the broader housing market.

While the housing crisis is indeed a serious issue, particularly for locals struggling to find affordable housing in proportion to their incomes, the root causes extend beyond the Golden Visa program. The core issue lies in a combination of factors, with a primary challenge being the lack of housing supply to meet rising demand. This demand is driven not only by Portuguese nationals but also by an influx of both EU and non-EU citizens seeking to live in the country. Furthermore, delays in public administration, including lengthy project evaluations and slow issuance of building permits, further exacerbate the housing supply shortage, contributing to price inflation and limiting the availability of affordable housing options.

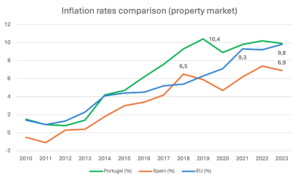

Additionally, despite perceptions, housing prices in these countries have increased at a rate that is closely aligned with inflation, both domestically and across Europe as a whole. According to Eurostat 2Eurostat. (2023). Interactive publication: Housing in Europe – 2023 edition. European Commission. https://ec.europa.eu/eurostat/web/interactive-publications/housing-2023, housing prices in the European Union rose by approximately 9.3% between 2021 and 2022 (fig. 1), largely in line with inflation trends driven by post-pandemic economic recovery, supply chain issues, and rising construction costs.

Fig. 1 – Source: Eurostat. (2023). Interactive publication: Housing in Europe – 2023 edition. European Commission.

In Portugal, there was a notable spike in housing prices around 2018, reaching a high of 10.4%, a sharp rise compared to the preceding years. This spike did not correlate with the peak in Golden Visa applications growth (fig. 3), which shows that foreign investment in real estate through the Golden Visa program was not the main driver of this price increase. Instead, broader factors such as inflation, a booming tourism sector, and increased demand for housing were likely contributors. After 2019, housing prices in Portugal began to stabilize, and by 2021, the growth rate approached that of the broader EU trend, around 9.3%, indicating a normalization of housing prices in line with European averages.

Spain, in contrast, has consistently maintained housing price increase rates below the EU average. However, a moderate spike occurred in 2018, when prices rose by 6.5%. Like in Portugal, this increase is more likely tied to economic factors such as inflation and the growing importance of tourism, particularly short-term rentals, which reduced the available housing stock. The establishment of low-period renting units also played a role in maintaining housing price increases.

Overall, the trends depicted in Figure 1 align more closely with general inflationary pressures and broader economic developments rather than the direct influence of foreign investment or migration programs such as the Golden Visa. While foreign investment, including revenues from Golden Visa applications, may have contributed to localized price increases, particularly in high-demand urban centers and during specific periods, there is insufficient evidence to conclude that this factor alone is driving the broader housing affordability challenges in these countries.

1.2 Housing Shortage in Portugal and Spain

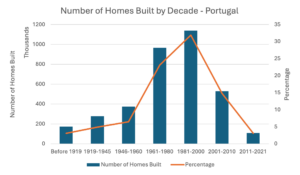

Portugal saw a notable boom of housing development occurring between 1961 and 2000 (fig. 2). During this period, housing construction surged dramatically, particularly between 1981 and 2000, when over 1.1 million homes were built, accounting for 31.9% of the total housing stock. This construction boom can be attributed to several factors, including rapid urbanization, economic growth, and increasing demand for housing in the wake of Portugal’s integration into the European Economic Community (EEC) in 1986. The expansion of infrastructure, rising incomes, and population growth also fuelled the need for residential development, leading to a significant rise in housing supply across the country.

Fig. 2 – Source: Eurostat. (2023). Housing in Europe – 2023 edition. European Commission.

However, there was a sharp decline in housing construction after 2000, with particularly low activity between 2011 and 2021, where the number of homes built dropped to the levels seen before 1919. This decline can be linked to multiple causes, including the 2008 global financial crisis, which led to reduced investment and tighter credit conditions, hampering construction efforts. Additionally, demographic shifts, such as a slower population growth rate and migration patterns, may have diminished the demand for new housing developments. The decrease in construction during the past decade reflects these broader economic challenges, underscoring the need for targeted strategies to stimulate housing production in response to ongoing demand in urban areas. The sharp decline in housing stock construction in Portugal since the early 2000s has significantly contributed to the skyrocketing property prices, as reflected in the chart illustrating inflation in the country’s real estate market.

