An Overview of the Russia Golden Visa Scheme

The Russian Golden Visa program is a residency-by-investment scheme introduced in 2018. The program offers a pathway to residency in Russia for foreign investors who make a minimum investment of 10 million rubles (approximately $122,000) in Russian businesses or real estate investment.

The Business Visa in Russia is designed to attract foreign investors interested in doing business in Russia and wanting to secure residency in the country.

To be eligible for the Russian Golden Visa, applicants must invest in a Russian business or real estate project registered with the Russian Federal Agency for State Property Management. The investment must be made in cash, and the applicant must hold the investment for at least three years.

After three years, the asset can be sold, and the applicant can recover their initial investment. Also, based on the multiple investment options available in Russia for foreign investors, the expenditure may vary from 10 million rubles to 30 million rubles ($122,000- $370,000 or €111,546 to €334,638).

The Russian Investor Visa program also offers a relatively low investment requirement compared to other European Golden Visa programs. For example, the Portuguese Golden Visa program requires a minimum investment of €280,000 in real estate. In contrast, the Spanish Golden Visa program requires a minimum foreign investment of €500,000 in real estate or €2 million in Spanish government certificates.

Moreover, the Russian Golden Visa scheme offers a pathway to Russian citizenship for investors who maintain their investments for at least five years. This allows investors to become permanent residents of Russia and enjoy all the benefits of citizenship.

The Investment Requirements of the Russian Golden Visa

It’s worth noting that the Russian Golden Visa is relatively new, and the investment requirements may be subject to change in the future. Therefore, understanding the current program requirements and regulations is essential before applying.

Entrepreneurship: Applicants who own and operate their own companies may be eligible to migrate to Russia and get a residence visa under the program. To qualify for a residence visa through this route, the applicant must grow the capital in the firm by 15 million rubles if it is a Russian corporation.

The applicant must enhance the company’s capital by 50 million rubles if it is a foreign firm. The only other criterion is that the business has been in existence for at least three years. However, whether this three-year period begins before or after the residence permit is issued is unclear.

Investing in a new business: The next option for candidates seeking a Russian residency visa is to invest in and create a new business. To qualify for this option, applicants must invest at least 10 million rubles in their firm and recruit at least ten Russian residents as workers. Based on these conditions, the Golden Visa program is likely the most cost-effective route to residency in Russia.

Investment in an existing Russian firm: Applicants may also choose to invest in a Russian company. First and foremost, the firm must have existed for at least three years. Furthermore, the firm must pay the Russian government 6 million rubles in taxes and employ at least 25 people. Furthermore, while choosing this option, the applicant is not required to become a shareholder of the firm.

Investment in government bonds: An applicant may also receive a residence visa in Russia by investing in government bonds worth 30 million rubles. The applicant must hold these government bonds for at least three years before applying for a residence visa in this country. This is the best choice for investors who wish to get a Russian residency visa without investing in a business or real estate.

Real estate investment: The applicant’s final option for obtaining a residence permit in Russia under the Golden Visa program is to invest in real estate. This option, like government bonds, needs a minimum investment of at least 30 million rubles. Furthermore, like with government bonds, the applicant must retain the property for at least three years before requesting a residency visa.

In addition to the investment requirement, applicants must also meet other eligibility criteria, such as having a clean criminal record, having a valid passport, and passing a medical examination.

Regardless of the option chosen, the applicant must first apply for a temporary residence permit and then apply for a Russian residency visa a year after the temporary residence permit is issued.

Why consider a Russian Golden Visa program?

The Russian Golden Visa offers several benefits to foreign investors considering residency in Russia. Here are some of the reasons why a Russia Golden Visa may be worth considering:

- Relatively low investment requirement: Compared to other Golden Visa programs in Europe, the Russian Golden Visa scheme offers a relatively low investment requirement.

- Favorable tax regime: Russia offers a favorable tax regime for foreign investors, including a flat income tax rate of 13 percent. This makes Russia an attractive destination for entrepreneurs and investors looking to reduce their tax burden.

- Pathway to Russian citizenship: The Russian Golden Visa also offers a path to Russian citizenship for investors who maintain their investments for at least five years. This allows investors to become permanent residents of Russia and enjoy all the benefits of citizenship, including access to social services, education, healthcare, and a Russian passport.

- Business opportunities: Russia offers a range of business opportunities for foreign investors, including access to natural resources, a skilled workforce, and a growing consumer market. With a Golden Visa, foreign investors can establish or expand their business operations in Russia and take advantage of these opportunities.