As mentioned, in Portugal, between 2012 and 2023, the Golden Visa program issued approximately 11,758 residency permits through real estate investment. This accounts for a small fraction of the overall housing market when compared to the total volume of real estate transactions across the country.

According to Portuguese Confederation of Construction and Real Estate (Confederação Portuguesa da Construção e do Imobiliário-CPCI), Portugal needs approximately 170,000 new housing units to meet current demand. The shortage is particularly acute in cities like Lisbon, Porto, and the Algarve region, where housing prices have surged due to limited supply and high demand from both domestic and international buyers.3World Economic Forum. (2024, February). How Lisbon and other world cities are tackling the affordable housing crisis. World Economic Forum. https://www.weforum.org/agenda/2024/02/how-lisbon-and-other-world-cities-are-tackling-the-affordable-housing-crisis/These numbers are much higher that any impact caused by foreign investors in Portugal.

The National Strategy for Housing (Estratégia Nacional para a Habitação) estimates that by 2030, Portugal will need to build an additional 200,000 to 300,000 new housing units to adequately address the housing shortage.4República Portuguesa. (n.d.). Mais Habitação: Medidas para resolver a crise de habitação. Governo de Portugal. https://www.portugal.gov.pt/download-ficheiros/ficheiro.aspx?v=%3d%3dBQAAAB%2bLCAAAAAAABAAzNDEyMAMASZs5EgUAAAA%3d. This deficit has been further amplified by slow construction rates (fig. 2) and rising construction costs, making it difficult to keep up with growing demand, especially for affordable housing.

Portugal’s housing deficit has been an ongoing issue for over a decade, and its roots lie in the aftermath of the 2008 financial crisis. The crisis severely impacted the economy, leading to a dramatic slowdown in construction activity as developers halted new projects and banks restricted lending. Even as the economy gradually recovered, the construction sector lagged, contributing to an insufficient housing supply. This issue has become more pressing in recent years, as urbanization has surged, with more people moving to cities like Lisbon, Porto, and Faro for employment opportunities and improved infrastructure. The demand for housing in these urban centers has far exceeded the available supply, particularly for affordable housing, while rural areas continue to experience depopulation. This concentration of demand has only deepened the housing deficit in key metropolitan areas.

Several other factors have compounded the problem. The rapid growth of tourism, particularly through short-term rental platforms, has led many property owners to convert long-term rental units into vacation rentals, reducing the availability of affordable housing for local residents. Additionally, much of Portugal’s existing housing stock is outdated, requiring significant investment in renovations to meet modern living standards. Rising construction costs and bureaucratic hurdles in obtaining building permits have also slowed new housing developments. These issues, combined with a lack of robust government initiatives for affordable housing over the past decade, have resulted in a critical shortage of affordable homes for middle- and lower-income families.

Similarly, in Spain, Golden Visas have often been cited as a factor contributing to housing shortages and price increase, but the available data suggests that their impact is far more limited than some believe. Between 2013 and 2023, a total of 14,586 visas have been granted to investors of all nationalities. Of these, 95% were granted under the category of real estate acquisition (see fig. 3). This highlights that property acquisitions with an investment value equal to or greater than €500,000 per applicant (under Article 63.2.b of Law 14/2013) are the primary reason for visa approvals within the framework of this legislation. Nevertheless, it represents only 0.1% of the 4.5 million home sales over the same period.5Idealista. (2024, April 18). The Spanish government will end the Golden Visa for foreigners for investment. Idealista News. https://www.idealista.com/en/news/luxury-real-estate-in-spain/2024/04/18/816496-the-spanish-government-will-end-the-golden-visa-for-foreigners-for-investment This small percentage makes it clear that non-EU investors benefiting from these visas have not played a significant role in driving housing demand or prices. Instead, the country’s housing problems stem from an overall lack of supply and rising demand6Banco de España. (2023). El mercado de la vivienda en España: Situación reciente y perspectivas. Boletín Económico, 2/2023. https://www.bde.es/f/webbde/SES/Secciones/Publicaciones/InformesBoletinesRevistas/BoletinEconomico/23/T2/Fich/be2302-art09.pdf, which affects home buyers and renters in both countries analyzed.

The Bank of Spain recently published a study showing that the surge in housing transactions in 2021 was driven by improved economic activity and increased market confidence after the lifting of strict pandemic restrictions. Additionally, it was driven by the use of accumulated savings during the pandemic and the continuation of historically low interest rates.7Banco de España. (2023). El mercado de la vivienda en España: Situación reciente y perspectivas. Boletín Económico, 2/2023. https://www.bde.es/f/webbde/SES/Secciones/Publicaciones/InformesBoletinesRevistas/BoletinEconomico/23/T2/Fich/be2302-art09.pdf The report notes that since summer 2021, the recovery of domestic and international tourism has increased housing allocated for vacations, signficantly boosting the proportion of tourist housing in certain local markets. The Bank of Spain acknowledges the involvement of foreign buyers in the country’s real estate market but does not provide a breakdown of acquisitions made through Golden Visa schemes or other specific forms of property investment.

In terms of buyer profiles, foreigners purchased over 87,000 homes in Spain in 2023, but only 9.7% of these transactions involved properties valued at over €500,000—the minimum required for a Golden Visa.8Idealista. (2024, April 18). The Spanish government will end the Golden Visa for foreigners for investment. Idealista News. https://www.idealista.com/en/news/luxury-real-estate-in-spain/2024/04/18/816496-the-spanish-government-will-end-the-golden-visa-for-foreigners-for-investment Of these higher-value purchases, approximately half were made by non-EU citizens, amounting to around 4,200 homes acquired by investors seeking residency through real estate investments. While these figures indicate a rise in foreign investment, they are insufficient to account for the broader increase in property prices across the country, which are primarily driven by domestic factors as previously mentioned.

1.3 Have Golden Visa investments really impacted housing market in Spain and Portugal?

The assertion that Golden Visa programs in Spain and Portugal have significantly driven up real estate prices and exacerbated the affordable housing crisis is an oversimplified narrative, as data suggests. While these programs have indeed attracted foreign capital, particularly in real estate, the number of Golden Visa applications has not been substantial enough to be the primary factor behind rising property prices.

Moreover, in the case of Portugal, the investment attracted to the housing market through Golden Visa applications helped to stimulate economic activity, create jobs, and support the recovery of the construction sector. This capital influx was crucial in mitigating the financial crisis’ impact on the economy, supporting construction and real estate industries across Portugal and aiding the country’s broader economic recovery.

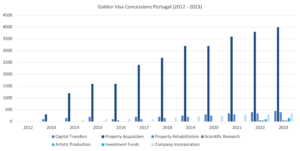

The chart below (fig. 3) demonstrates the crucial role foreign investment, specifically through Portugal’s Golden Visa program, played in reviving the country’s housing market following the 2008 financial crisis (and Portugal’s IMF bailout during 2011-2014). The property sector was particularly affected during that period, and real estate investment became a vital tool to stabilize the market. Since October 2012, approximately 90% of the €7.3 billion generated by the Golden Visa program has been funnelled into the real estate sector.

Fig. 3 – Source: Serviço de Estrangeiros e Fronteiras. (n.d.). Autorização de residência para atividade de investimento (ARI). SEF.

Similarly in Spain, the significant influx of Golden Visa investments can be largely attributed to the downturn in the country’s real estate market following the 2008 financial crisis, which presented foreign investors with the opportunity to acquire properties at more competitive prices.

Introduced in 2013, Spain’s Golden Visa program attracted non-EU nationals by offering residency in exchange for real estate investments of at least €500,000. Spain’s Golden Visa program offers several investment options for non-EU citizens seeking residency. These include: (1) investing a minimum of €500,000 in real estate, either residential or commercial; (2) transferring at least €1 million into Spanish shares, investment funds, or venture capital funds; (3) depositing €1 million in a Spanish financial institution; (4) investing €2 million in Spanish government bonds; and (5) creating a business that generates at least 10 new jobs. Each of these pathways provides a fast-track to Spanish residency, with the flexibility to include family members in the application. With 95% of applications focused on property purchases (fig. 4), Spain’s appeal as a destination for second homes, combined with its recovering property market and potential for capital gains, made real estate the dominant choice for investors.