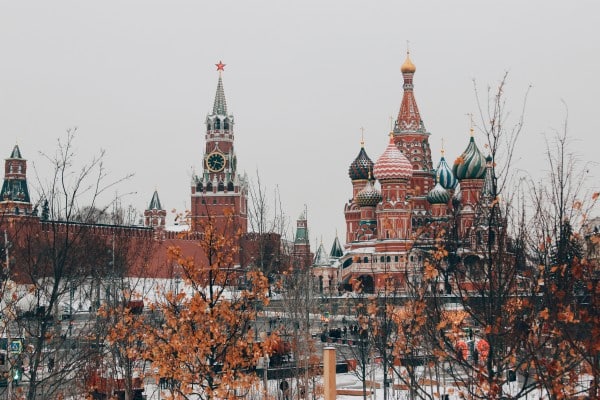

- High quality of life: Russia offers a high quality of life, with world-class cultural attractions, excellent healthcare, and rich history and culture. Moreover, Russia is home to some of the world’s most beautiful cities, including Moscow and St. Petersburg.

Overall, this Golden Visa scheme offers a unique opportunity for foreign investors to gain residency in Russia and access the country’s business opportunities. With a relatively low investment requirement, a favorable tax regime, and a pathway to citizenship, the program is an appealing option for investors who want to expand their operations in Europe and beyond.

Tax Benefits and Obligations for Russian Golden Visa Holders

Foreign investors who obtain a Russian Golden Visa are entitled to several tax benefits but also have certain obligations under Russian tax law. Here are some of the tax benefits and obligations for Russian Golden Visa holders:

The flat income tax rate

The Russian tax system operates on a flat income tax rate of 13 percent, which applies to all types of income, including employment income, business income, and capital gains. This means foreign investors who earn income in Russia are subject to the same tax rate as Russian citizens.

Tax exemptions for foreign income

Foreign investors who earn income from outside Russia are generally exempt from Russian income tax, provided the payment is not sourced in Russia. This means that foreign investors who have income from sources outside Russia can benefit from the low tax rates in Russia without paying tax on their foreign income.

Deductions for investment and business expenses

Foreign investors who invest in Russian businesses or engage in business activities in Russia are entitled to deductions for investment and business expenses, such as depreciation, interest, and operating expenses.

Obligation to file tax returns

Russian tax law requires foreign investors who earn income in Russia to file tax returns and pay tax on their income. Failure to comply with these obligations can result in penalties and fines.

Obligation to register for tax purposes

Foreign investors who plan to stay in Russia for more than 183 days in a calendar year are required to register for tax purposes and obtain a tax identification number. This is necessary to comply with Russian tax law and avoid potential penalties.

Obligation to pay social security contributions

International investors employed in Russia are required to pay social security contributions, which are calculated as a percentage of their gross income. The employer is also required to make contributions on behalf of the employee.

This Golden Visa program offers several tax benefits to foreign investors, including a low flat income tax rate, exemptions for foreign income, and deductions for investment and business expenses.

However, foreign investors must also comply with Russian tax law and meet their obligations under the tax system, including filing tax returns, registering for tax purposes, and paying social security contributions.

Conclusion

Although the program has advantages, foreign investors must consider their eligibility and investment requirements before applying. They must also be aware of their obligations under Russian tax law and comply with the relevant regulations to avoid any potential penalties or fines.

In conclusion, the Russian Golden Visa offers foreign investors an attractive opportunity to obtain temporary residence in Russia and enjoy various benefits, including tax incentives, access to real estate, and business opportunities. The program is open to investors willing to make a substantial investment in Russia by investing in a Russian business, purchasing real estate, or depositing in a Russian bank.

The program offers a range of benefits, making it an appealing option for investors looking to establish a presence in Russia and Schengen Area.

Global Citizen Solutions: How We Can Help

Expats and foreign investors can encounter many difficulties when applying for a Business Visa in Russia, which is why it is worthwhile to have an expert on hand to provide personalized Russian visa assistance throughout the application process.

Our specialists can help you with the following:

- Minimize the visits you have to make to the designated country

- Have someone who works solely on your behalf

- Reduce the hassle associated with putting your application together

- Acquire insider knowledge from someone with years of experience in the market

Let’s get you moving forward in your quest to obtain a Russian Golden Visa. Get in touch with us to book a free consultation.

Frequently Asked Questions about Russian Golden Visa

Does Russia have Golden visa?

Yes, Russia has a Golden Visa program for foreign investors who make substantial investments in Russia by investing in a Russian business, purchasing real estate, or depositing in a Russian bank. The program offers temporary residence in Russia and a range of benefits, including tax incentives, access to real estate, and business opportunities.

Can we get permanent residency in Russia?

Foreign investors who obtain a Russian Golden Visa may have the opportunity to apply for a permanent resident visa or citizenship in Russia, depending on the duration and type of their investment. However, permanent residency or citizenship is not guaranteed and is subject to strict eligibility requirements and government approval.