Fig. 4 – Source: Transparencia Internacional España. (n.d.). Golden visas: La adquisición de permisos de residencia por inversión en España.

According to Eurostat (fig. 1), housing price inflation in Spain decreased in both 2022 and 2023, showcasing how Golden Visa investments are not a primary factor driving inflation in the real estate market. While Golden Visa investments have steadily increased, particularly in high-demand urban centers, the broader trend of declining inflation in property prices suggests that other domestic market factors are more influential.

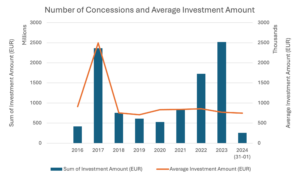

Data from Spain’s Golden Visa program shows a clear uptick in the number of concessions, rising from 2,017 in 2022 to 3,273 in 2023 (fig. 5). Although this growth reflects an increasing interest from foreign investors, the proportion of real estate transactions linked to Golden Visas remains relatively small. Consequently, the influx of foreign capital through this program has not significantly contributed to the general housing market inflation, which is more closely tied to factors like supply constraints and domestic demand.

Fig. 5 – Source: Transparencia Internacional España. (n.d.). Golden visas: La adquisición de permisos de residencia por inversión en España.

Despite this, Golden Visa investments continue to bring direct and indirect benefits to Spain’s economy, with total investments peaking at over €2.5 billion in 2023 (fig. 5). This infusion of capital has stimulated construction projects, revitalized urban areas, and supported the real estate market, particularly in cities like Madrid, Barcelona, and coastal regions. Moreover, the inflow of foreign capital through Golden Visas has broader economic benefits beyond real estate. Foreign investors who establish businesses or invest in Spanish companies also contribute to the country’s entrepreneurial landscape, fostering innovation and competitiveness. The indirect effects of these investments include increased consumption in local economies, particularly from high-net-worth individuals who spend on goods and services, boosting retail, hospitality, and tourism sectors.

Fig. 6 – Source: Transparencia Internacional España. (n.d.). Golden visas: La adquisición de permisos de residencia por inversión en España.

When analyzing the housing stock and rising prices in Spain and Portugal, it becomes evident that Golden Visa programs have played a minimal role in the broader housing market challenges. The exclusion of real estate-related investments from Portugal’s Golden Visa program, under the ‘More Housing’ bill passed in October 2023, oversimplifies the issue. By eliminating property acquisition, rehabilitation, and real estate investment funds, the government has cut key capital sources for housing development, which were vital for addressing the housing shortage through growth and innovation.

Instead of excluding real estate investment, the government could have restructured the Golden Visa program to target critical needs, allowing investment in affordable housing, energy efficiency, sustainable building, or underdeveloped regions to help ease the housing crisis. This would have provided a direct link between foreign investment and the development of essential infrastructure, creating a win-win scenario for both the investors and the local housing market. Instead, a more nuanced approach that incentivized specific, high-impact investments was overlooked.

The only positive aspect that remained in the GV program following these changes was the retention of investment in non-real estate funds, alongside other qualifying options such as cultural donations, scientific research, and job creation. While these routes still offer opportunities for foreign investment, they fall short of addressing the pressing housing supply issues that the program could have influenced. The real potential of the GV program to contribute meaningfully to the housing market was largely missed in this overhaul, leaving a gap in addressing the root causes of Portugal’s housing crisis.

Spain should avoid repeating the same mistake that Portugal made by completely eliminating real estate as a qualifying investment for its Golden Visa program. Instead, Spain has the opportunity to strategically direct these investments toward real estate funds focused on affordable housing developments. By doing so, the country can help bridge the gap between the supply and demand for new housing units. Investment in real estate funds tailored to affordable and sustainable housing projects would not only attract foreign capital but also ensure that these funds contribute to the long-term social and economic stability of the country.

Real estate funds have the potential to address the critical shortage of housing units while simultaneously providing a stable and lucrative investment vehicle for foreign investors. By establishing regulations that channel Golden Visa investments into sectors that need development—such as affordable housing—Spain can leverage foreign capital to meet domestic needs without exacerbating the housing crisis.

Section 2: Golden Visa Funds: An Overlooked Solution to Affordable Housing

2.1 Investment Funds as Tools for Economic Growth under the Golden Visa Program

Investment funds have a long history as financial instruments, but they became an eligible option under Portugal’s Golden Visa program in 2017/2018. The government recognized their potential in achieving the program’s core objective of stimulating economic growth by attracting foreign capital. These funds offered an ideal solution by diversifying investments across various sectors, making them a powerful tool for fostering national economic development and job creation.

These instruments are highly effective vehicles for economic stimulation. Funds screen markets for promising projects, particularly those with high growth potential, ensuring capital flows to areas where it can be most profitable and impactful. The Portuguese GV program benefits significantly from Venture Capital (VC) and Private Equity (PE) funds, which support innovation and growth by investing in startups and small-to-medium enterprises (SMEs).

Since these funds primarily invest in Portuguese startups, SMEs and mid-sized companies, it is logical that they qualify for Golden Visa eligibility, as their investments align directly with the program’s goals of fostering economic development and job creation in Portugal.

Foreign investors find investment funds appealing due to the diversified exposure they provide across various sectors. Furthermore, these funds are subject to regulation and oversight, which ensures a high level of compliance and protection for investors. The management of these funds by experienced professionals with industry expertise also adds to their attractiveness, providing reassurance to foreign investors that their capital is being handled by knowledgeable and well-connected teams, who have a fiduciary duty towards their investors. This confidence in the professionalism and regulation of investment funds has made them a popular option under the GV program, particularly after the real estate option was dismissed.

Portugal’s startup ecosystem has made the country a highly attractive destination for VE funds. Lisbon and Porto have become hubs for innovation, especially in the technology sector, benefiting from Portugal’s competitive labor costs and skilled workforce. Government initiatives such as startup visas, tax incentives, and co-investment schemes have further enhanced the country’s appeal to venture capital investors. Additionally, high-profile events like Web Summit have connected international investors with Portuguese startups, making the country a key location for venture capital activity in Europe.

PE funds, meanwhile, play a crucial role in supporting Portuguese SMEs, many of which are family-owned and form the backbone of the country’s economy. In Portugal, it is estimated that family-owned businesses account for 70% to 80% of all companies, with 99% being small and medium-sized enterprises (SMEs).9Marques, L. (2023). The impact of foreign direct investment on housing markets: A case study of Portugal and Spain. European Journal of Management and Economics, 6(2), 45-60. https://revistia.org/files/articles/ejme_v6_i2_23/Marques2.pdf These businesses employ around 50% of the national workforce and contribute approximately two-thirds of the country’s GDP.10Marques, L. (2023). The impact of foreign direct investment on housing markets: A case study of Portugal and Spain. European Journal of Management and Economics, 6(2), 45-60. https://revistia.org/files/articles/ejme_v6_i2_23/Marques2.pdf Given their significant role in the economy, these figures present a valuable opportunity for investment funds to support the growth and consolidation of these enterprises. Private equity funds provide these companies with much-needed capital, as well as strategic guidance and operational support. This capital allows SMEs to expand, compete in larger markets, and improve operational efficiencies, aligning with the GV program’s objective of stimulating economic growth through targeted investments.

Open-end funds, which differ from VC and PE funds by offering more liquidity, also play a role in the Golden Visa program. These funds primarily invest in large, publicly listed Portuguese companies. Though initially considered for exclusion during recent legislative reforms, open-end funds remain an eligible option under the GV program. While they may have less direct impact on SMEs, open-end funds still contribute to the overall economy by investing in Portugal’s largest corporations. Their liquidity and flexibility offer additional options for foreign investors seeking more liquid assets.

In addition to GV applicants, investment funds in Portugal often attract institutional investors, such as family offices, investment banks, and pension funds, lending credibility to the market. One notable institutional player is Banco Português de Fomento (BPF), the state-owned development bank that has been actively contributing to investment funds in recent years. BPF’s involvement, particularly in sectors such as innovation, green finance, and SME development, aligns with both national and European Union economic objectives. Through its partnership with EU institutions, BPF channels resources to vital sectors and helps amplify the economic impact of investment funds in Portugal.

BPF plays an instrumental role in supporting GV-eligible funds, namely those that target high-impact areas like technology, life sciences, and the blue economy. Through its collaboration with the European Investment Bank and other institutions, BPF has helped drive investment into critical sectors. Examples such as the Biovance Capital Fund, which focuses on biotech innovation, and the Growth Blue Fund, which supports sustainable blue economy companies, demonstrate how BPF’s involvement has helped attract foreign capital to innovative and strategic industries.({Biovance Capital. (2024, July 9). How foreign investment is shaping housing markets in Southern Europe. https://www.biovancecapital.com/2024_07_09_news.html

}) These funds, supported by both public and private investments, align with the broader objectives of the GV program, ensuring that foreign investments contribute to Portugal’s sustainable economic growth.

In summary, investment funds have proven to be an effective mechanism for advancing the goals of Portugal’s Golden Visa program. By facilitating foreign investments into startups, SMEs, and other strategic sectors, these funds support economic growth and innovation.

Spain’s Golden Visa program offers non-EU investors a unique opportunity to gain residency by making significant financial contributions to the Spanish economy. Among the options within the program is the investment of at least €1 million in Spanish shares, investment funds, or venture capital which directly support key sectors such as technology, renewable energy, and business development.

Eligible investment funds within this program include open-ended funds, which allow for the pooling of resources from multiple investors, and closed-ended funds, which typically focus on private equity or early-stage companies. Venture capital funds play a particularly crucial role in supporting Spain’s growing startup ecosystem, particularly in cities like Madrid and Barcelona. These funds provide essential capital that helps businesses scale, innovate, and create jobs, thereby fostering long-term economic sustainability. The growth of the tech industry and renewable energy projects are among the areas that have significantly benefited from these investments.

Oversight and regulation of these investments are managed by Spain’s National Securities Market Commission (CNMV), which ensures transparency and legal compliance in fund operations.

Over the last decade, investments in Spanish funds through the Golden Visa program have contributed an estimated €3 billion to sectors such as technology, infrastructure, and renewable energy. Spain can further capitalize on these investments by strategically redirecting Golden Visa funds toward the construction of affordable housing. Public-private partnerships, incentivized funds, and government-backed initiatives could further accelerate the development of affordable housing, addressing both the shortage of housing stock and the inflationary pressures in the real estate market. This approach would allow Spain to maintain its attractiveness to foreign investors while also solving its domestic housing challenges, creating a win-win scenario for both the economy and social stability.

In sum, in both Portugal and Spain, the GV program offers foreign investors diversified opportunities, regulatory oversight, and professional management through venture capital, private equity (sector-agnostic or focused), and even open-end funds. By directing foreign capital toward affordable housing developments, both countries can expand their housing stock, alleviating supply constraints that have driven up prices in recent years. Additionally, such investments would stimulate the local construction sectors, providing job creation and economic growth, while enhancing urban infrastructure through the rehabilitation of aging properties. This focus on increasing supply through both new builds and rehabilitated units would not only stabilize housing prices but also improve access for low- and middle-income households, fostering greater social equity. Furthermore, rehabilitating existing structures aligns with sustainability goals, promoting energy efficiency and reducing the environmental impact of new developments

2.2 The Potential of Real Estate Funds

Real estate funds are one of the most effective mechanisms for pooling large-scale investment to finance housing developments. These funds, when appropriately structured, can direct capital toward affordable housing projects, thereby addressing both profitability for investors and societal needs. The decision to exclude real estate funds from Portugal’s Golden Visa program was, in many ways, an oversimplification of a complex problem.

Countries such as the U.S., Germany, Brazil, and Canada have successfully used real estate investment funds to pool capital and finance large-scale housing projects. Mechanisms like REITs in the U.S. and Canada11National Association of Real Estate Investment Trusts. (n.d.). Nareit: Everything REITs. https://www.reit.com, Spezialfonds in Germany 12BVI. (n.d.). Snapshot: Spezialfonds [PDF]. BVI Bundesverband Investment und Asset Management e.V. https://www.bvi.de/uploads/tx_bvibcenter/Snapshot_Spezialfonds_en_web_02.pdf and FIIs in Brazil13Silva, P. (2023). Scaling up affordable housing supply in Brazil: The ‘My House My Life’ programme. ResearchGate. https://www.researchgate.net/publication/376396018_Scaling_up_affordable_housing_supply_in_Brazil_The_’my_house_my_life’_programme/references have proven to be effective in increasing housing stock and providing affordable housing options. These funds allow for the aggregation of institutional and retail investments, helping finance residential developments while providing consistent returns to investors.

Both Portugal and Spain can adopt these strategies to channel foreign direct investment from their Golden Visa programs into dedicated real estate funds. By doing so, these countries can increase the availability of affordable housing, using the steady flow of capital from international investors to finance new developments. Additionally, the creation of specialized funds focusing on housing and urban regeneration will help address the current housing supply shortages in major urban areas.

In Portugal, if real estate funds focused on green and affordable housing had remained a qualifying investment, they could have helped address the issues the government aimed to resolve. Real estate funds provide several advantages in this context:

- Pooling of Capital: Funds can pool significant amounts of capital from multiple investors, making it feasible to develop large-scale affordable housing projects.

- Long-Term Investment Horizon: Golden Visa investors, who typically focus on securing residency, tend to have a longer-term investment outlook, which aligns well with the timelines required for large housing developments.

By excluding funds pursuing real estate activities, Portugal effectively missed a valuable opportunity to channel foreign investment into affordable housing development. Instead of completely eliminating real estate investments, the government could have restructured the program to direct funds into green and affordable housing projects. This would have addressed housing shortages while ensuring that these developments met sustainability goals in line with European Union priorities.

Spain, on the other hand, still has the opportunity to capitalize on this potential by directing its Golden Visa funds toward the development of affordable housing.

2. 3 The Importance of Public-Private Partnerships

Public-private partnerships (PPPs) can be instrumental in maximizing the impact of Golden Visa investments in affordable housing. By combining public resources, such as land or regulatory support, with private investment from Golden Visa funds, PPPs offer an effective way to address housing shortages while ensuring sustainability.

- Risk Sharing: PPPs help distribute the risks of large-scale affordable housing projects between the public and private sectors, making them more attractive to private investors, including those participating in Golden Visa programs.

- Efficient Use of Public Land: Public entities can contribute land for affordable housing projects, reducing overall costs and allowing Golden Visa funds to focus on construction and sustainability aspects.

Portugal has already seen success with PPPs in affordable housing, such as the public-private partnership in Lisbon’s Beato district. In this initiative, public land was made available for affordable housing, with private developers contributing capital and expertise. By structuring similar projects through Golden Visa funds, both Spain and Portugal could significantly scale their efforts to provide affordable housing.

Spain can also draw from its own experience with green affordable housing projects, such as those in Catalonia, where PPPs have supported the development of energy-efficient housing for lower-income residents. With the involvement of Golden Visa funds, these initiatives could expand rapidly to meet the growing demand. Golden Visa investors would also feel they would be making a positive contribution to the country where they seek to establish residency, while making a relatively secure investment.

2.4 Accessing European Funds for Sustainable Housing

Both Spain and Portugal are eligible for substantial financial support from the European Union to address housing shortages, particularly through sustainable development projects. Programs such as the European Green Deal, Horizon Europe, and InvestEU are all aligned with the goals of green, affordable housing, providing an opportunity to combine Golden Visa investments with EU funding to maximize impact.

By leveraging these European funds alongside Golden Visa investments, Spain and Portugal can expand affordable housing developments that are both environmentally sustainable and financially viable.

The European Investment Bank (EIB) has been a key player in funding affordable housing projects across Europe. By securing EIB loans or grants and combining them with Golden Visa funds, Portugal and Spain could rapidly expand their affordable housing capacity. In Portugal, for example, the EIB has already financed several affordable housing projects in Lisbon. Integrating Golden Visa capital into similar projects could provide the necessary scale to meet the country’s housing needs.

Recommendations

The decision to phase out real estate investments in Portugal’s Golden Visa program and the potential for similar changes in Spain risks missing a crucial opportunity to address the urgent need for affordable housing. Both countries are at a crossroads: Spain is contemplating reforms that could phase out real estate investments, while Portugal has already removed this option entirely. This approach oversimplifies the challenges in the housing market and overlooks how well-directed investments, particularly through real estate funds, can actually be part of the solution.

In Spain, the Golden Visa program continues to attract significant foreign capital, particularly in real estate. However, instead of eliminating this option, Spain should focus on creating regulations that guide these investments into environmentally friendly, high-tech affordable housing units. Doing so would allow Spain to retain the economic benefits of the Golden Visa program while addressing its housing crisis and meeting EU sustainability goals.

In Portugal, the decision to eliminate real estate focused funds from the Golden Visa program, though intended to curb rising property prices, missed an opportunity to channel these funds into green and affordable housing projects. Real estate funds could be reassessed and redesigned to focus on investments in housing projects that align with Portugal’s sustainability and affordability objectives.

Recommendations:

- Reassess the Role of Real Estate Funds in the Golden Visa Program

Portugal should reconsider its decision to eliminate real estate funds as a qualifying investment for the Golden Visa. Instead of removing this option entirely, regulations could be introduced to direct real estate fund investments specifically toward affordable housing developments. By mandating that these funds be used for environmentally friendly affordable housing projects, Portugal could increase its housing stock without exacerbating the real estate market pressures in urban areas. This would also help align the program with the country’s broader sustainability goals from international organizations such as the European Union. - Retain Golden Visa Fund Investment Opportunities and Introduce Targeted Regulations

Spain should not eliminate the option to invest in real estate through its Golden Visa program. Instead, it should introduce regulations that encourage investment in sustainable, affordable housing projects. By guiding foreign capital towards green developments and high-tech housing units, Spain can use the Golden Visa program as a tool to solve its affordable housing crisis. This would help ensure that Golden Visa investments have a positive impact on both the economy and local communities, while also promoting environmentally responsible construction practices. - Create Specific Investment Channels for Green and Affordable Housing

Both Spain and Portugal should establish dedicated channels for Golden Visa investments that focus on green, affordable housing. These channels could take the form of regulated real estate funds that are required to invest in projects that meet specific environmental and affordability criteria. For example, funds could be directed towards energy-efficient housing developments or the construction of high-tech modular units that reduce the carbon footprint of new builds. These investment channels would align with EU climate goals while also addressing the housing shortages in both countries. - Introduce Incentives for High-Tech, Sustainable Housing Developments

Governments in Spain and Portugal should provide tax incentives and subsidies to Golden Visa investors who direct their funds into high-tech, sustainable housing projects. By offering financial benefits such as tax reductions or rebates, both countries can encourage investment in projects that incorporate advanced technologies like modular construction, smart home systems, and renewable energy sources. This would help lower construction costs, making it more feasible to develop affordable housing while maintaining a high standard of sustainability. - Promote Public-Private Partnerships (PPPs) for Affordable Housing Projects

Public-private partnerships (PPPs) can play a pivotal role in maximizing the impact of Golden Visa investments. Spain and Portugal should actively promote PPPs that leverage Golden Visa funds alongside public resources, such as land and regulatory support, to develop affordable housing projects. These partnerships can share the risks and rewards between the public and private sectors, making it more attractive for investors to participate in large-scale affordable housing developments. Moreover, PPPs can ensure that the government retains some control over the location and type of housing being developed, as well as to whom is targeted, ensuring alignment with national housing and sustainability strategies and promoting social equity. - Implement Regional Investment Incentives to Spread Economic Development

Both Spain and Portugal should encourage Golden Visa investments in regions that are less economically developed, thereby reducing the concentration of investments in urban areas. By offering additional incentives, such as lower minimum investment thresholds for housing projects in rural or underdeveloped regions, both countries can distribute the economic benefits of the Golden Visa program more evenly. This approach would help address regional disparities while also contributing to the overall housing supply, particularly in areas that need it most. Encouraging investments in green affordable housing in these regions would also support the EU’s broader goals of regional cohesion and sustainable development.